Bitcoin Long-Term Holders Show Increased Selling Activity Amid Price Correction

The role of Bitcoin long-term holders (LTHs) is under analysis as the asset faces a 4.5% correction from its all-time high (ATH) above $100,000 reached recently. LTHs, defined as those retaining Bitcoin for over 155 days, significantly influence market movements through accumulation and distribution behaviors.

Key Trends And Historical Context

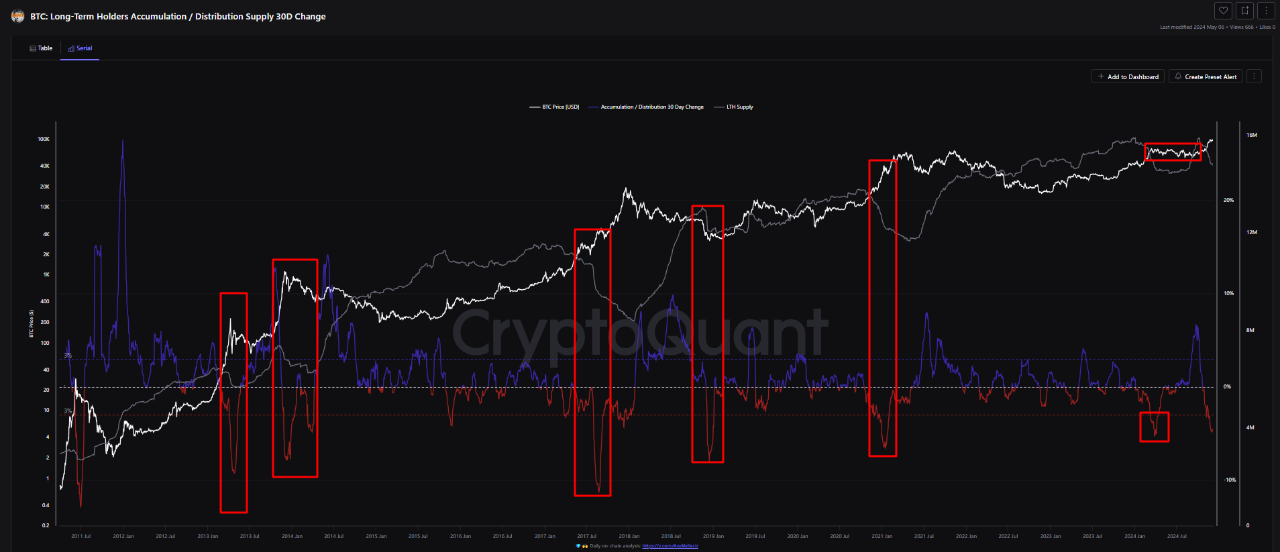

Insights from CryptoQuant analyst Datascope emphasize the importance of the LTH accumulation/distribution ratio as an on-chain metric. This ratio indicates whether LTHs are accumulating Bitcoin, suggesting market bottoms, or liquidating during price peaks, often signaling corrections.

Historical patterns from 2013 and 2017 show LTHs sold substantially at market highs, while intense accumulation in 2019 and 2020 led to subsequent bull markets. The peaks of 2013 and 2017, marked by increased selling from LTHs, correlated with significant price corrections.

These corrections, driven by profit-taking, marked the end of bullish cycles. In contrast, strong accumulation tendencies during the lows of 2019 and 2020 indicated confidence in Bitcoin's long-term potential, paving the way for price surges.

In 2024, the LTH metric is again providing insights into market conditions. Recent data shows increased selling activity among LTHs, typically observed during periods of market resistance. This trend may suggest an impending correction but also indicates a potential transition to a new accumulation phase, supported by sustained buying pressure from U.S. investors.

Bitcoin passes $100k as institutional demand drives the market.

The Coinbase Premium Index highlights sustained buying pressure from U.S. investors. pic.twitter.com/eZvKFCmVxs

— CryptoQuant.com (@cryptoquant_com) December 5, 2024

Current Outlook On Bitcoin

Bitcoin has experienced a decline following the $103,679 ATH recorded recently. Currently, BTC has dropped 2.2% in the past 24 hours, trading at $99,208. Despite this, Bitcoin remains in an uptrend, showing an increase of roughly 33.6% over the past month, with a market capitalization of $1.965 trillion.

Datascope commented on Bitcoin's current market outlook: "The market is at a crossroads, potentially entering a new upward cycle or consolidating before a deeper correction. With Bitcoin in an 'overheated' zone, investors should exercise caution and evaluate profit-taking opportunities."

Featured image created with DALL-E, Chart from TradingView