Bitcoin Investor Sentiment Drops to Lowest Level Since October

Data indicates that Bitcoin investor sentiment has decreased to its lowest level since mid-October. This analysis explores the implications for BTC's price.

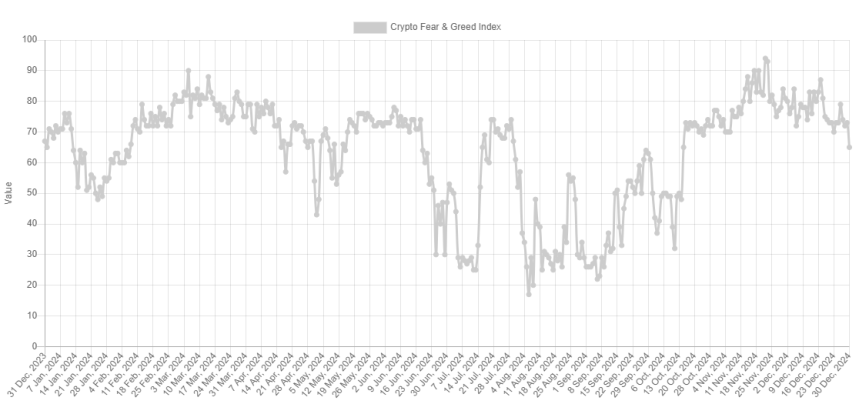

Bitcoin Fear & Greed Index Decline

The Fear & Greed Index, developed by Alternative, measures overall trader sentiment in Bitcoin and cryptocurrency markets. It considers five factors: volatility, trading volume, market cap dominance, social media sentiment, and Google Trends.

An index value above 53 indicates greed among investors, while a value below 47 suggests fear dominates. Values between these thresholds reflect neutral sentiment.

Current status of the Bitcoin Fear & Greed Index:

The latest index value stands at 65, indicating a sentiment of greed, down from yesterday's value of 73, as depicted in the chart below.

The decline in sentiment correlates with recent price drops for BTC. The index previously hovered near the "extreme greed" zone, defined as 75 or higher, which often precedes price peaks.

Historically, Bitcoin trends oppositely to prevailing investor expectations, with the likelihood of price corrections increasing as sentiment solidifies in one direction. Extreme greed typically signals upcoming price tops, while extreme fear occurs at values of 25 or lower.

A significant decline in sentiment may reduce the risk of another major correction, although ongoing greed suggests that substantial price rallies are also unlikely.

BTC Price Update

In the past 24 hours, Bitcoin's price has declined further to $91,900.