Bitcoin MVRV Ratio Reaches 2.64 Indicating Potential Profit-Taking

Bitcoin gained 19.16% last week, reaching a new all-time high of $93,434, increasing the likelihood of hitting a six-figure price by year-end.

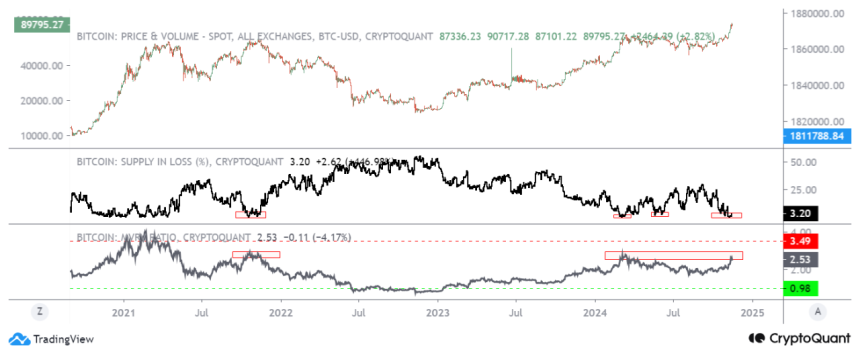

Despite this market surge, CryptoQuant analyst Amr Taha warns of potential price declines based on the Bitcoin MVRV ratio, which has reached 2.64, indicating that many investors may be considering profit-taking.

Bitcoin Enters Profit-Taking Zone – Sell Or HODL?

Taha's analysis highlights that an MVRV ratio over 2 suggests significant unrealized gains among investors, typically leading to profit-taking. Historical data indicates that when the MVRV ratio falls between 2.5 and 3.5, it often precedes notable corrections.

The current MVRV ratio of 2.64 raises concerns about a potential major price correction, supported by the asset’s relative strength index (RSI) remaining in the overbought zone. However, Taha notes that Bitcoin may still trend upward if bullish momentum continues, as historical peaks often occur closer to an MVRV of 4. He recommends monitoring the MVRV ratio, with increases towards 3 suggesting further gains and declines to 1.5-2 indicating a local market top.

Short-Term Holders Realized Cap Hits $30 Billion

Taha also pointed out that short-term holders have a realized market cap exceeding $30 billion, a level last seen in March 2024. Historically, significant price corrections follow similar realizations, serving as another caution for investors regarding potential downturns.

Currently, Bitcoin trades at $91,738 with a 3.97% gain in the past 24 hours. The trading volume has decreased by 7.42%, totaling $80.73 billion.