Bitcoin Coinbase Premium Index Drops to -0.221% Indicating Possible Buy Opportunity

A quant has analyzed the recent trend in the Bitcoin Coinbase Premium Index, suggesting a potential buying opportunity for Bitcoin.

Bitcoin Coinbase Premium Index Decline

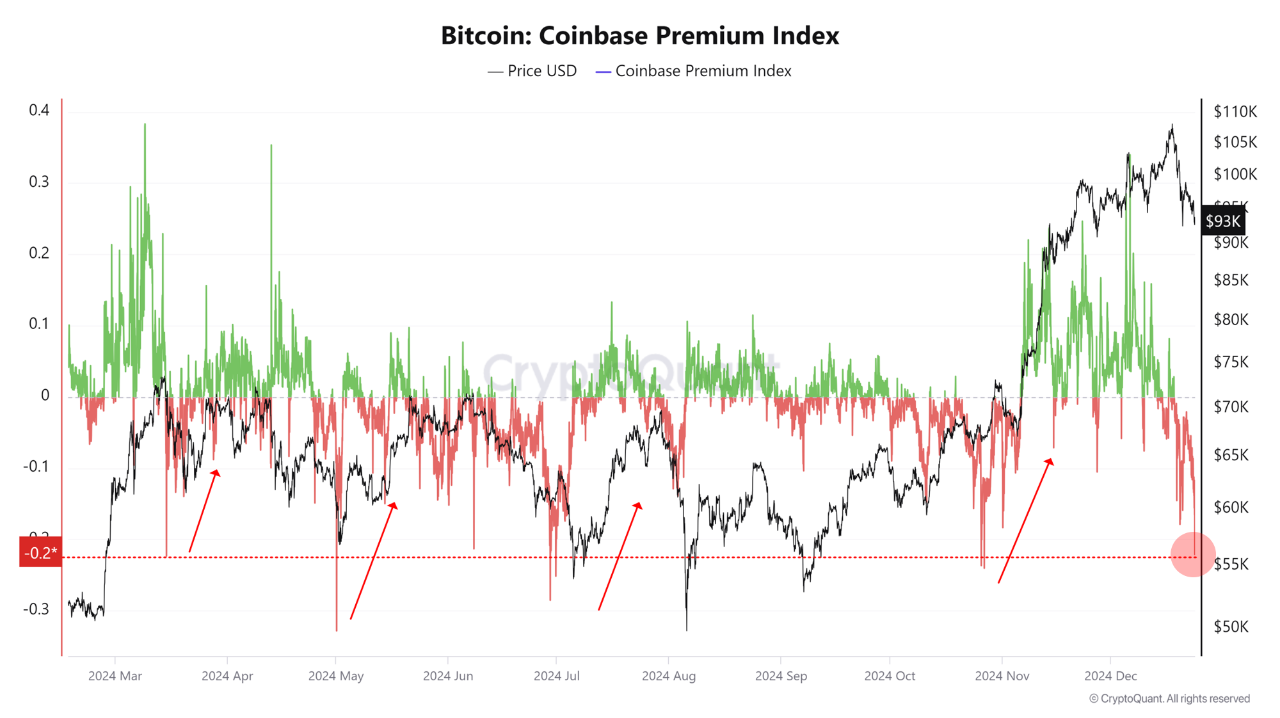

The Bitcoin Coinbase Premium Index has dropped to -0.221%. This index measures the percentage difference between BTC prices on Coinbase (USD pair) and Binance (USDT pair). A positive value indicates higher trading rates on Coinbase, reflecting greater buying pressure there. Conversely, a negative value suggests increased buying activity on Binance.

A recent chart illustrates the downward trend of the Bitcoin Coinbase Premium Index, indicating increased selling on Coinbase:

This decline correlates with a decrease in Bitcoin's price, suggesting the negative premium may be influencing this downward movement. Historically, Bitcoin's price has mirrored shifts in buying and selling on Coinbase. The decline in the index implies that institutional investors, primarily based on Coinbase, are selling their holdings, which is typically viewed as a bearish signal.

However, a notable pattern exists: whenever the index reaches around -0.2%, it often rebounds. This rebound might indicate that buyers enter the market to accumulate Bitcoin at lower prices, thereby pushing both the index and Bitcoin's price upward.

