Bitcoin Bull Run Remains Predictable Despite Market Fluctuations

This is a segment from the Empire newsletter.

Happy Friday!

The current bitcoin market shows signs of struggle, but some analysts suggest potential for new all-time highs in December. The sentiment echoes the UK government's advice: remain calm.

This segment explores the cyclical nature of bitcoin's market behavior and emerging trends regarding AI agents.

This time is no different

Historical patterns in bitcoin bull markets indicate predictability. Aside from the recent all-time high occurring before the halving, the current trend aligns with previous cycles.

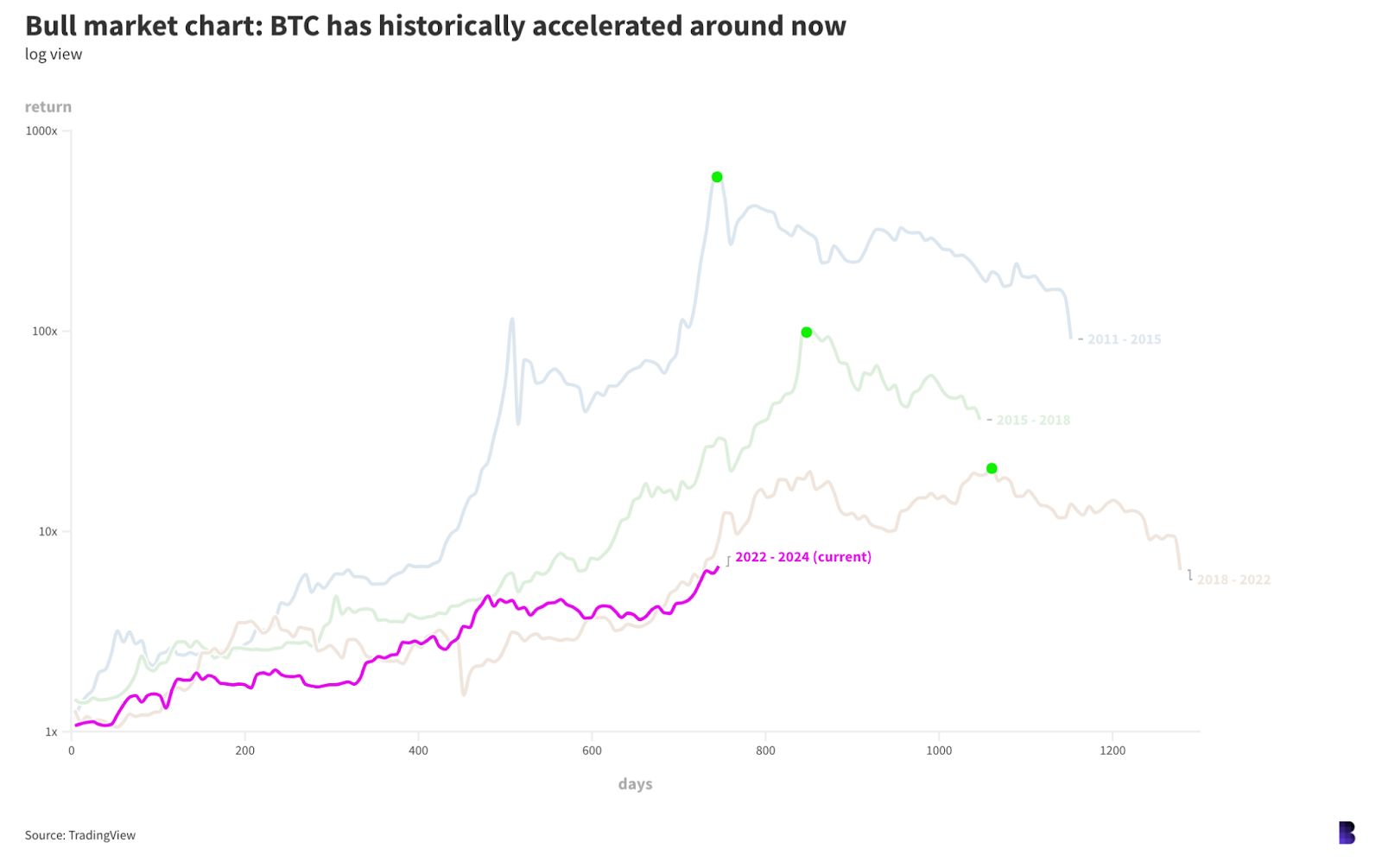

The chart below compares the current bull run (purple) with past cycles, showing that this run is consistent with historical performance.

