Bitcoin Approaches All-Time High Against Gold at $98,000

Bitcoin is nearing a significant milestone: surpassing gold in price discovery mode.

Bitcoin reached an all-time high of $98,000, resulting in a market cap around $1.94 trillion (fully diluted: $2.06 trillion).

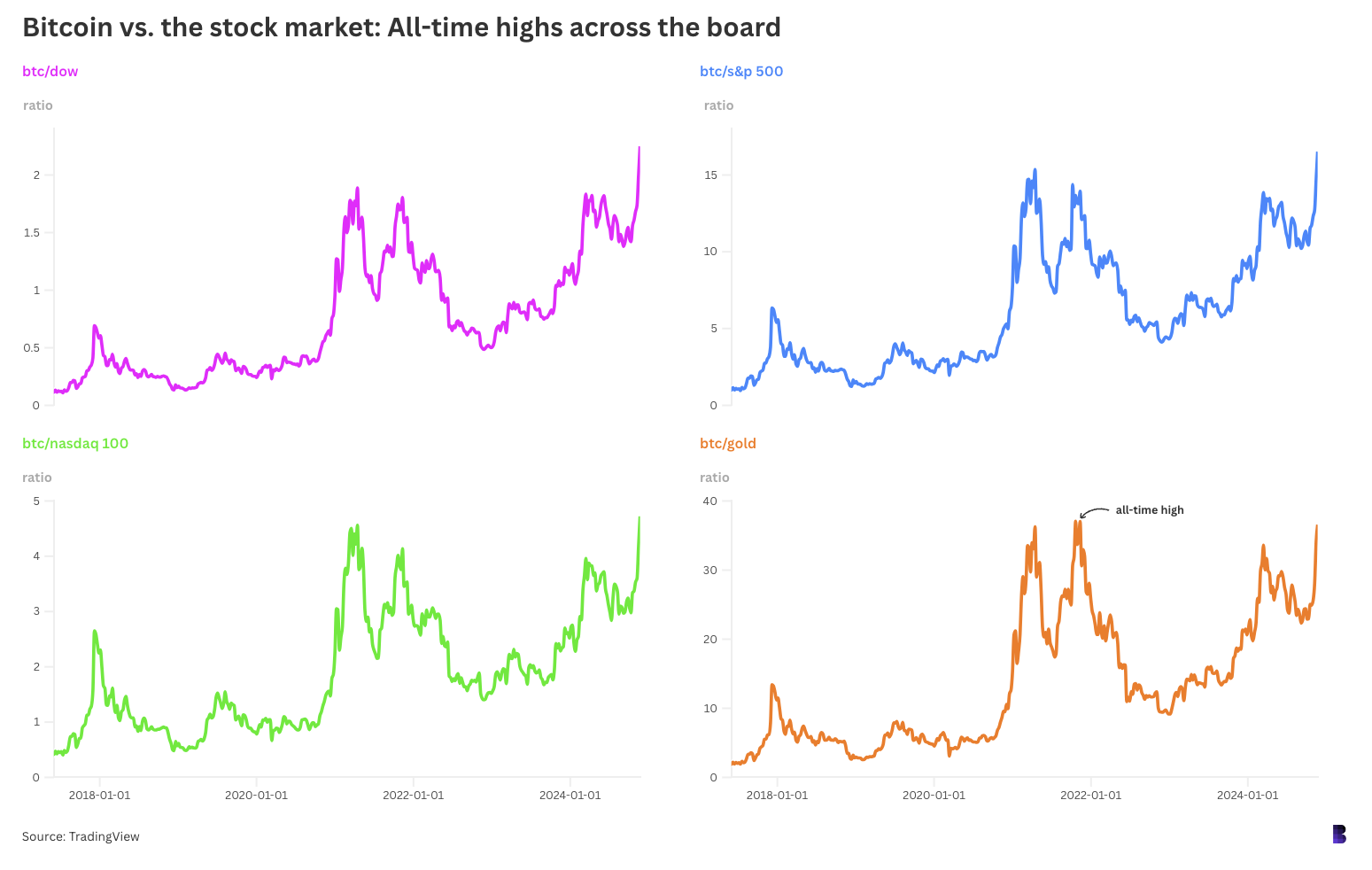

The cryptocurrency has also surpassed 2021 records against major US stock indexes: the Dow Jones, S&P 500, and Nasdaq 100.

Following its peak in November 2021, bitcoin had outperformed gold by 55% compared to gold's 46% increase as of this morning.

Bitcoin still needs to align with gold, specifically regarding BTC’s previous high against gold and its ratios to the US dollar and stock market.

As of Thursday morning, the bitcoin-to-gold ratio was just under 36.83. In November 2021, it peaked at 37.05, indicating a minimal difference of less than half a percent.

If gold remains stable today, a rise to $98,500 would facilitate bitcoin's goal, or even less if gold decreases slightly (current bitcoin price: $97,845).

Market watchers are closely monitoring the bitcoin price chart, including federal regulators.

The US government's crypto holdings, primarily from criminal case seizures, have risen to nearly $21 billion, with over 98% in bitcoin. This is up from just under $10 billion at the start of the year, according to Arkham Intelligence data. The exact value fluctuates due to regular transfers between unmarked wallets.

A specific example includes the sale of 3,999 BTC by the government in June and July, valued at an average of $61,300 during transfer to Coinbase Prime, generating over $245 million. If sold today, they would be worth approximately $392 million, reflecting a potential loss of $147 million.

The German state of Saxony sold almost 50,000 BTC around the same time, receiving the euro equivalent of $2.78 billion. Had they retained these assets, their value would now be nearly $4.9 billion, representing a lost potential revenue of over $2.1 billion, equivalent to 1.7% of Saxony’s GDP in 2018.

In total, identified government crypto treasuries are valued at approximately $28.5 billion, held by the US, UK, Bhutan, and El Salvador.

With bitcoin entering price discovery mode, the resilience of these governmental holdings will be tested.