Bitcoin Flash Crash Triggers $893 Million in Cryptocurrency Liquidations

Data indicates that the cryptocurrency derivatives market experienced substantial liquidations following a recent Bitcoin flash crash within the past 24 hours.

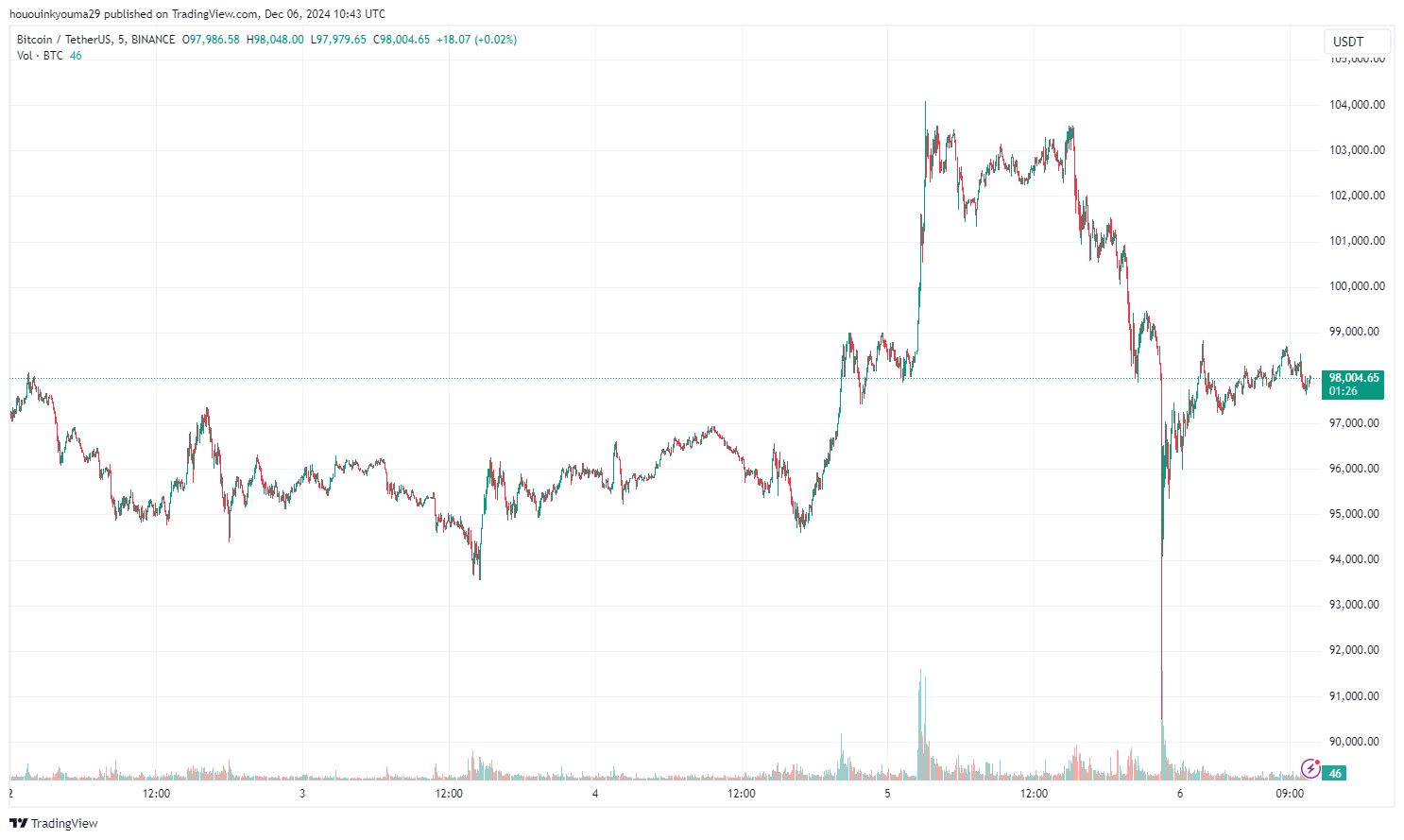

Bitcoin's Recent Price Volatility

Bitcoin (BTC) exhibited significant price fluctuations, reaching a high of $103,500 and a low of $90,500 in a short time frame. The decline to $90,500 was characterized as a flash crash.

The chart shows that the sharp drop was brief, with BTC quickly rebounding to approximately $98,000, reflecting a 5% decrease from its peak. Other major cryptocurrencies followed BTC's bearish trend, with Ethereum (ETH) and Solana (SOL) experiencing smaller declines of around 2% over the same period.

