Bitcoin Derivatives Market Sees Increased Open Interest and Leverage Ratio

Recent data indicates an uptick in Bitcoin derivatives market indicators, potentially increasing BTC's price volatility.

Bitcoin Open Interest & Leverage Ratio Increase

According to CryptoQuant analyst Maartunn, Bitcoin Open Interest has surged alongside the asset's return above $100,000. Open Interest tracks the total number of open BTC derivatives positions across centralized exchanges.

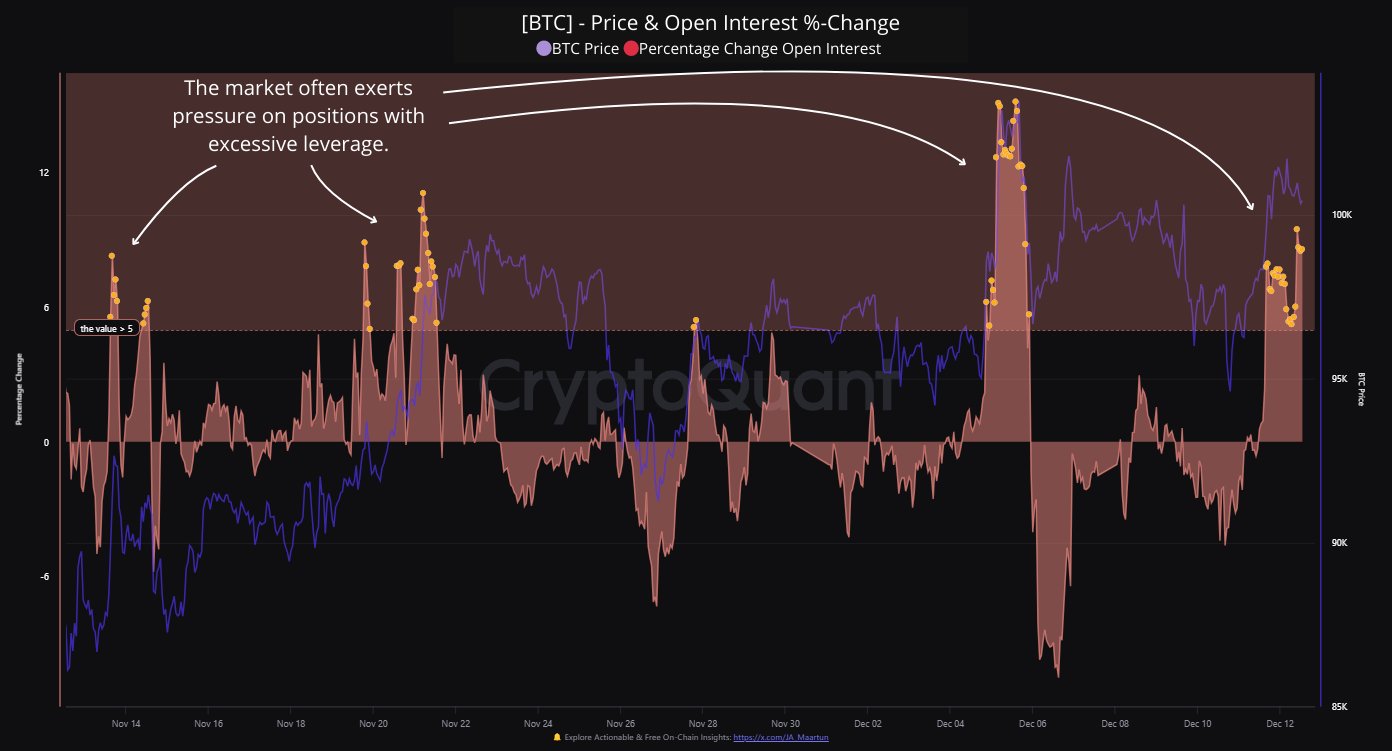

The following chart illustrates the percentage change in Bitcoin Open Interest over the past month:

The graph shows a significant increase in Bitcoin Open Interest, indicating many new market positions. Previous instances of similar increases have generally led to price cooldowns within the month.

