Bitcoin Bull Market Driven by Leveraged Bets and Increased Investor Confidence

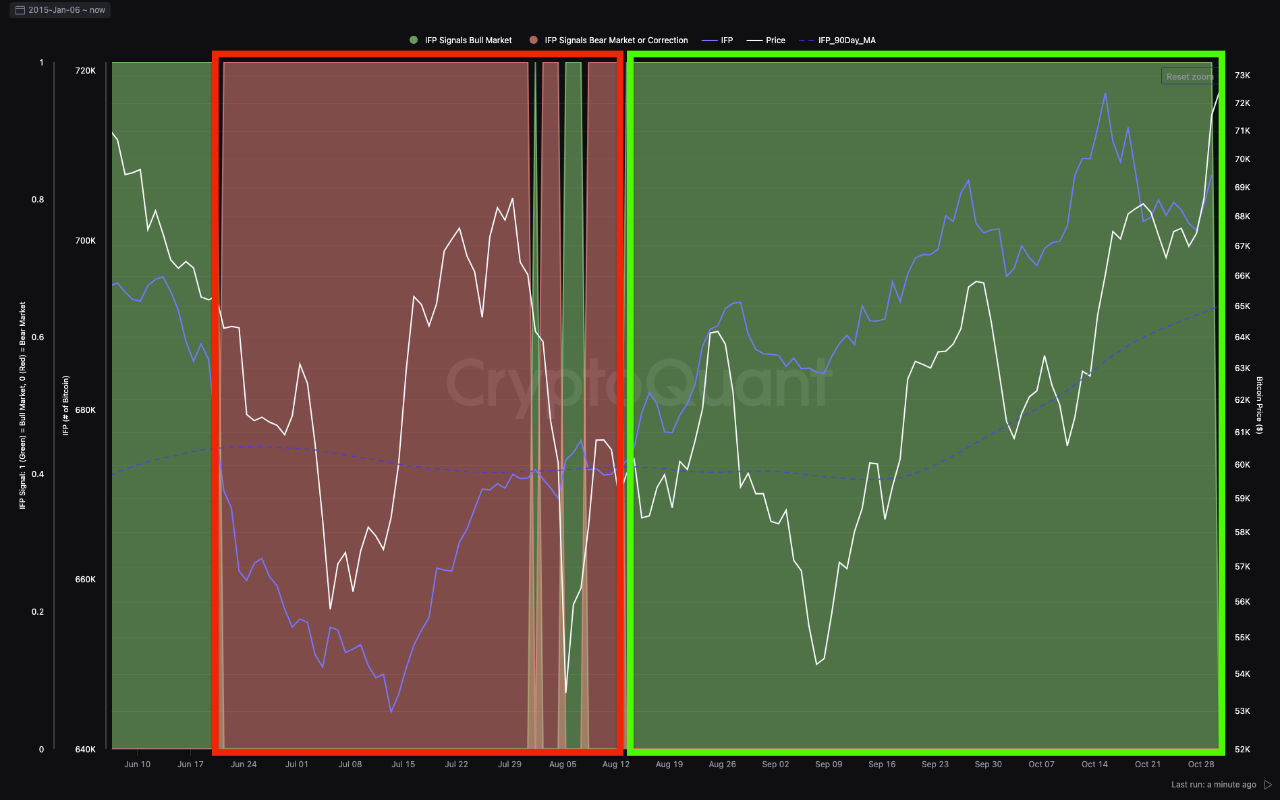

The recent increase in Bitcoin price correlates with a change in investor behavior, as noted by CryptoQuant analyst ‘crypto sunmoon.’

In a post on CryptoQuant QuickTake, the analyst reported that the current bull market is driven by leveraged bets, particularly in derivatives markets. This trend contrasts with previous cycles where increased deposits typically accompanied BTC bull runs to spot exchanges.

Leveraged Bets’ Role in Bitcoin Price Growth

Leveraged bets use borrowed funds to amplify investment size. For instance, with 2x leverage, a trader can open a position twice the size of their capital. In Bitcoin futures trading, this strategy can yield profits during price increases but carries risks, including potential liquidation if the market moves against the trader.

The inflow of Bitcoin into derivatives exchanges indicates heightened investor confidence, fostering belief in further price increases. This creates a feedback loop where rising prices lead to more leveraged bets, thus supporting the bull market.

Bitcoin bull market begins with leveraged bets

“The bull market will continue as #bitcoin continues to be deposited into futures exchanges for leveraged bets using derivatives, rather than into spot exchanges for selling.” – By @t0_god

Link

https://t.co/1egL7L2YoO pic.twitter.com/uuQPEiSWtb

— CryptoQuant.com (@cryptoquant_com) October 30, 2024

BTC Price Performance And Outlook

Bitcoin's price has increased by 8.2% over the past week, currently trading at $71,804. Despite a slight retracement from a recent high of $73,562, upward momentum persists.

This consistent price growth and influx of leveraged trades indicate broader investor optimism towards Bitcoin’s future. The analyst suggests that as long as Bitcoin continues to flow into futures rather than spot exchanges, bullish sentiment will likely remain strong.

Leveraged bets represent one of several metrics related to Bitcoin, indicating a potential continued price increase.

The Stablecoin Supply Ratio Oscillator (SSRO) has reached low levels not seen since 2022. This decrease suggests more stablecoins are being converted to BTC, indicating increasing demand for the asset.

Technical indicators also support further price rallies. Analyst Ali notes that historically, BTC peaks at 1.618 and 2.272 Fibonacci retracement levels. If this pattern holds, BTC could reach prices between $174,000 and $462,000.

In past bull cycles, #Bitcoin has peaked between the 1.618 and 2.272 Fibonacci retracement levels. Following a similar pattern, the next $BTC top could land between $174,000 and $462,000! pic.twitter.com/KUq51Tt57z

— Ali (@ali_charts) October 30, 2024

Featured image created with DALL-E, Chart from TradingView