The current index stands at -0.221%, possibly signaling that Bitcoin is nearing a bottom, assuming institutional investors believe the bull run is ongoing.

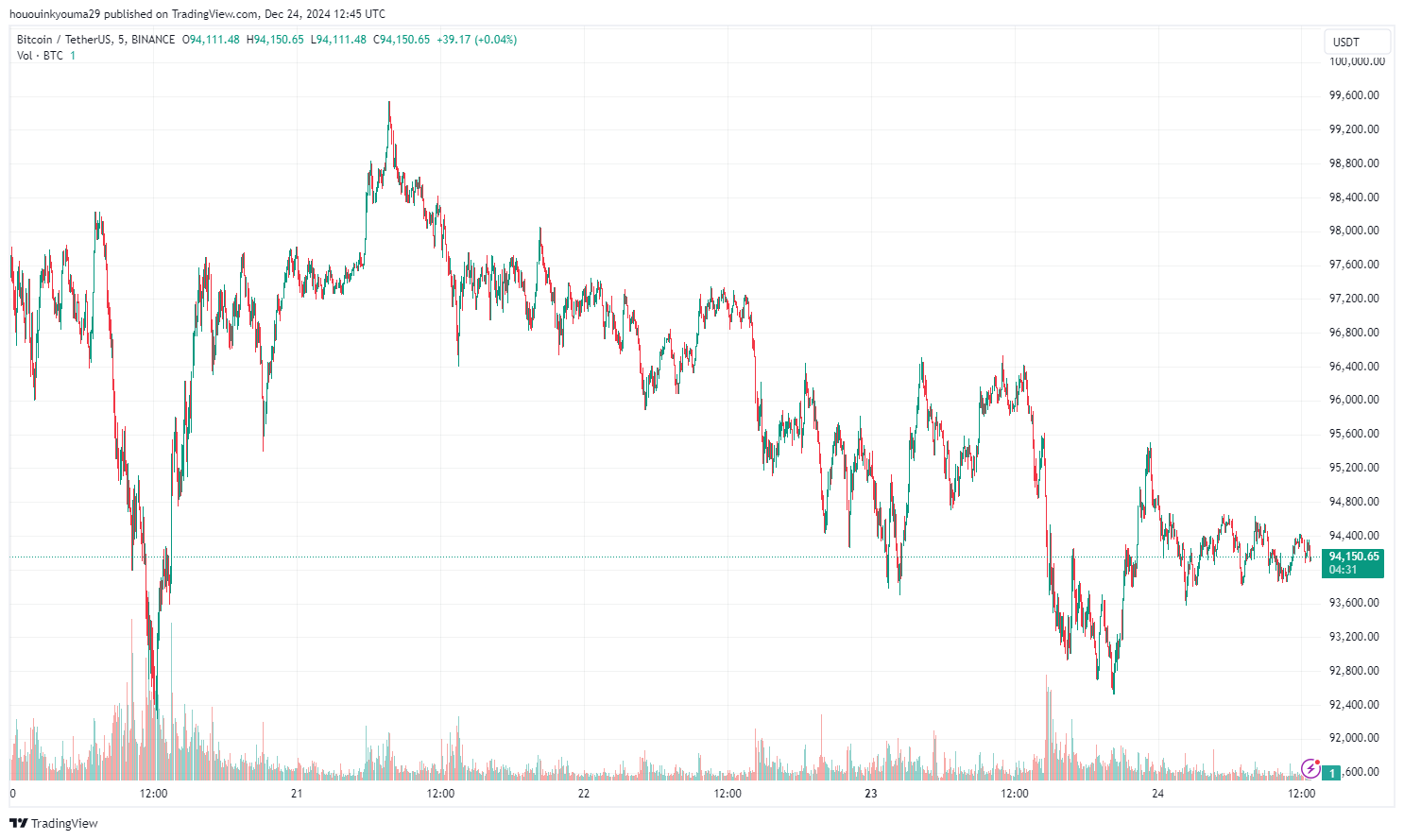

BTC Price Update

Bitcoin briefly dipped below $93,000 but has since rebounded, currently trading around $94,100.