1 0

Bitcoin Faces Potential Downturn as Large Inflows Signal Investor Distribution

Bitcoin's Resistance and Potential Distribution Risks

- Bitcoin failed to surpass the $97,000 resistance level after a mid-January price surge.

- The cryptocurrency is currently in a state of inertia, with minimal movement.

- Recent on-chain data suggests potential distribution risks for Bitcoin.

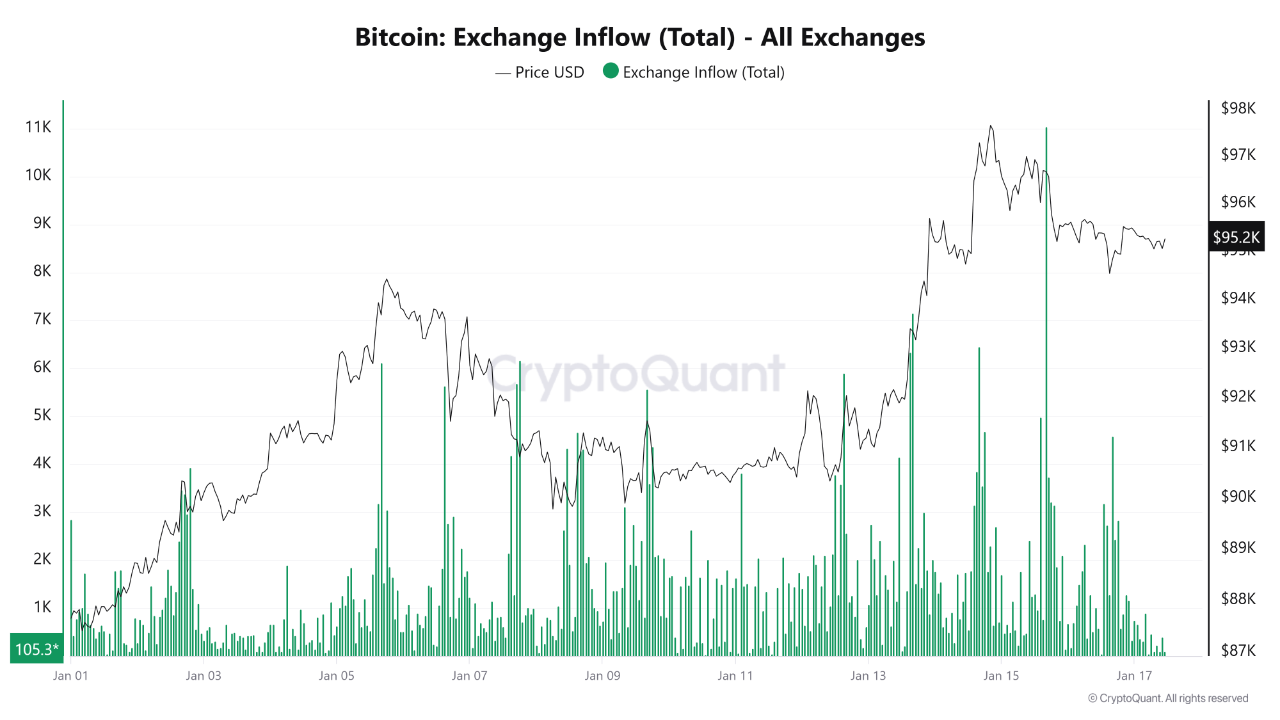

Exchange Inflows Indicate Possible Distribution

- CryptoZeno, a key opinion leader, highlights increased Bitcoin inflows into exchanges.

- Surges in exchange inflows are seen as indicators that investors might be preparing to distribute BTC holdings.

- This trend typically follows strong BTC price advances, leading to potential sell-side pressure.

- Large inflows often precede periods of heightened volatility or corrective price action.

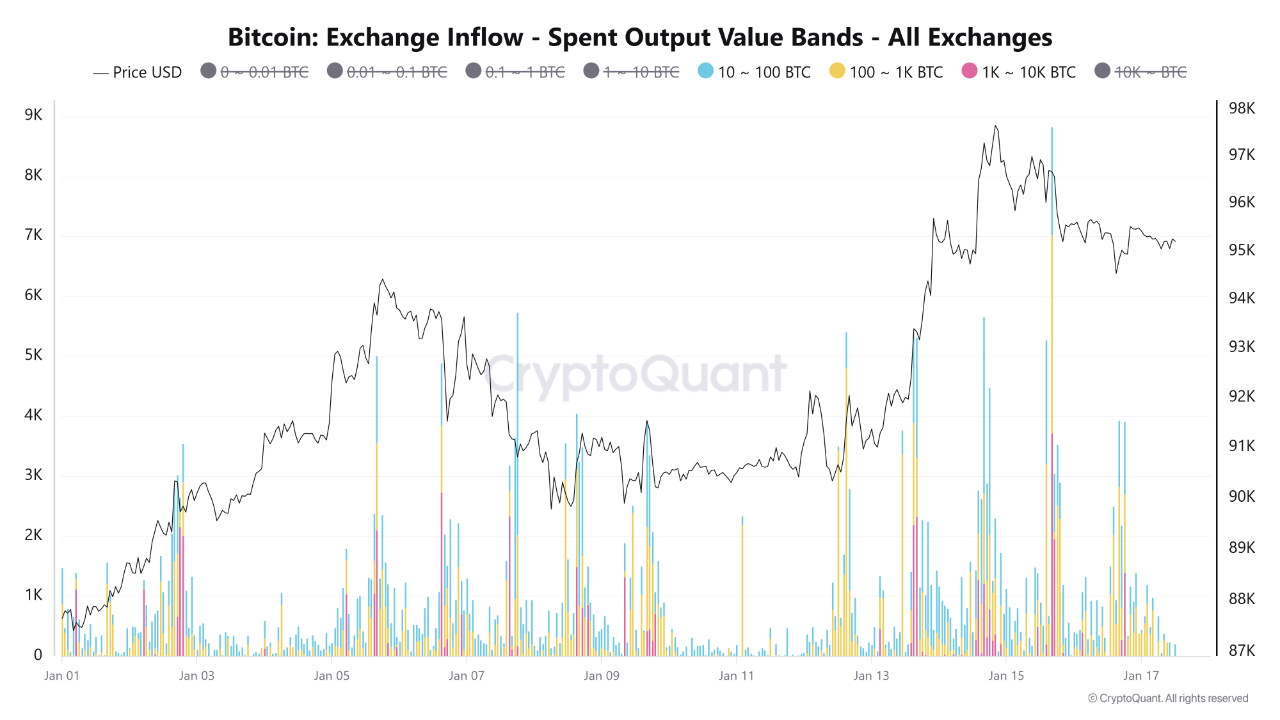

Main Contributors to Exchange Inflows

- Mid-to-large size bands (10-100 BTC, 100-1,000 BTC) are major contributors to the recent inflow spike.

- These bands are associated with whales and long-term investors, who act strategically.

- Simultaneous large investor activity and high exchange inflows suggest a fragile market phase.

- If high inflows persist while prices stagnate, Bitcoin could face supply over demand issues.

Current Bitcoin price: $95,250 with negligible growth from the previous day.