10 0

Bitcoin Bull Phase Possible as Stablecoin Reserves Reach All-Time High

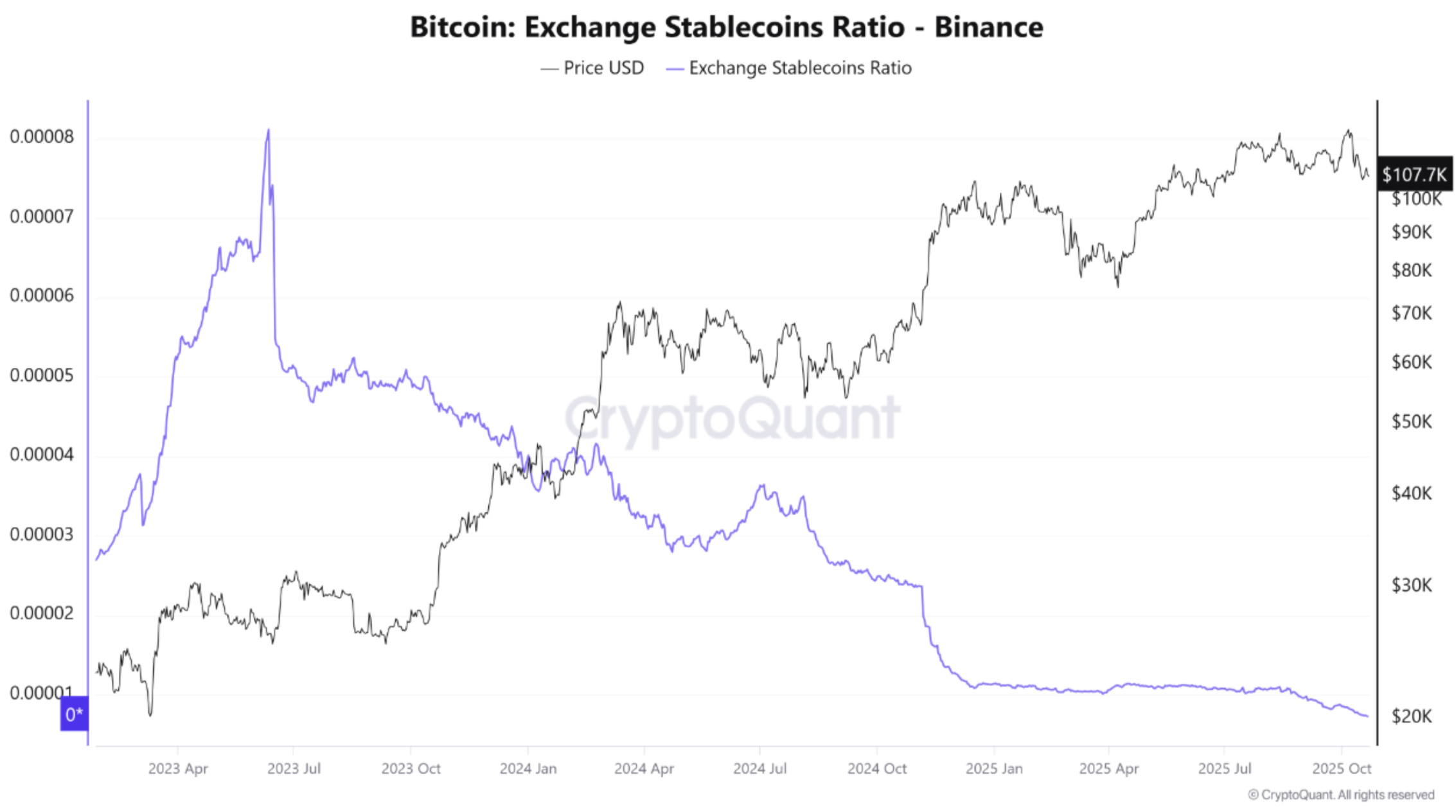

Bitcoin's price remains in the high $100,000 range after a recent market crash on October 9. Some positive indicators are surfacing, notably the rise of stablecoin reserves on major exchanges like Binance, reaching all-time highs. This suggests potential for a Bitcoin rally.

Stablecoin Reserves and Bitcoin Impact

- CryptoQuant reports Binance's stablecoin reserves nearing ATH, indicating readiness to buy BTC.

- The Bitcoin-Stablecoin Ratio (ESR) is dropping, signifying increased buying power.

- A low ESR suggests more stablecoins than BTC on exchanges, potentially leading to a bull rally.

- If ESR rises, it indicates increasing short-term selling pressure.

The current low ESR level suggests large stablecoin reserves, which could mean substantial buying power if market confidence returns.

Gold Rotation and Bitcoin

- Post-crash, Bitcoin fell from over $126,000 to $102,000, causing significant liquidations.

- Bitwise predicts capital moving from gold to BTC could drive its price to $242,000.

- Trader Peter Brandt forecasts a possible 50% drop in BTC value from current levels.

As of now, Bitcoin trades at $108,268, a slight decrease of 0.3% in the last 24 hours.