Bitcoin Bull Score Reaches Rare Level Amid Market Transition

Bitcoin has shown renewed bullish momentum, approaching the $97,000 level after a period of selling pressure. This shift indicates easing downside pressure and increased buyer interest.

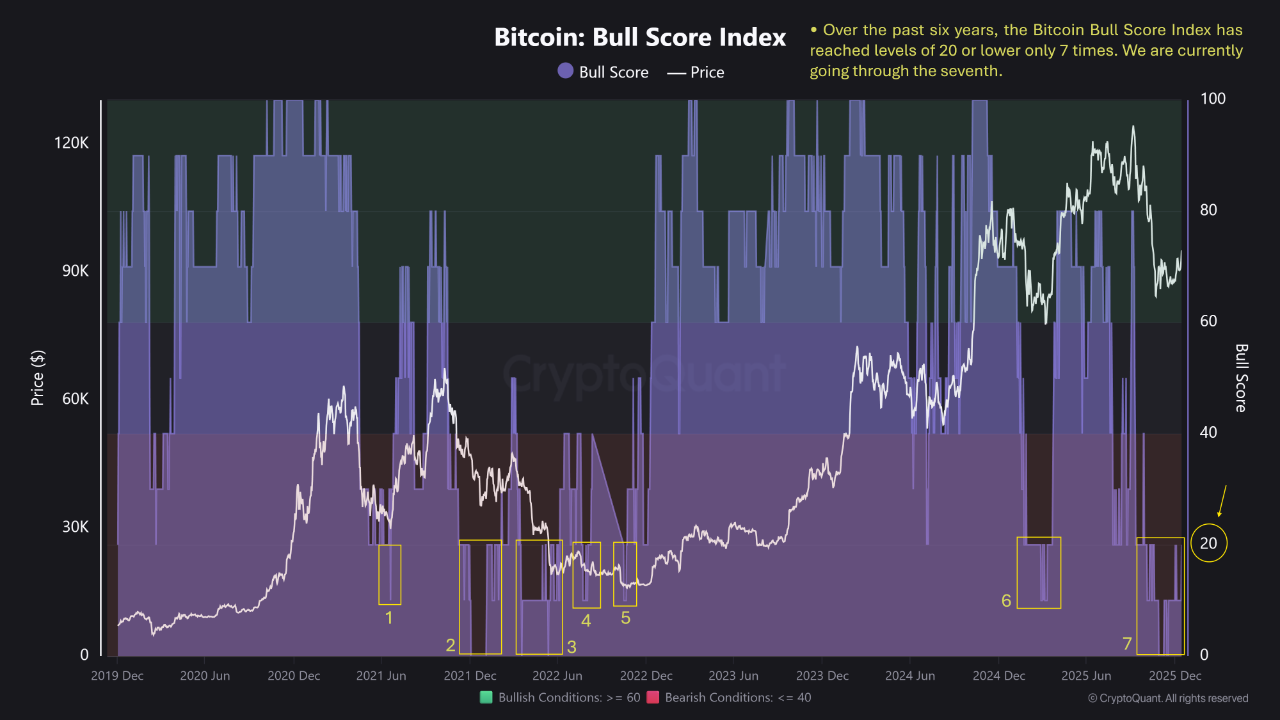

- The Bitcoin Bull Score Index is at 20, a rare occurrence that historically reflects deeply pessimistic conditions.

- Such environments typically signal transitional phases rather than sustained declines.

- This index aggregates multiple indicators to assess market conditions, with readings near 20 suggesting caution over optimism.

The timing is crucial as Bitcoin approaches the psychological $100,000 zone, a key resistance point for both short-term and long-term holders. The outcome will depend on whether Bitcoin can break through this level or remain in consolidation.

Weekly Chart Shows Recovery Attempt Below Resistance

Bitcoin is trading around the $96,000–$97,000 range, a technically significant area. This aligns with past support turned resistance from mid-2025. Recent price action suggests buyers are defending higher lows, but confirmation of a trend reversal remains incomplete.

- Bitcoin is still below the declining 50-week moving average, a critical level for trend continuation.

- The 100-week moving average provides structural support, indicating broader market strength despite short-term weakness.

- The recent rebound occurred without major volume expansion, suggesting the move may lack strong conviction.

If Bitcoin consolidates above $95,000 and reclaims the 50-week moving average, it could continue toward the $105,000–$110,000 range. Failure to hold could lead to tests in the mid-$80,000s, keeping consolidation unresolved.