Bitcoin ETFs Experience Varied Performance Since Trump’s Election

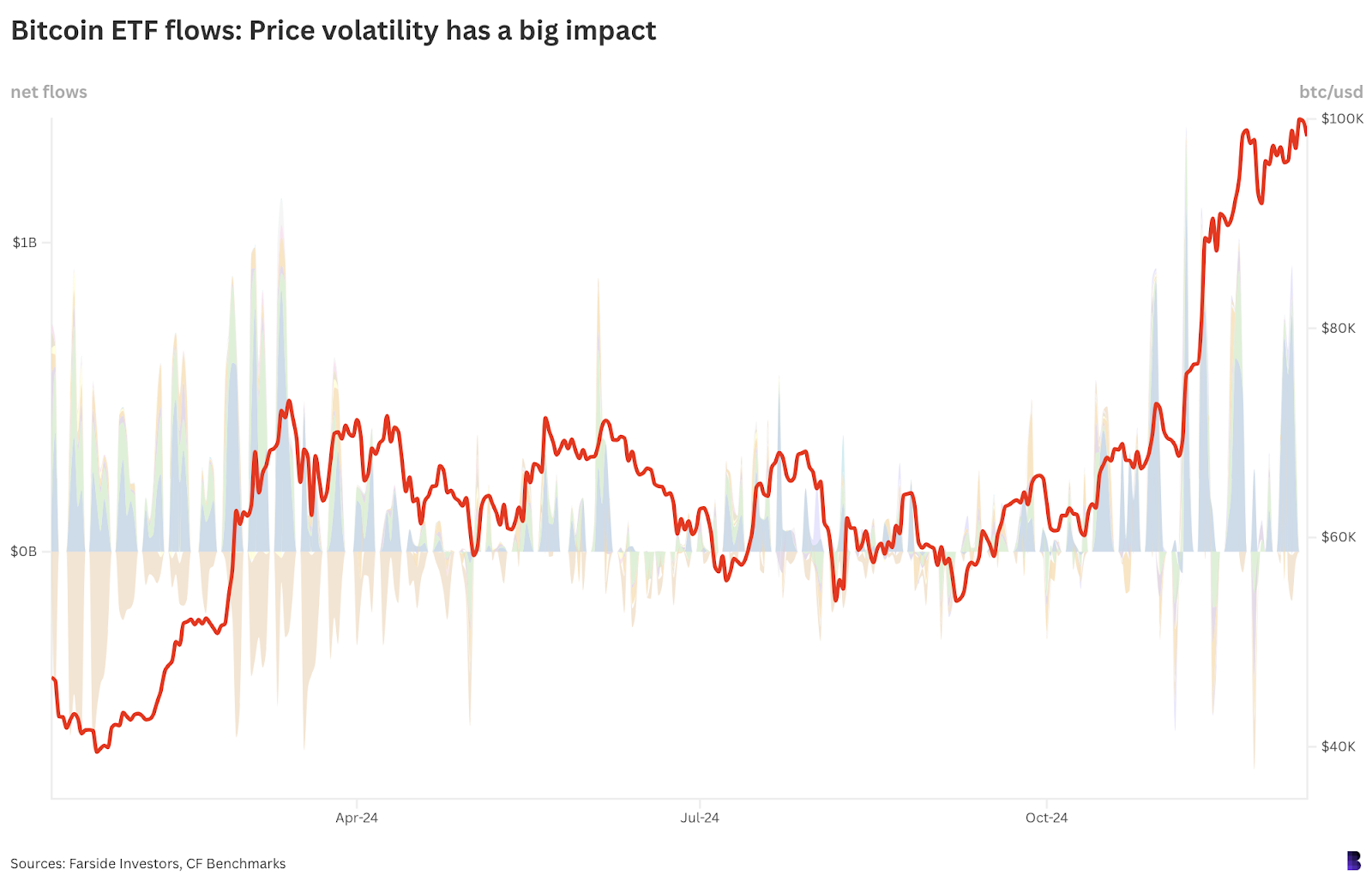

It is clear that the performance of bitcoin directly influences bitcoin ETFs.

Since Trump's election, nearly $10 billion net has flowed into US-listed spot funds, with about 83% directed to BlackRock’s IBIT.

ETF share prices are designed to closely track bitcoin prices; however, they do not indicate the funds' profit or loss on their bitcoin purchases.

Funds must buy an equivalent amount of BTC for every dollar that flows in and sell coins when there are negative net flows.

