Bitcoin Sees Decline in Demand as Gold Gains Favor Amid Economic Uncertainty

President Trump's recent “reciprocal tariffs” announcement spiked the economic trade policy uncertainty index, leading to a decline in risk assets, including cryptocurrencies. Federal Reserve Chairman Jerome Powell indicated that unemployment may rise as tariffs impact the economy, further dampening investor sentiment.

Key points:

- Nasdaq fell 1.17%, S&P 500 dropped 2.24%.

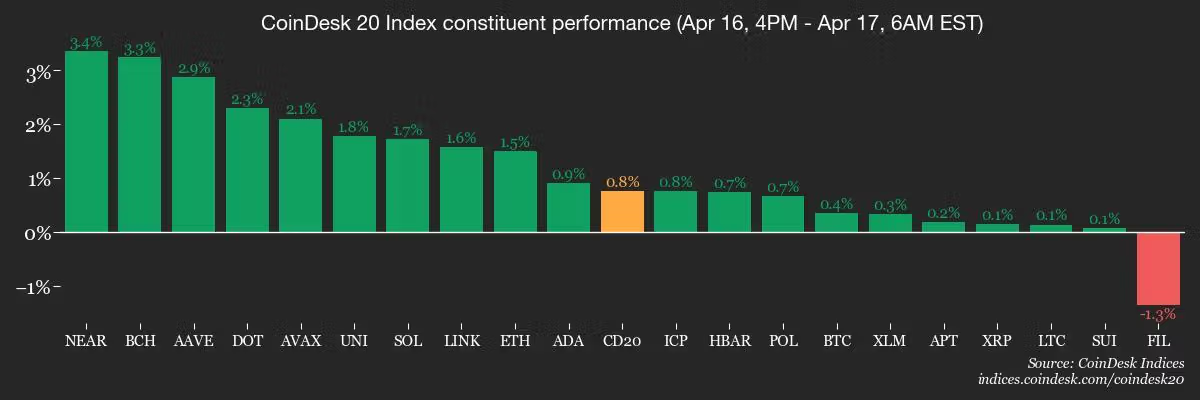

- Bitcoin increased by over 1% in 24 hours while the CoinDesk 20 index rose by 1.8%.

- Investor demand for gold is rising; it has gained 11% this month and 27% this year, trading at approximately $3,340 per ounce.

- 49% of fund managers consider "long gold" the most crowded trade according to Bank of America’s Global Fund Manager Survey.

- Gold fund flows reached $80 billion in 2025; Bitcoin ETFs experienced substantial outflows totaling over $900 million this month.

Upcoming Crypto Events

- April 17: EigenLayer activates slashing on Ethereum mainnet.

- April 18: Pepecoin undergoes second halving.

- April 20: BNB Chain opBNB mainnet hardfork.

- April 21: Coinbase Derivatives to list XRP futures pending CFTC approval.

- April 25: SEC Crypto Task Force Roundtable on crypto custody considerations.

Market Movements

BTC is stable at $84,312 (up 0.4%). ETH rose 1.26% to $1,593.44. Gold is up 0.35% at $3,338.30/oz. The Nasdaq and S&P 500 saw significant declines amid tariff uncertainties.

Technical Analysis

Bitcoin has found support between $74,995 and $73,213, indicating potential bullish momentum. Current price action shows it testing critical moving averages.

Derivatives Overview

CME bitcoin futures open interest hit 138,235 BTC. The funding rate turned negative during Powell's speech, reflecting market uncertainty.

Crypto Stats

- BTC Dominance: 63.89%

- Hashrate: 905 EH/s

- Total Fees: 5.78 BTC / $482,907

ETF Flows

Spot BTC ETFs saw daily net outflows of -$171.1 million, with cumulative flows at $35.36 billion. Spot ETH ETFs had daily net flows of -$12.1 million.