Bitcoin Miner Sell Pressure Drops, Indicating Positive Trend for BTC Recovery

Bitcoin (#BTC) has experienced a significant drop in miner sell pressure following the Fed-induced pullback in December. During the late 2022 rally, miners engaged in profit-taking.

Recent data shows a reset in miner sell pressure as it remained below 1, according to Charles Edwards, founder of Capriole Investment, which he views positively for BTC.

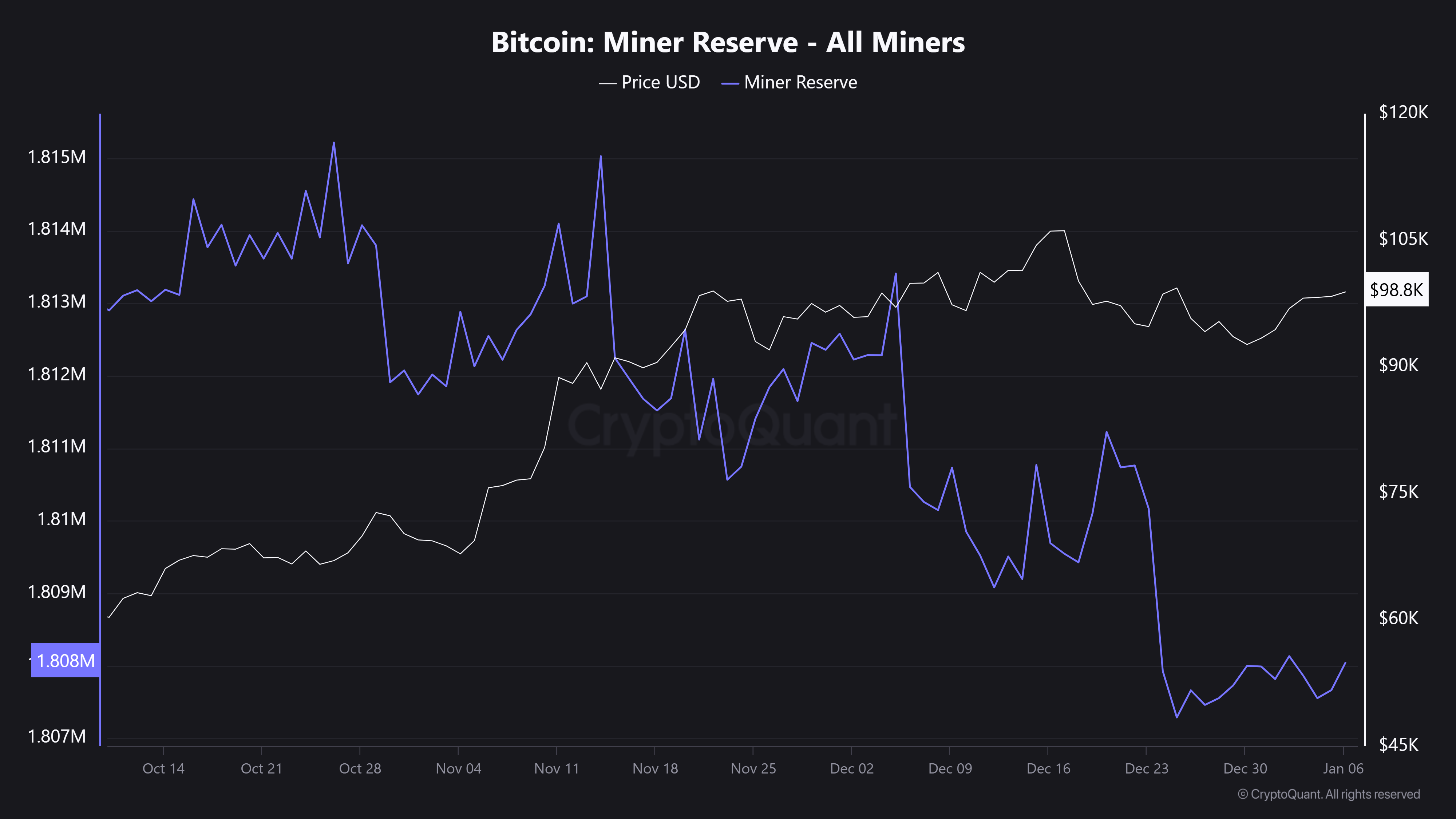

Miners’ intense selling coincided with a local price peak of $108K last month. CryptoQuant data indicates that miner reserves decreased from 1.813M to 1.807M BTC, meaning over 6K BTC were offloaded in December and nearly 8K BTC since late November.

The Miner Reserve metric remains stable above 1.80M BTC, indicating reduced sell pressure. This decrease in miner profit-taking may allow BTC to recover from December's losses and potentially surpass $100K.

Increased demand from large entities like MicroStrategy has absorbed recent BTC supply, contributing to a supply shock on exchanges, as noted by analyst Willy Woo.

The combination of low miner selling and heightened demand from large players could facilitate BTC's recovery. Currently, BTC is valued at $98.9K, reflecting an increase of nearly 8% from a low of $91.5K.

Upcoming events, including the FOMC Minutes and US labor updates, may introduce volatility. The Fed's hawkish stance previously led to market-wide sell-offs, raising concerns about potential selling pressure.

BTC trader Cryp Nuevo anticipates a rise towards the liquidity pool near $101K. The sustainability of the recovery above $100K will depend on these macroeconomic updates, followed by attention shifting to President-elect Donald Trump's inauguration on January 20.