11 March 2025

5 0

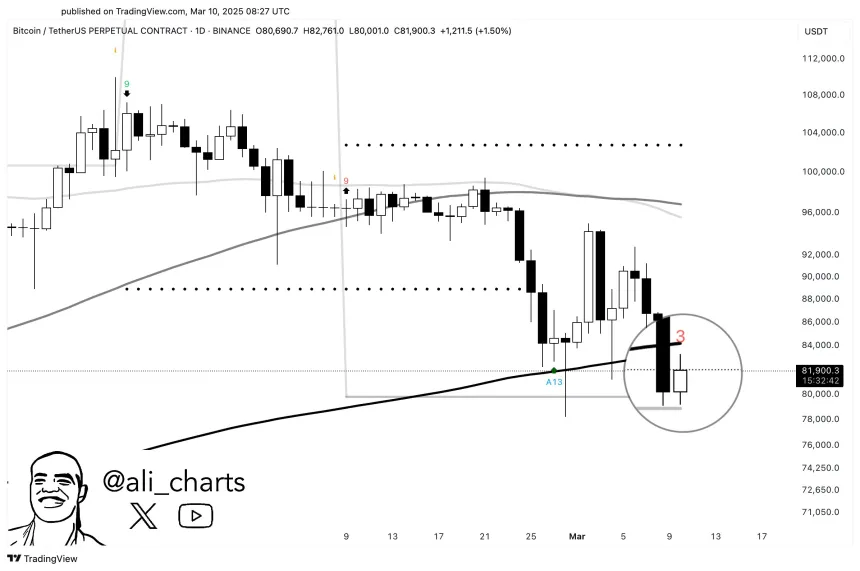

Bitcoin Drops 11.3% and Trades Below 200-Day Moving Average

Bitcoin (BTC) has declined 11.3% in the past week, trading in the low $80,000 range. This drop has pushed BTC below the 200-day moving average (MA), raising concerns of a deeper pullback.

Key Price Level to Defend

- BTC is below the critical 200-day MA, which historically serves as strong support.

- Analyst Ali Martinez noted that BTC must stay above the TD Sequential risk line at $79,280 for potential recovery.

- A move above this level may lead to a rebound.

- Analyst Ted pointed out that BTC often experiences 25% to 30% corrections before rebounding to new all-time highs.

- If BTC follows previous patterns, it could reach approximately $104,000 after climbing 30% from its current price.

- Macroeconomic factors, including trade tariffs and Federal Reserve policies, may impact BTC’s trajectory.

Reclaiming $84,000 Necessary

- Martinez highlighted the need for BTC to reclaim $84,000 as support before any significant upward movement.

- Once secured, BTC could potentially rally toward $128,000.

- Several indicators suggest BTC may have found a local bottom, with Rekt Capital noting the recent plunge to $78,258 as a possible cycle low.

- The US Dollar Index (DXY) recorded one of its largest weekly breakdowns since 2013, historically signaling bullish momentum for BTC.

At press time, BTC trades at $80,137, down 3.5% in the last 24 hours.