Updated 20 December

Bitcoin Drops 8% After Fed Rate Cut but Holds Above $98,000

Bitcoin experienced an 8% decline from its all-time high of $108,300 following a Federal Reserve announcement of a 25 basis point rate cut and fewer anticipated cuts in 2025. Despite this drop, Bitcoin maintained a position above $98,000, a critical liquidity level under close observation by analysts.

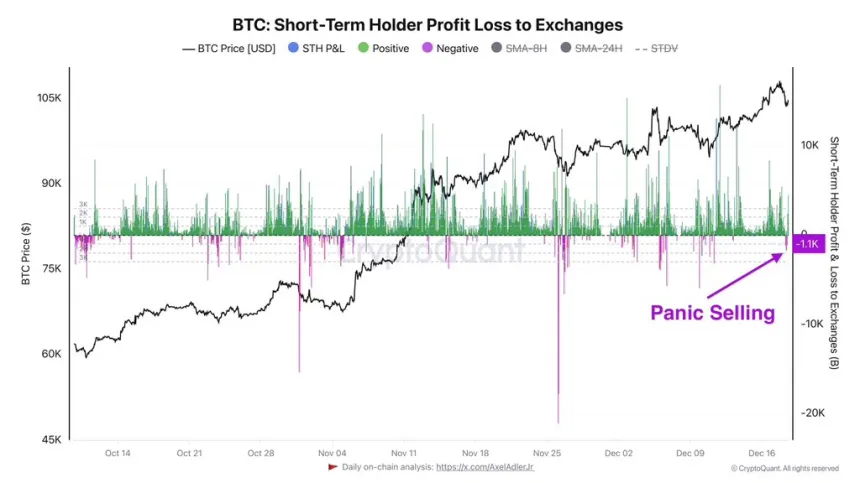

This price movement raises questions about the potential for a significant correction or if it is a temporary shakeout to support Bitcoin's next rally. CryptoQuant analyst Axel Adler noted that there is no substantial panic selling, indicating ongoing investor confidence.

Bitcoin's resilience at current levels suggests market recalibration following the Fed’s announcements. The focus remains on whether Bitcoin can regain momentum toward previous highs or if deeper retracements are imminent. The upcoming days will be crucial in determining Bitcoin's trajectory.

Bitcoin Remains Strong

Despite recent volatility, Bitcoin holds above key liquidity levels, preserving its long-term bullish structure. The price drop, influenced by the Federal Reserve’s policy changes, has raised concerns, but Bitcoin’s ability to maintain critical support highlights its strength.

Top analyst Axel Adler shared insights on X, indicating no significant panic selling even after the decline. He presented a chart showing BTC short-term holder profit-loss metrics, which remain higher than during early December sell-offs, suggesting the recent sell-off was strategic rather than fear-driven.

This shakeout may create liquidity necessary for Bitcoin’s continued rally, although it could also signal the start of a broader correction that might take time to unfold.

The coming weeks are pivotal for Bitcoin as traders monitor its ability to reclaim higher levels or face further downside consolidation.

Price Action: Technical Levels To Hold

Currently trading at $101,800, Bitcoin successfully tested local demand at $98,695. The price structure shows a pattern of higher highs and higher lows, indicating sustained bullish momentum. Market sentiment remains optimistic as BTC holds above critical support levels.

For Bitcoin to sustain its upward trend, it must decisively break above $103,600, a significant pivot point from the previous week. Overcoming this resistance could renew momentum and lead to further gains.

Conversely, failure to surpass $103,600 or a decline below the $100,000 psychological level may indicate the onset of a broader correction, potentially driving prices to lower support zones as the market adjusts.

The next few days will be critical for Bitcoin's near-term direction, with traders closely monitoring the $103,600 resistance and $100,000 support levels to determine if BTC continues its rally or enters a corrective phase.

Featured image from Dall-E, chart from TradingView