5 0

Bitcoin Trades Above $115K Amidst Weak Supply and Liquidity Concerns

Bitcoin is trading above the $115,000 level following a recent surge. This rise coincides with expectations of a US Federal Reserve interest rate cut, positively impacting risk assets like cryptocurrencies.

- The key challenge for Bitcoin is maintaining its position above $115K amid macroeconomic uncertainties and on-chain developments.

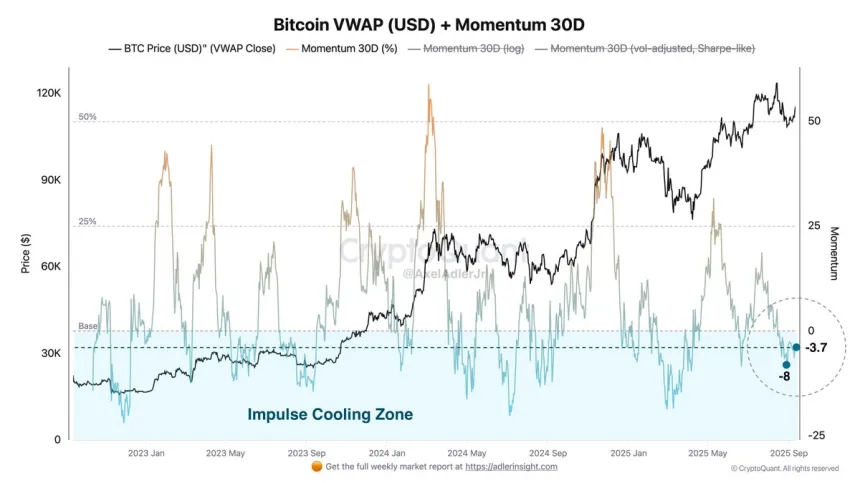

- Analyst Axel Adler notes that Bitcoin’s 30-day momentum is in the Impulse Cooling Zone, indicating short-term momentum has softened but the broader uptrend persists.

- Adler highlights the importance of 30-day momentum returning to positive and exceeding +10% for a strong impulse phase.

- Current market conditions are characterized by thin liquidity and sideways action, with risks of rapid collapse if selling pressure spikes.

- Real demand forms when Bitcoin trades at a discount, not at cycle highs, highlighting the need for value-driven inflows.

Bitcoin's current price is around $115,142, recovering from the $110,000 zone. Technical indicators show BTC testing key averages:

- 100 SMA at $114,610 acts as resistance.

- 200 SMA at $112,267 provides support.

- A move above $116,000 could lead to testing $118,000 and resistance at $123,217.

- Support levels include $114,000 and $112,000, below which selling pressure may increase.

If Bitcoin maintains above the moving averages and surpasses $116,000, it might advance further, though $123K remains a significant resistance point.