Bitcoin Market Experiences Correction After Surging Above $108,000

The Bitcoin market is currently undergoing a correction after exceeding $108,000. This decline raises concerns among investors about a potential prolonged cooling-off period or the conclusion of the bull cycle. Historically, such corrections have often been followed by renewed upward momentum, prompting analysts to examine key on-chain metrics for insights into the current phase and its implications for Bitcoin's price trajectory.

Key On-Chain Indicators Reflect Market Sentiment

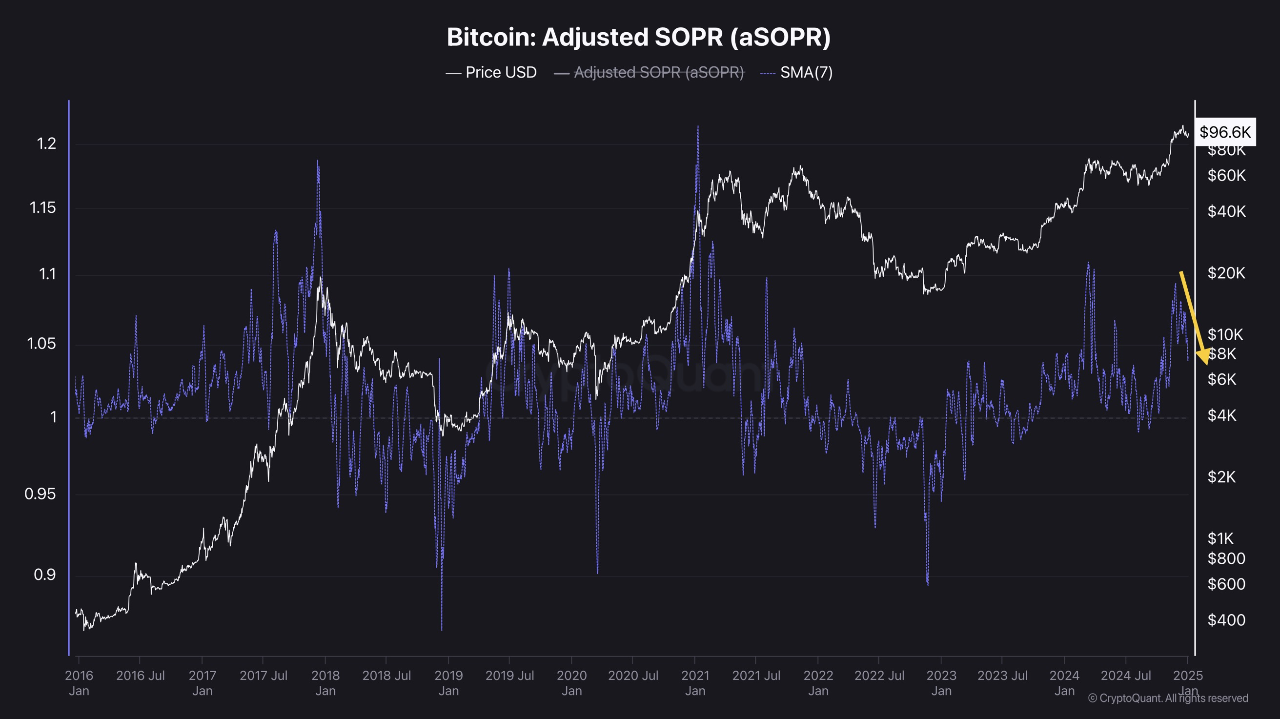

Analyst Avocado Onchain from CryptoQuant suggests that the market remains within a broader bull cycle, utilizing on-chain indicators like the Adjusted Spent Output Profit Ratio (SOPR), Miner Position Index (MPI), and funding rates to assess Bitcoin's status.

The SOPR (7-day Simple Moving Average) remains above 1 but is trending downward, indicating reduced profit margins for sellers. Drops below 1 historically signal rebounds as selling pressure diminishes.