While trajectories remain similar, two trends are emerging:

1. BTC is taking longer to reach cycle peaks each time

Bitcoin reached its first peak approximately 750 days into the 2011-2015 cycle, 845 days in the 2015-2018 cycle, and over 1,060 days in the 2018-2022 cycle. Currently, at day 746, projections suggest another 10 months to a year until a peak.

2. Returns are shrinking

Bitcoin saw returns of 621x, 100x, and nearly 22x in its respective bull runs. Based on this trend, future returns may approximate 6x from the bear market bottom to the peak, already surpassed by BTC reaching $100,000 at 6.7x.

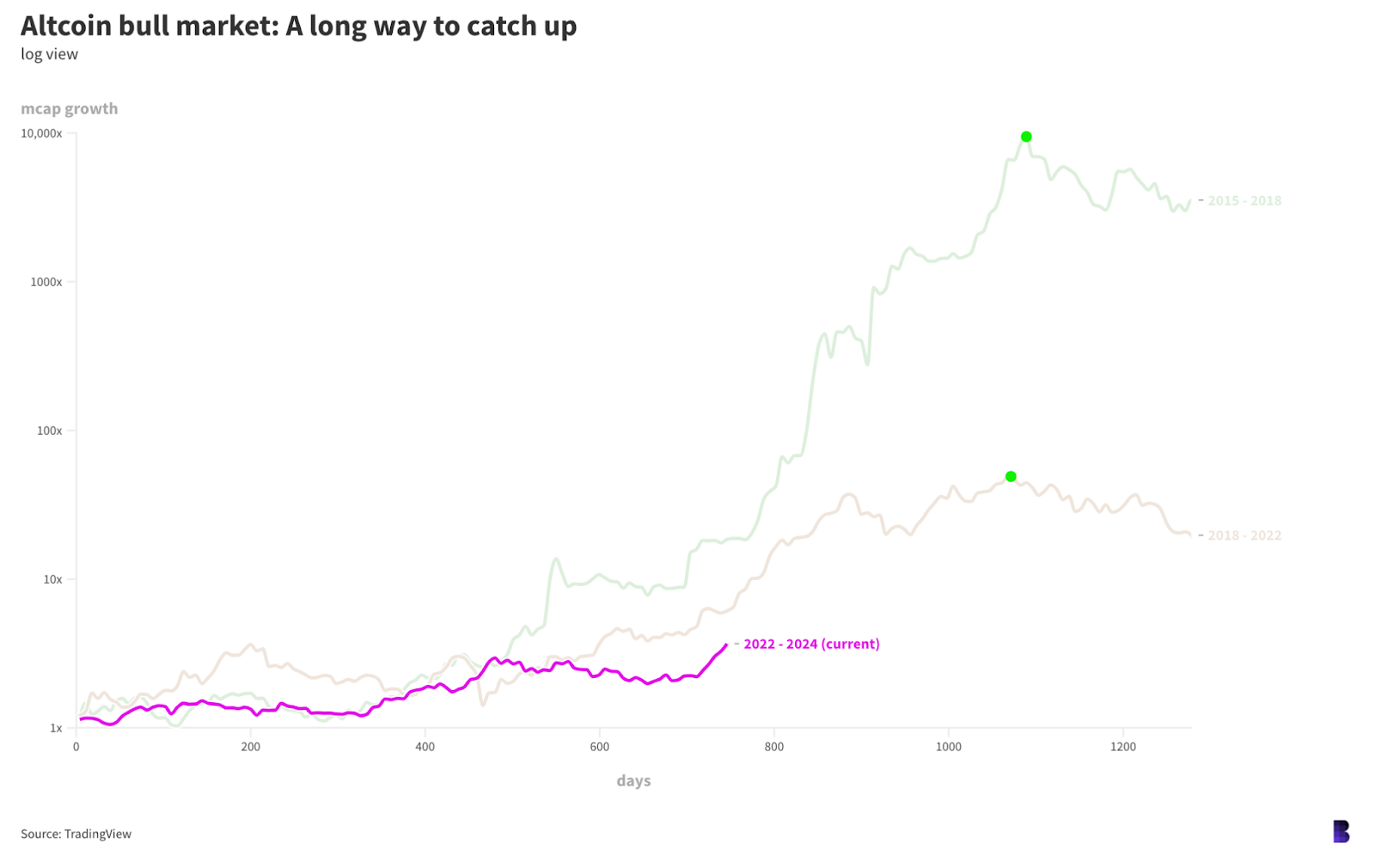

The chart above illustrates altcoin performance, which has grown only 3.7x since the last peak compared to a previous 49x increase. Historical data shows altcoins typically require over 1,000 days to reach their peaks, indicating potential growth ahead.

The outlook suggests ample time remains for altcoins to gain traction.