0 0

Bitcoin Futures Turn Bullish as Positioning Index Breaks October Levels

Bitcoin has surpassed the $95,000 level as market selling pressure eases, providing short-term stability after a volatile period. Buyers have regained control, pushing Bitcoin into a range that previously acted as resistance. However, skepticism remains about a potential broader corrective phase.

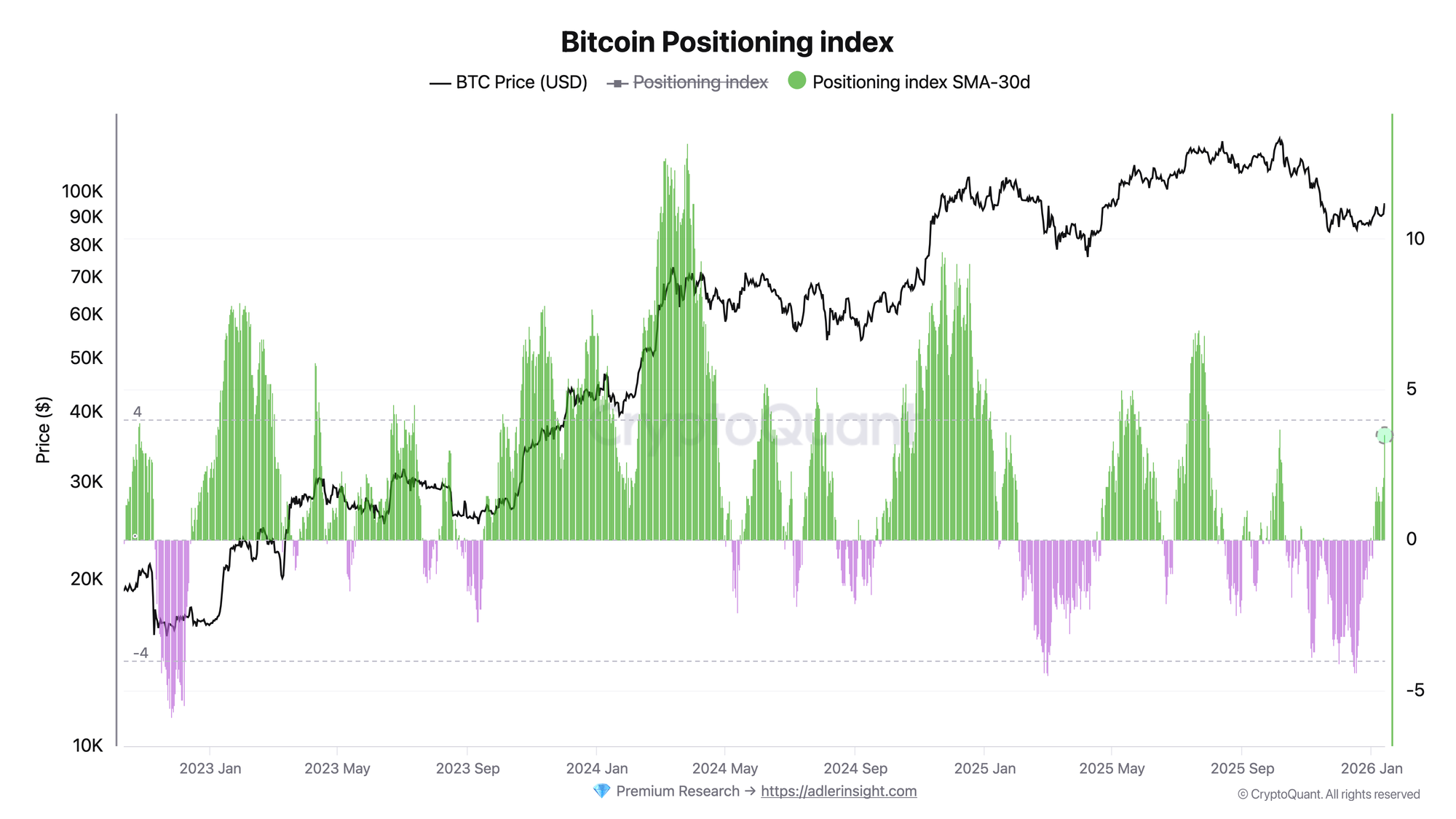

- The Positioning Index SMA-30d for Bitcoin rose to 3.5, its first breakout above 3.0 since October 2025, indicating possible shifts in market behavior beneath the surface.

- This index reflects futures market dynamics, including open interest and long-short activity, suggesting traders are taking more directional exposure.

Futures Market Shift

- Axel Adler Jr. highlights the significance of the Positioning Index SMA-30d breaking above 3.0, signaling a shift from neutral or defensive positioning.

- Confirmation of this shift requires maintaining the SMA above 2.0 for at least a week.

