Bitcoin Cost Basis Distribution Shows Strong Demand at $97K Level

Bitcoin recently reached an all-time high (ATH) before experiencing a 15% correction. This volatility has split investor sentiment, with some anticipating further gains and others preparing for potential declines. The market is focused on Bitcoin's ability to regain its bullish momentum.

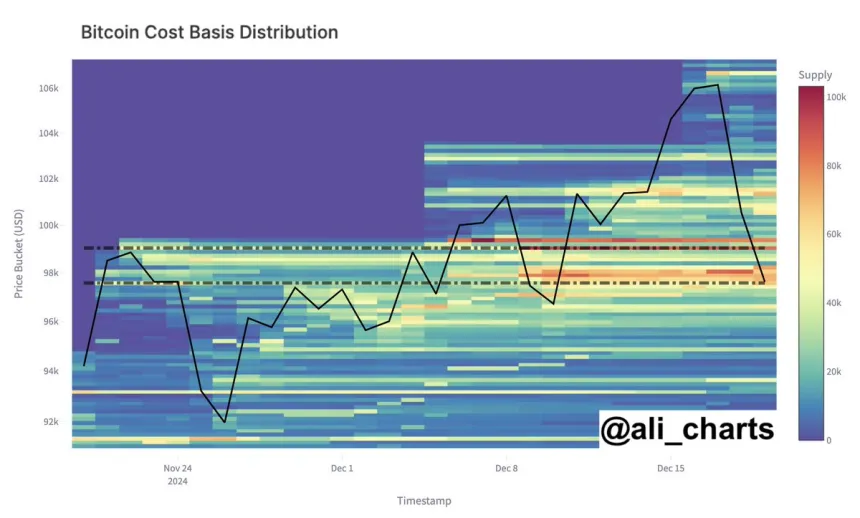

Analyst Ali Martinez highlighted significant data from Bitcoin's cost basis distribution, identifying $97K as a key support level. Holding this level is crucial for BTC to sustain its uptrend and avoid deeper corrections. However, Bitcoin struggles to surpass the psychological resistance at $100K.

Some investors view the recent correction as a necessary adjustment after Bitcoin's rapid ascent, while failure to break higher may indicate a prolonged consolidation phase. With Bitcoin trading near critical levels, the upcoming days will be pivotal in determining its trajectory.

Bitcoin Holding Above Key Demand

Bitcoin remains above the critical demand level of $97,000, providing optimism for bulls amid recent fluctuations. After testing lower demand at $92,000, the market demonstrated resilience against selling pressure. The price currently sits at a crucial juncture that could influence its direction heading into the new year.

Martinez noted the importance of the $99,000–$97,000 range, marking it as a vital support threshold for Bitcoin's current uptrend. He cautioned about potential downside risks if Bitcoin fails to maintain this range, stating, “We really don’t want this level to become resistance.”

As Bitcoin consolidates near these levels, market sentiment remains mixed. Bulls hope for a momentum recovery toward all-time highs, yet the $100,000 resistance persists. Bears suggest that the recent pullback may indicate a larger correction ahead.

The coming days are critical as the year ends. For Bitcoin to preserve its bullish structure, it must hold the support zone or face potential downward movements. The next major price action will depend significantly on BTC's performance within this range.

BTC Testing Liquidity

Currently trading at $97,000, Bitcoin shows resilience after bouncing from local lows of $92,000, indicating strong market demand at these levels. The price structure above $97,000 suggests BTC is well-positioned for another rally towards its ATH.

However, the $100,000 psychological barrier poses a significant challenge for bulls. Previous attempts to breach this level have failed. A successful breakout above $100,000 could reignite bullish momentum, leading Bitcoin towards new ATHs and restoring investor confidence.

If Bitcoin cannot overcome this resistance, it may face increased selling pressure, resulting in a downturn and retesting key support levels.

Featured image from Dall-E, chart from TradingView