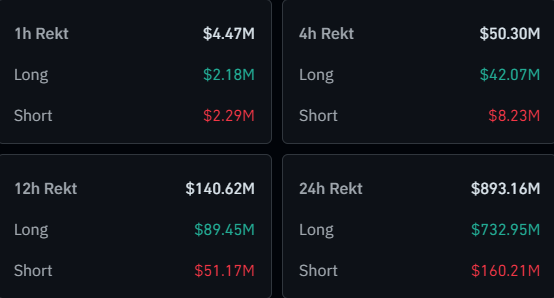

Liquidation Squeeze in Cryptocurrency Derivatives

According to data from CoinGlass, the cryptocurrency derivatives market faced significant liquidations due to sharp price movements across assets.

Approximately $893 million worth of cryptocurrency derivatives were liquidated in the last 24 hours. Liquidation occurs when an exchange forcibly closes a contract after it incurs significant losses. Of this total, nearly $733 million involved long positions, representing 82% of all liquidations, driven by the overall bearish market trend.

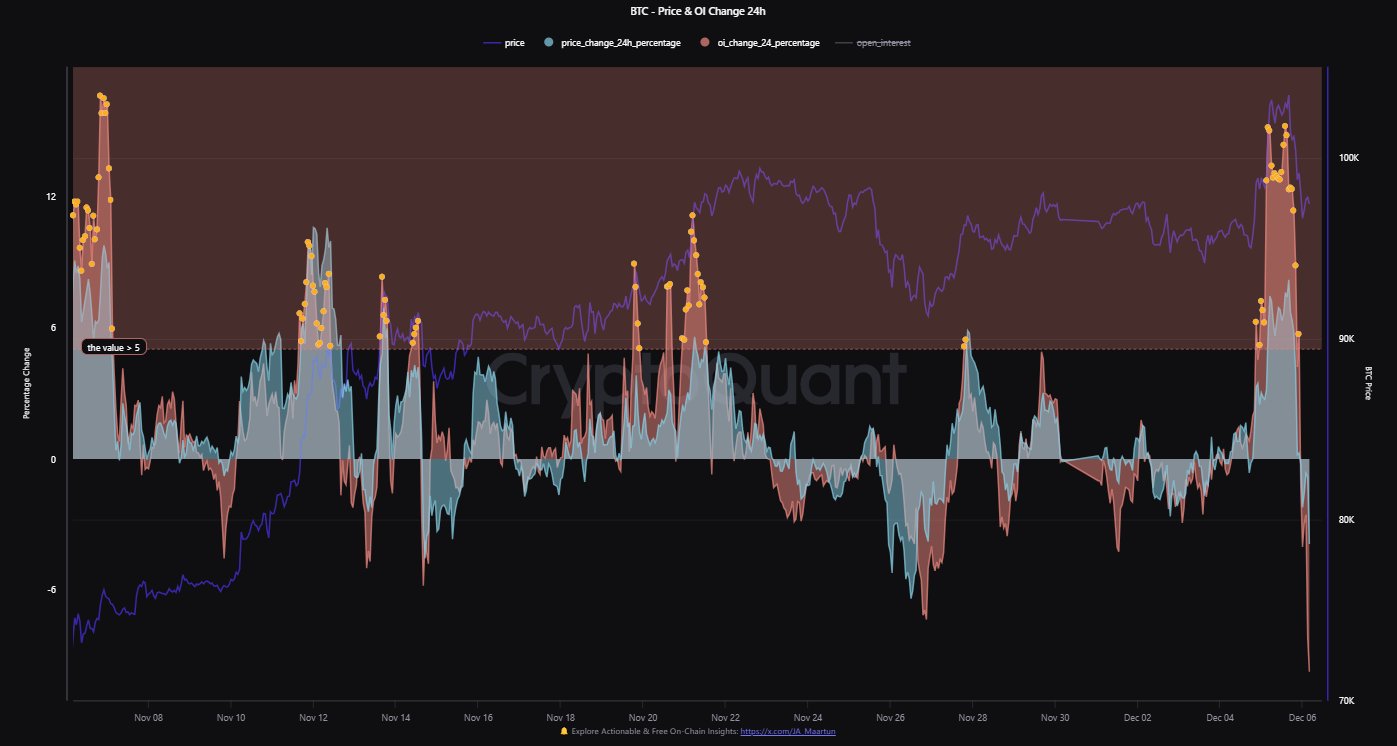

This mass liquidation event is referred to as a squeeze, specifically a long squeeze due to the predominance of long contracts. This long squeeze may have been a natural outcome of the heightened market conditions leading up to it. Analyst Maartunn noted that Open Interest increased alongside the Bitcoin surge.

The Open Interest rose over 15% during the recent Bitcoin rally, indicating leveraged positions. Such price movements often result in rapid unwinding, exacerbating volatility. When the price reversed, these leveraged longs contributed further to the crash dynamics, explaining the sharpness of the price drop.