The MPI measures miner behavior regarding Bitcoin sales in anticipation of significant market events. Current trends show minimal outflows from miners to exchanges, indicating that large mining operations are retaining their Bitcoin reserves, reflecting confidence in Bitcoin's long-term value despite short-term volatility.

Additionally, total network fees, assessed via a 7-day Simple Moving Average, indicate transaction activity and overall on-chain engagement. A recent decline in network fees points to decreased trading activity, signaling a temporary cooling-off phase. Historically, lower transaction activity precedes renewed bullish momentum when other indicators align.

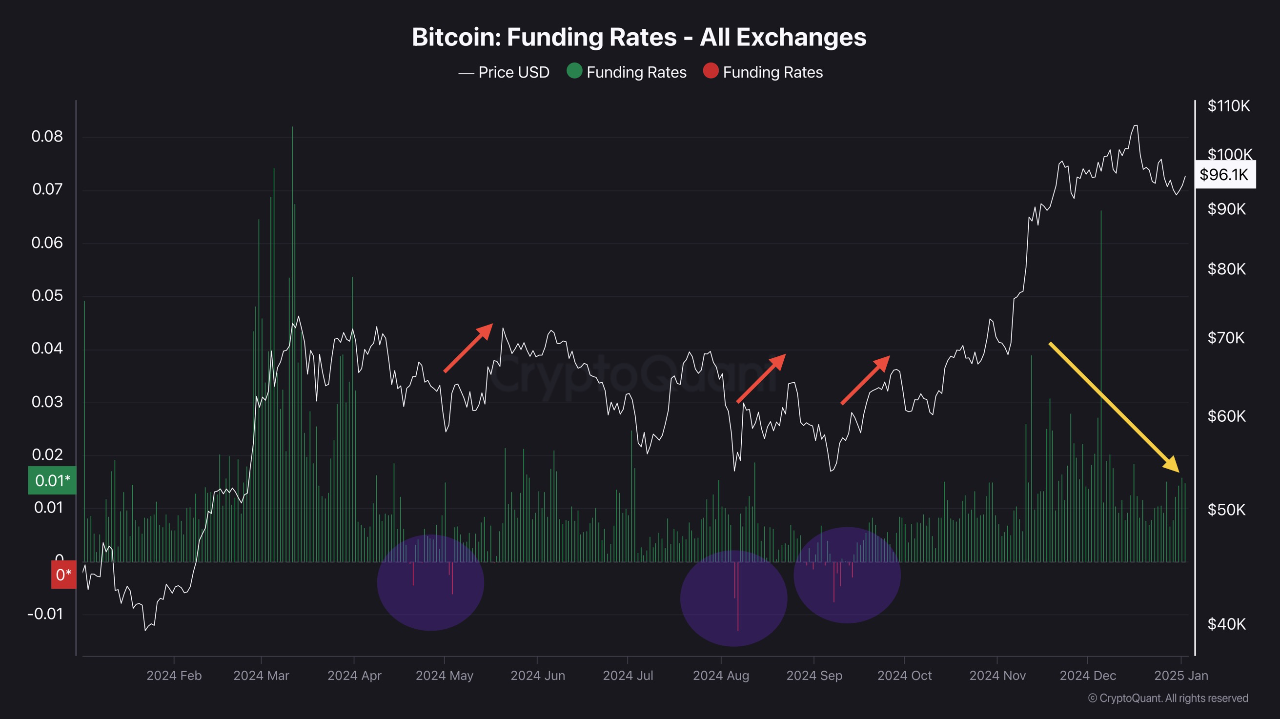

Bitcoin Funding Rates And Investor Sentiment

Funding rates, which reflect the cost of holding long or short positions in Bitcoin futures, have shown a downward trend. These rates are often indicative of market sentiment. During bull cycles, sharp drops in funding rates are typically followed by rebounds, as bearish sentiment reaches an extreme point and buyers return.

While current on-chain data indicates a cooling-off phase rather than an end to the bull cycle, short-term price movements remain uncertain. Historically, drops in funding rates have represented buying opportunities for long-term investors during periods of heightened market pessimism.

Featured image created with DALL-E, Chart from TradingView.