Updated 6 December

Bitcoin Reaches All-Time High of $104,088 Driven by Institutional Demand

Bitcoin surpassed $100,000 for the first time, reaching an all-time high of $104,088 in New York. After dipping to $94,587 on Wednesday, it rebounded due to several key factors:

#1 Fed Chair Powell Compares Bitcoin To Gold

Federal Reserve Chair Jerome Powell acknowledged Bitcoin during the New York Times DealBook Summit, stating that Bitcoin is viewed as a speculative asset similar to gold rather than a payment method or store of value. This comparison may enhance Bitcoin's legitimacy within the financial ecosystem.

If your central bank owns gold, but rejects digital gold… they’re done. How did betting against digitalization work for Kodak, Blockbuster, etc? It’s the most obvious trade in history https://t.co/tdJp8XCTjO

— David Bailey (@DavidFBailey) December 4, 2024

#2 Russia’s Putin Signals Openness To Bitcoin

Russian President Vladimir Putin expressed support for Bitcoin at the Russia Calling forum, asserting that no one can ban Bitcoin or electronic payment methods. His comments suggest a potential "Bitcoin Space Race" among global superpowers. President-elect Donald Trump has pledged to establish a Strategic Bitcoin Reserve in the US, with calls for urgent action from David Bailey, CEO of BTC Inc.

It must be a national priority to stand up the Strategic Bitcoin Reserve in the first 100 days of the Trump admin. We need an aggressive plan to grow USA’s proportional ownership of the Bitcoin supply. https://t.co/a85wLNoXSS

— David Bailey (@DavidFBailey) December 4, 2024

#3 Strong Spot Demand And Institutional Interest

The price increase was supported by robust spot market activity and significant institutional interest. Open interest in Bitcoin futures surged by over $4 billion. The rally was driven by demand in spot markets, indicating healthy growth. Major players, including MARA Holdings, may have contributed to buying pressure, with speculation regarding their recent fundraising efforts being used to acquire Bitcoin.

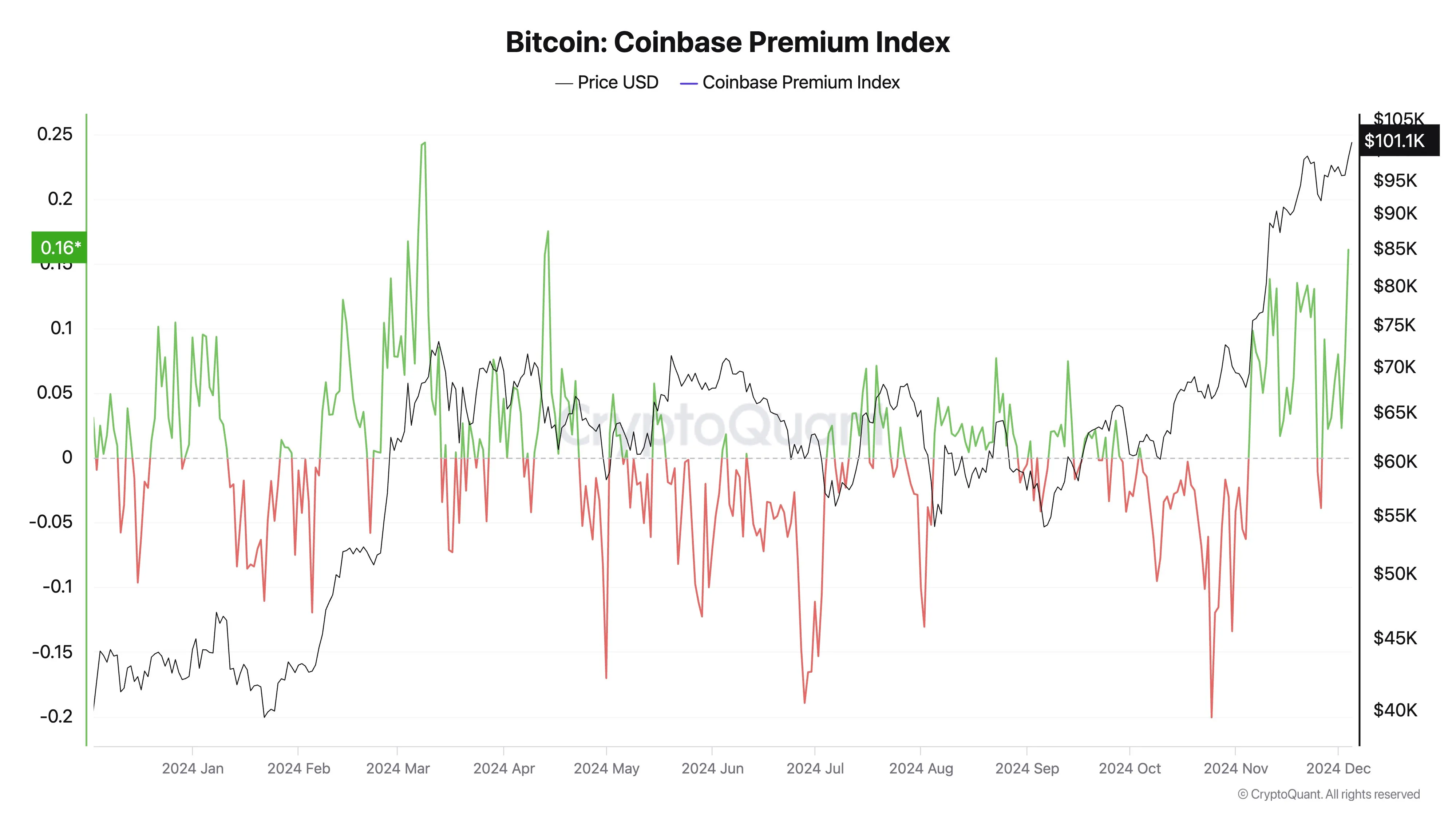

CryptoQuant reported that Bitcoin's rise past $100k was largely due to institutional demand, highlighting strong buying pressure from US investors.

#4 Retail Market In Disbelief

Despite the bullish trend, retail traders remain skeptical. On-chain analytics firm Santiment noted strong whale accumulation but cautious retail sentiment, with expectations of a price retracement. The sentiment analysis indicated hesitance among traders, although historical trends suggest that crypto markets often move contrary to crowd expectations. As of press time, BTC traded at $102,681.