Estimating daily BTC transactions involves dividing daily US dollar flow by the bitcoin price per CF Benchmark reference rate used by major funds.

Current cumulative holdings total over 855,000 BTC ($84.2 billion), excluding Grayscale’s GBTC, and more than 1.1 million BTC ($108.3 billion) including it, representing about 5.6% of circulating supply.

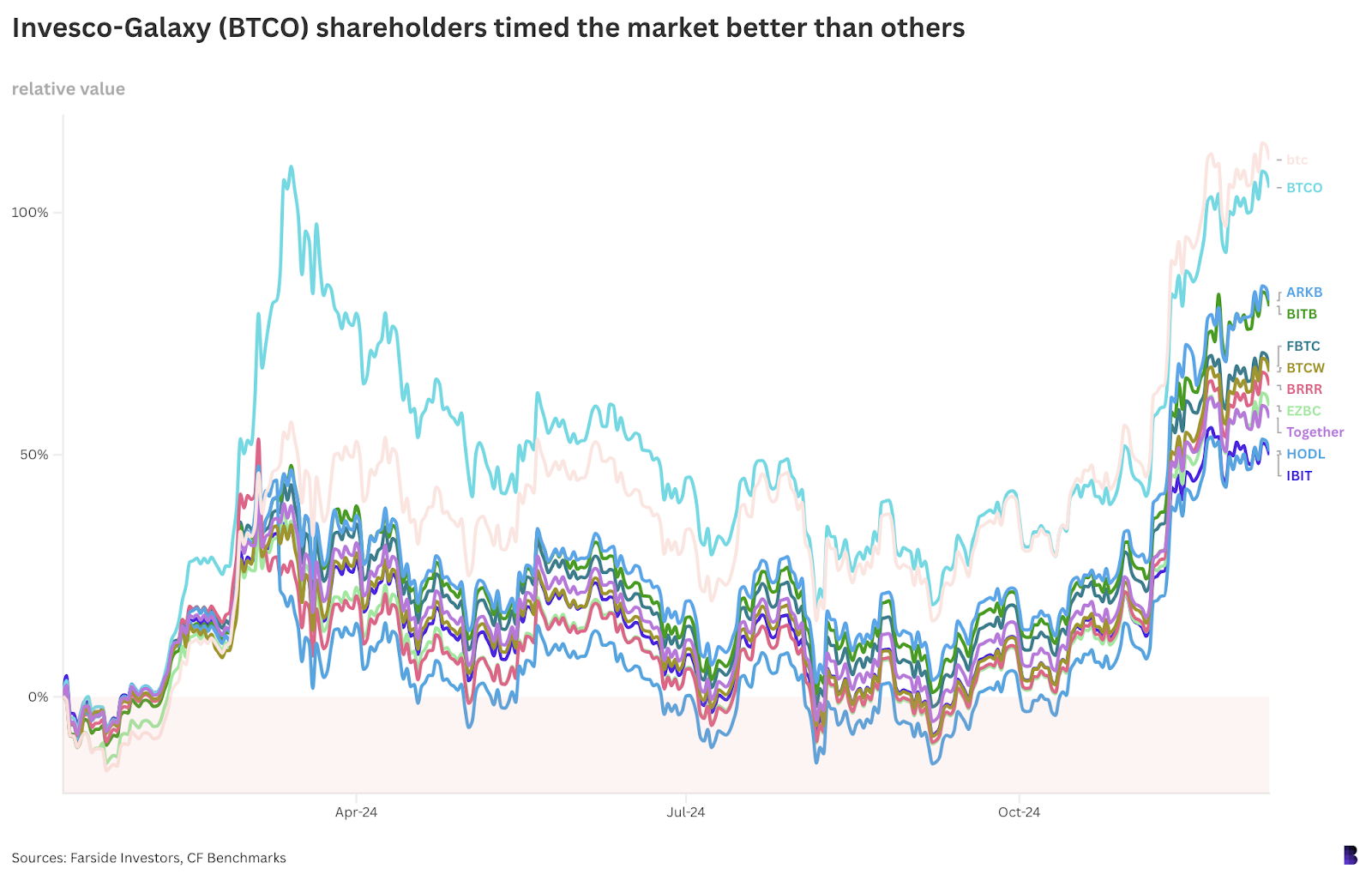

The relative value of each fund’s BTC stash compared to its purchase cost is significant.

Invesco-Galaxy’s BTCO leads with approximately 8,740 BTC acquired for $418.9 million; current value stands at $860.6 million, yielding over 100% gain.

