Bitcoin Hashrate Declines Over 4% From Recent Peak

On-chain data indicates a recent decline in the Bitcoin Hashrate, suggesting that miners may lack confidence in the sustainability of the asset's price increase.

Bitcoin Mining Hashrate Decline

The Hashrate measures the total computing power of miners on the Bitcoin network, expressed in hashes per second (H/s) or terahashes per second (TH/s). An increase signifies new miners entering the network or existing miners expanding operations, indicating perceived profitability. Conversely, a decline suggests miners are disconnecting their rigs, possibly due to unprofitability.

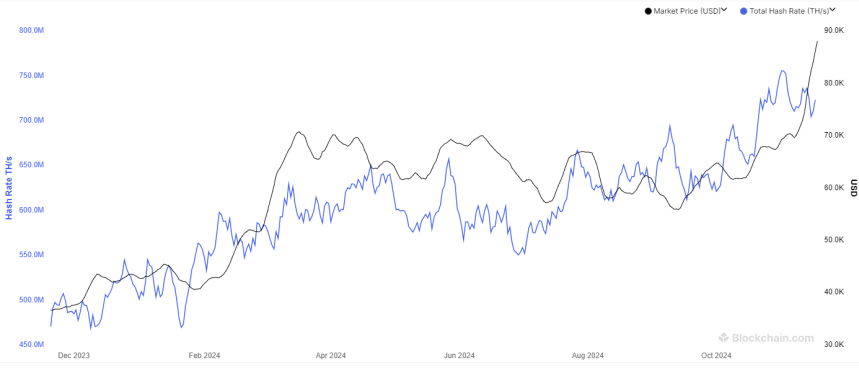

Below is a chart showing the 7-day average of the Bitcoin Mining Hashrate over the past year:

The chart reveals a significant rise in the 7-day average Hashrate, peaking near 755 million TH/s at the beginning of the month, followed by a decline. This earlier increase was linked to positive price movements, as miner revenue correlates directly with Bitcoin's price.

Miners generate income through transaction fees and block subsidies. Transaction fees vary based on network activity, while block subsidies remain fixed for approximately four years before halving events reduce them by half. Although the subsidy amount in BTC is predictable, its USD value fluctuates with market prices, leading to increased Hashrate during bullish periods.

Despite recent highs for Bitcoin, the Hashrate has remained subdued at around 723 million TH/s, down over 4% from its peak. This trend could indicate that miners anticipate challenges ahead for the current rally.

BTC Price

Currently, Bitcoin is priced at approximately $91,900, reflecting an increase of over 8% in the past week.