Updated 22 December

Bitcoin Demand Increases as OTC Desk Inventories Decline by 26,000 BTC

This week, Bitcoin experienced significant volatility, reaching a new all-time high before dropping approximately 13% to a low of $92,000 on December 20. This decline followed the US Federal Reserve’s rate cut, which negatively impacted other financial markets. Currently, Bitcoin is showing signs of recovery, trading around $97,000.

Can Growing Demand Push BTC Price Back Above $100,000?

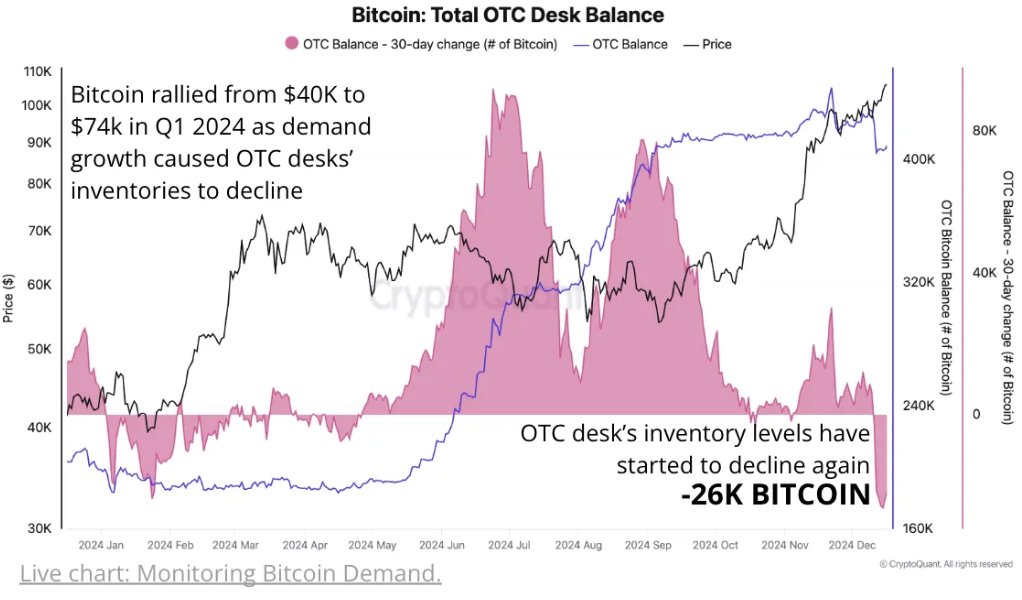

A report from market analytics platform CryptoQuant on December 20 highlighted an increase in investor interest in Bitcoin. The Total OTC Desk Balance metric tracks Bitcoin held by Over-The-Counter (OTC) desks, providing insights into supply available to large investors and institutions.

CryptoQuant noted that OTC desks have seen their largest monthly inventory decline in 2024, with over 26,000 BTC lost in December alone. The past 30 days have witnessed a total drop of 40,000 BTC since November 20.

This decline in the Total OTC Desk Balance suggests increased demand for Bitcoin alongside a shrinking supply, potentially leading to significant price appreciation. Historically, a similar situation occurred when Bitcoin's price rose from $40,000 to around $74,000 in the first quarter of 2024 as OTC inventories decreased.

Currently, Bitcoin's apparent demand is growing at a monthly rate of 228,000 BTC, with accumulation addresses increasing at a record high of 495,000 BTC per month.

Bitcoin Price At A Glance

As of this writing, Bitcoin's price is approximately $97,655, reflecting a 0.1% decline over the past 24 hours and nearly 4% down for the week, according to CoinGecko data.

Featured image created by DALL-E, chart from TradingView