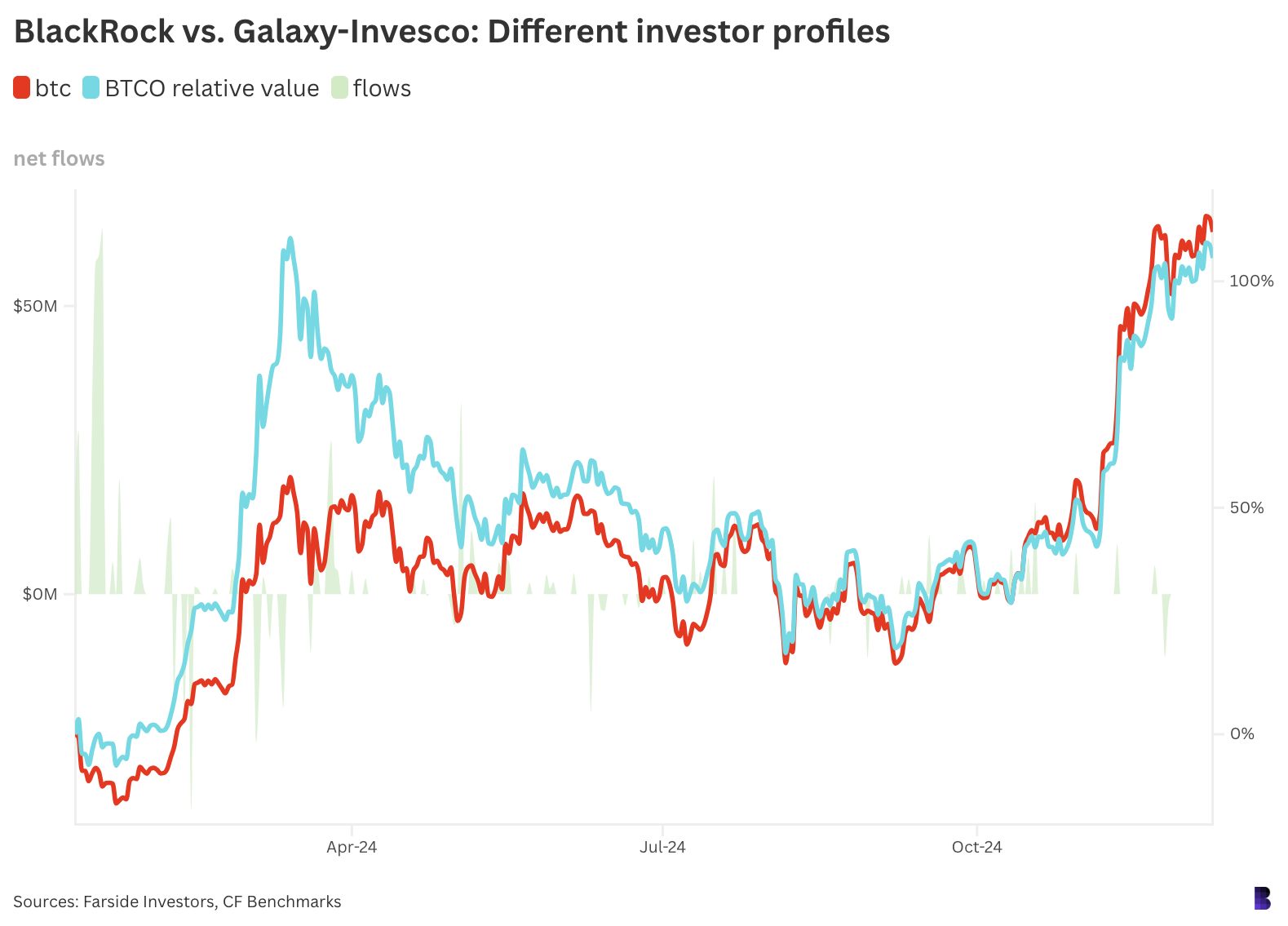

BTCO's net flows were concentrated in the first two weeks of trading when bitcoin was under $43,000, with an average purchase price of $47,930.

In contrast, BlackRock’s IBIT has consistently maintained flows, acquiring roughly 523,935 BTC from $34.4 billion net flows. This resulted in an average coin price of $65,600.

Though IBIT is approximately 50% ahead in BTC acquisition, its market timing has been less favorable than other funds.

Despite IBIT's BTC appreciating significantly in raw dollar terms due to its larger size, BTCO's contributors have performed notably well. The sustainability of their gains remains to be seen.