13 March 2025

4 0

Bitcoin Mining Difficulty Increases Amid Market Correction

Bitcoin shows potential signs of reversal after a bearish trend, currently priced at $83,510, up by 2.6%. However, it remains down approximately 7.5% over the past week.

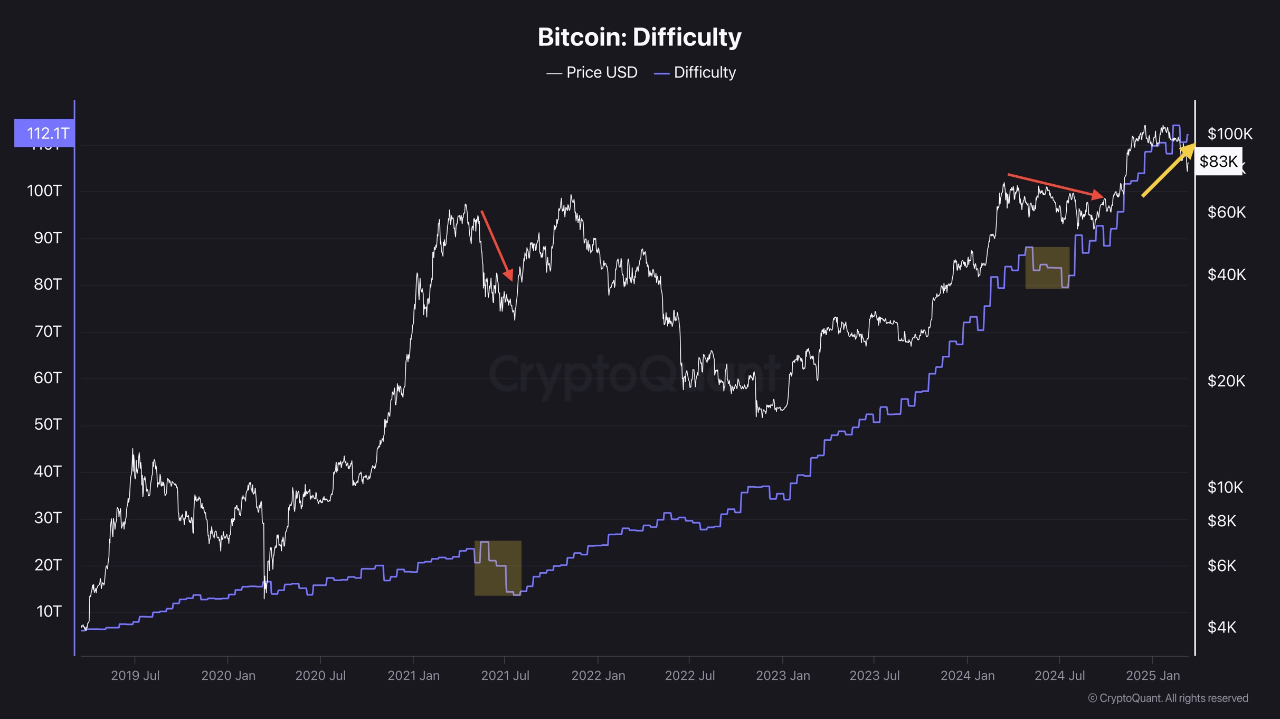

Rising Bitcoin Mining Difficulty and Miner Holding Strategy

- Bitcoin’s mining difficulty is increasing despite a recent market correction of about 30%.

- Historically, declines in mining difficulty indicate miners shutting down inefficient rigs, signaling market distress.

- Miners are holding onto reserves instead of selling, suggesting confidence in future price recovery.

- The Miner Position Index (MPI) shows no significant selling pressure that led to downturns previously.

- Further price corrections could lead to miner capitulation if mining difficulty decreases.

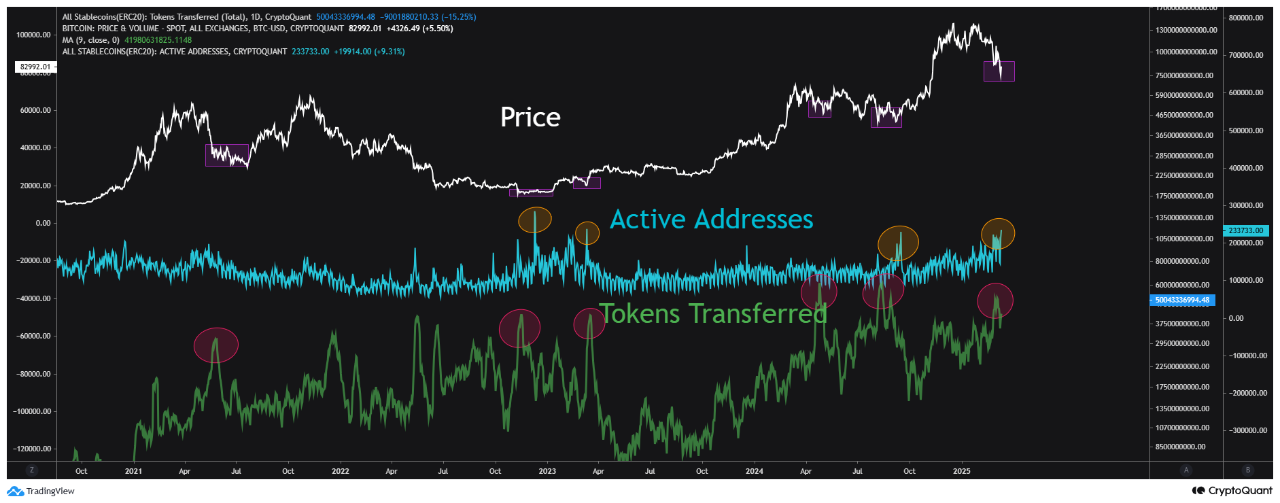

Stablecoin Transfers and Market Absorption

- Surge in stablecoin transfers indicates large-scale investors absorbing market shocks.

- This typically occurs post-price drops during consolidation phases.

- Increased stablecoin activity and active Bitcoin addresses suggest heightened network participation.

- Ongoing accumulation amidst low sentiment may lead to rapid upward price movement for Bitcoin.