This trend suggests that a greater number of positions often correlates with increased leverage. This scenario raises the likelihood of a squeeze, where numerous positions are liquidated simultaneously, propelling price movements and triggering further liquidations.

Squeezes typically impact the side of the market with more leveraged positions. Historical data indicates that previous Open Interest spikes accompanied uptrends, suggesting new positions were primarily long. Hence, a long squeeze may occur to eliminate excess positions.

The latest increase in Open Interest could similarly affect Bitcoin, especially since it coincides with a price rally. The outcome hinges on whether these positions are overleveraged.

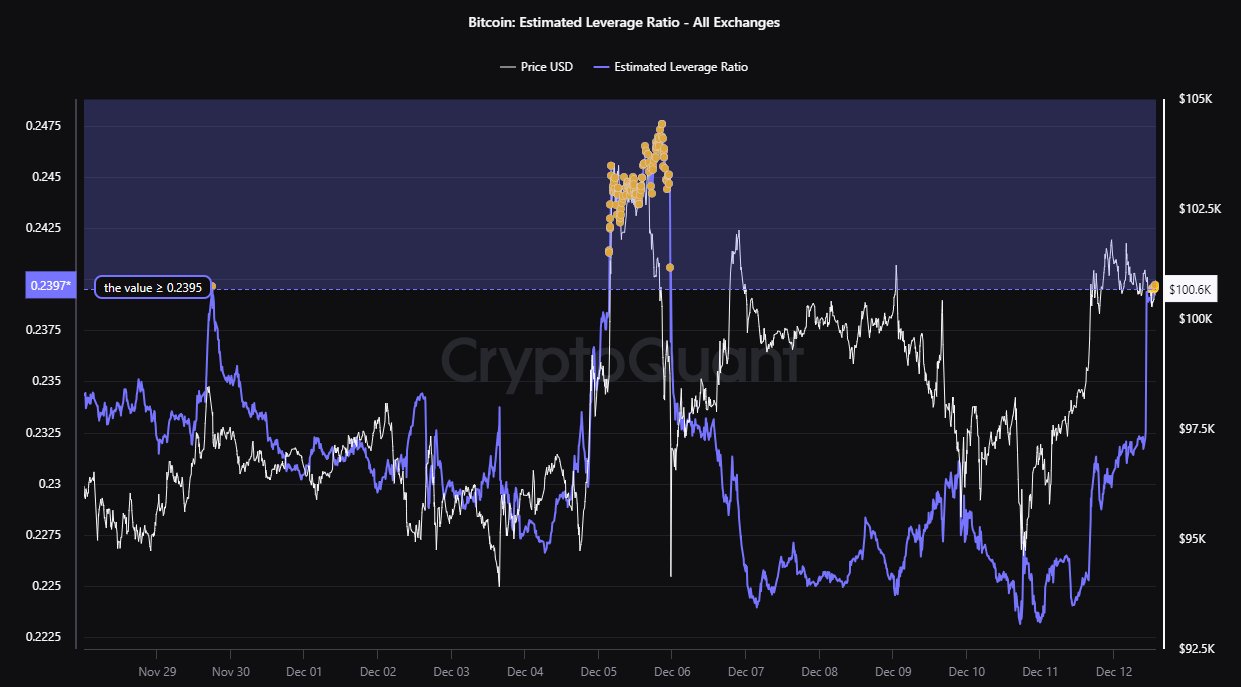

Current data from CryptoQuant indicates that this condition is likely met, as reflected by the Estimated Leverage Ratio shared by IT Tech, which has also risen alongside Open Interest.

The Estimated Leverage Ratio reveals the average leverage users employ in the derivatives market. Its recent spike suggests that new positions may carry considerable leverage.

Future developments for Bitcoin remain uncertain due to the potentially overheated conditions indicated by these derivatives metrics.

BTC Price

Currently, Bitcoin is priced around $100,400, reflecting an increase of over 2% in the past week.