5 0

Bitcoin Trades Above $115K Amid Fed Interest Rate Decision Anticipation

Bitcoin is trading above the $115K level as the market anticipates tomorrow's Federal Reserve meeting, which could impact interest rates and global markets. Currently, Bitcoin fluctuates between $114.6K and $117.1K, showing cautious optimism among investors.

- Analyst Axel Adler notes Bitcoin's price action suggests a constructive trend with buyers gaining strength despite no breakout.

- The market awaits the Fed's decision, which might trigger volatility across risk assets.

Bullish Sentiment Favors Breakout

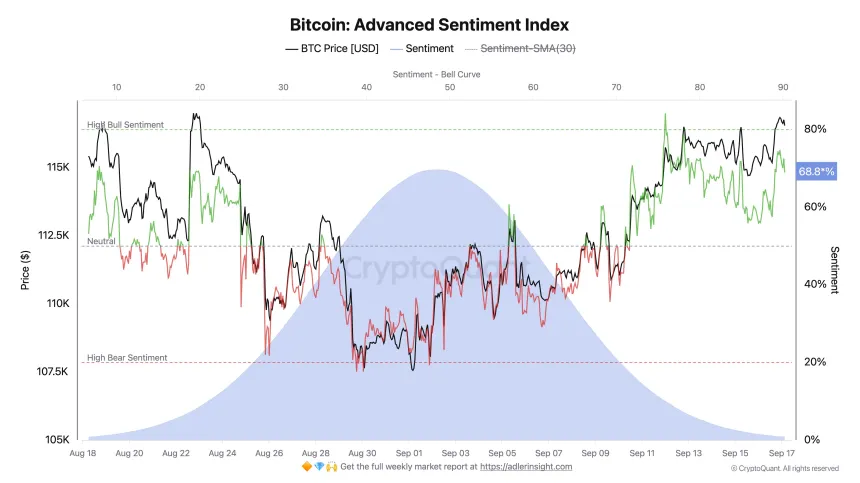

- Axel Adler discusses a bullish sentiment in the Bitcoin market, indicated by an Advanced Sentiment of 68.8%.

- This high sentiment suggests traders expect higher prices, especially if the Fed's decision is seen positively.

- The sentiment often precedes strong upward moves, potentially triggered by supportive macroeconomic events like the Fed's rate decision.

If the Fed announces a moderate rate cut, it could align technical structure, sentiment, and macro drivers in favor of Bitcoin reaching new highs.

Bitcoin Price Analysis: Sideways With Bullish Bias

Bitcoin trades at $116,607, consolidating near short-term highs after recovering from an early September dip. The current sideway price action occurs below the key resistance at $123,217.

- The 50 SMA is upward, indicating momentum; the 100 SMA flattens, while the 200 SMA supports at $115,387.

- A break above $117.5K could lead to a retest of $123K, whereas a drop below $114K may bring corrections to $112K–$113K.

- The chart shows sideways consolidation with a bullish bias, awaiting the Fed's decision for a decisive move.