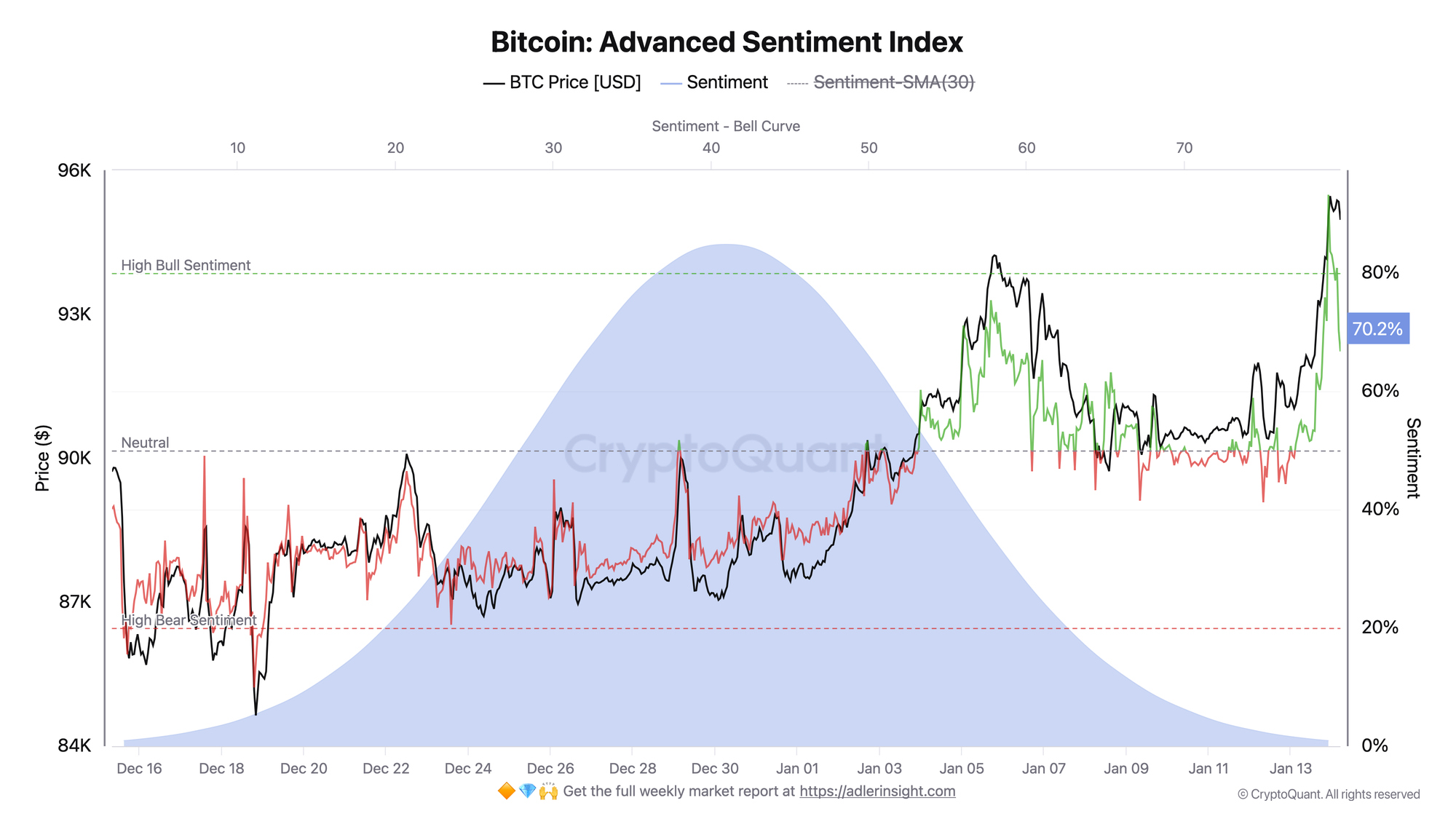

- The Bitcoin Advanced Sentiment Index peaked at 93.15% but has cooled to 70%, remaining well above the neutral 50% threshold.

- A decline in sentiment is seen as a healthy reset rather than a trend reversal, unless it falls below 50% alongside a price drop under $92,000.

Price Action

- Bitcoin's daily chart shows stabilization after a sharp November sell-off, forming a higher-low structure.

- The recent push above $95,000 is the highest daily close since mid-November, placing Bitcoin above its short-term moving average.

- The 50-day moving average acts as near-term resistance, whereas the 200-day moving average trends higher, indicating potential recovery.

- The advance toward $95K occurred without significant volume, suggesting reduced selling pressure rather than new demand.

Maintaining the $93K–$95K range is crucial for sustaining momentum. Failing to do so may lead to renewed range-bound trading or a pullback toward $90K support.