Bitcoin ETF Options Launch Achieves Nearly $2 Billion in Trading Volume

Bitcoin (BTC) ETF options launched recently, achieving nearly $2 billion in notional exposure on their first day of trading. On November 20, options linked to BlackRock’s Bitcoin exchange-traded fund, IBIT, started trading.

Bloomberg Intelligence analyst James Seyffart reported a significant trading volume:

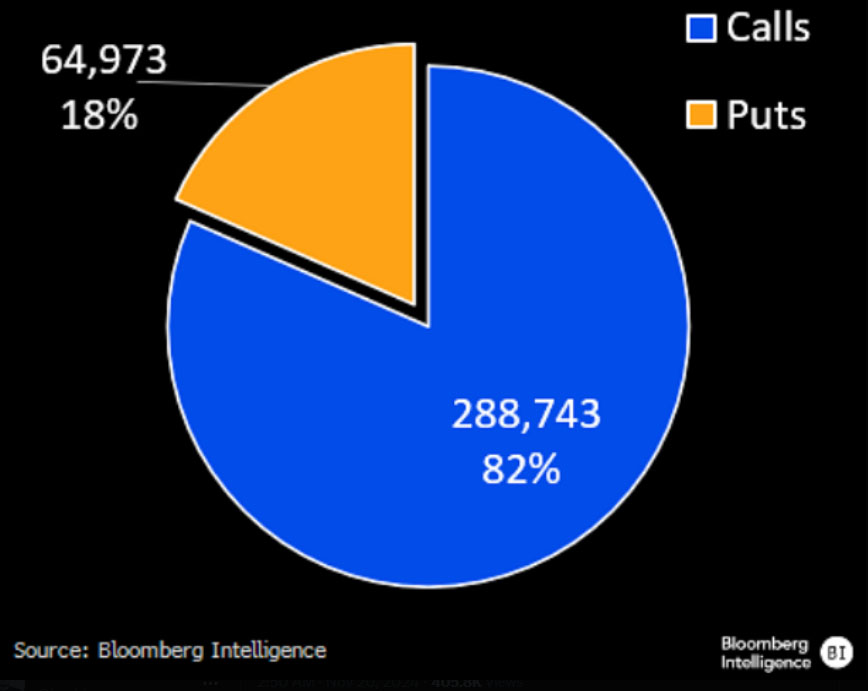

“1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts, […] That’s a ratio of 4.4:1. […] These options were almost certainly part of the move to the new Bitcoin all-time highs today.”

The launch of IBIT options is pivotal for Bitcoin investors, especially institutions. The availability of these options is expected to draw more institutional interest in Bitcoin. This follows the US Securities and Exchange Commission's approval in September for options on several spot bitcoin ETFs across various exchanges, with more products anticipated soon.

Bitcoin Sees 80% Bullish Options Surge

Seyffart noted that IBIT's options trading debuted strongly, with $1.9 billion in notional exposure from 354,000 contracts. Call options comprised 82% of this activity, indicating strong bullish sentiment.

Source: Bloomberg Intelligence

Of the 354,000 contracts, 289,000 were calls and 65,000 were puts, resulting in a call-to-put ratio of 4.4:1. This indicates a strong preference for bullish positions on Bitcoin. The increase in options trading reflects optimism about Bitcoin’s price movement during the ongoing crypto rally.

Financial derivatives provide buyers the right to buy or sell an asset at a specified price within a defined timeframe. A call option allows purchasing at the strike price, while a put option permits selling at that price. Investors typically favor call options when anticipating price increases, while put options offer protection against declines or allow speculation on price drops.

The rise in IBIT options trading introduces new strategies for seasoned investors, enhancing market liquidity and influencing the broader market. Institutional investors can utilize IBIT options to hedge bullish positions and generate income by selling calls. Speculators can leverage both call and put options to benefit from Bitcoin’s volatility without holding the asset directly.

Can Bitcoin Options Reduce Long-Term Volatility?

The influx of IBIT call options may affect Bitcoin’s implied volatility over time. Analysts suggest that substantial call option volumes could lead to lower long-term volatility. In the short term, increased demand during bullish trends might cause price surges similar to GameStop's gamma squeeze, where leveraged buying results in rapid price increases.

Bitcoin reached a new high of $93,800, continuing its post-election rally. Prices stabilized near $91,000 after climbing past $80,000 and $90,000 for the first time last week, marking a significant milestone for the cryptocurrency.

This price increase is associated with the “Trump trade,” driven by President-elect Donald Trump’s promises to consider crypto-friendly initiatives. Proposals such as creating a Bitcoin national stockpile have boosted market optimism, highlighting the cryptocurrency’s growing influence in both policy and global financial markets.