7 1

Bitcoin Liquidity Setup Signals Potential for Big Move

Bitcoin's Current Market Setup

- Bitcoin trades at approximately $104,500, a 0.5% decrease over the past day.

- Recent price action saw a decline to near $103,400, briefly touching $102,850.

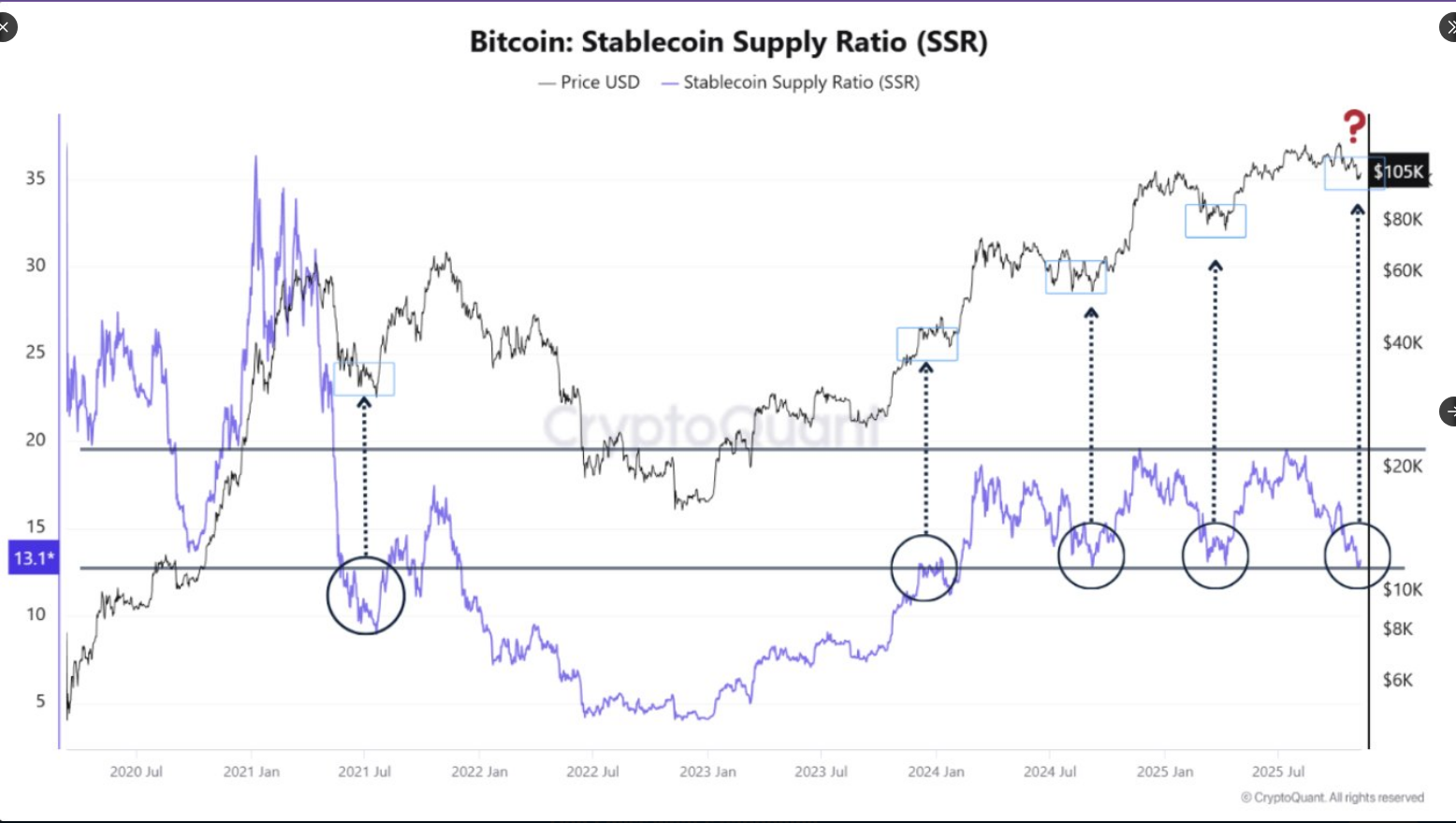

Stablecoin Supply Ratio (SSR)

- SSR has dropped into the 13 range, historically aligning with market lows in mid-2021 and multiple times in 2024.

- This drop suggests potential liquidity buildup, hinting at possible buying after a period of low volatility.

Binance Reserve Trends

- On Binance, stablecoin balances are increasing while Bitcoin reserves are decreasing.

- This pattern indicates capital on the sidelines, with holders moving coins off exchanges for longer-term storage.

Market Conditions and Risks

- The trading environment is cautious despite positive macroeconomic news from the US.

- Some capital has rotated back to stocks, with large holders taking profits post-recent highs.

- Moreno warns that if current liquidity metrics fail, it could signal a deeper market reset.

Outlook and Potential Scenarios

- Moreno sees limited downside risk with potential upside due to stablecoin supply and falling exchange BTC reserves.

- Historically, Bitcoin often gains in the last three months of the year, though past performance doesn’t guarantee future results.

- Current indicators suggest potential for fresh buying to push prices higher if sentiment improves.

- A break below current levels could alter market dynamics, requiring participants to reassess positions.

Image from Gemini, chart from TradingView