Bitcoin Reaches New All-Time High Above $104,000 Amid Negative Exchange Netflow

Bitcoin has reached a new all-time high (ATH) exceeding $104,000 recently, yet on-chain data indicates investors are reluctant to sell.

Bitcoin Exchange Netflow Remains Negative

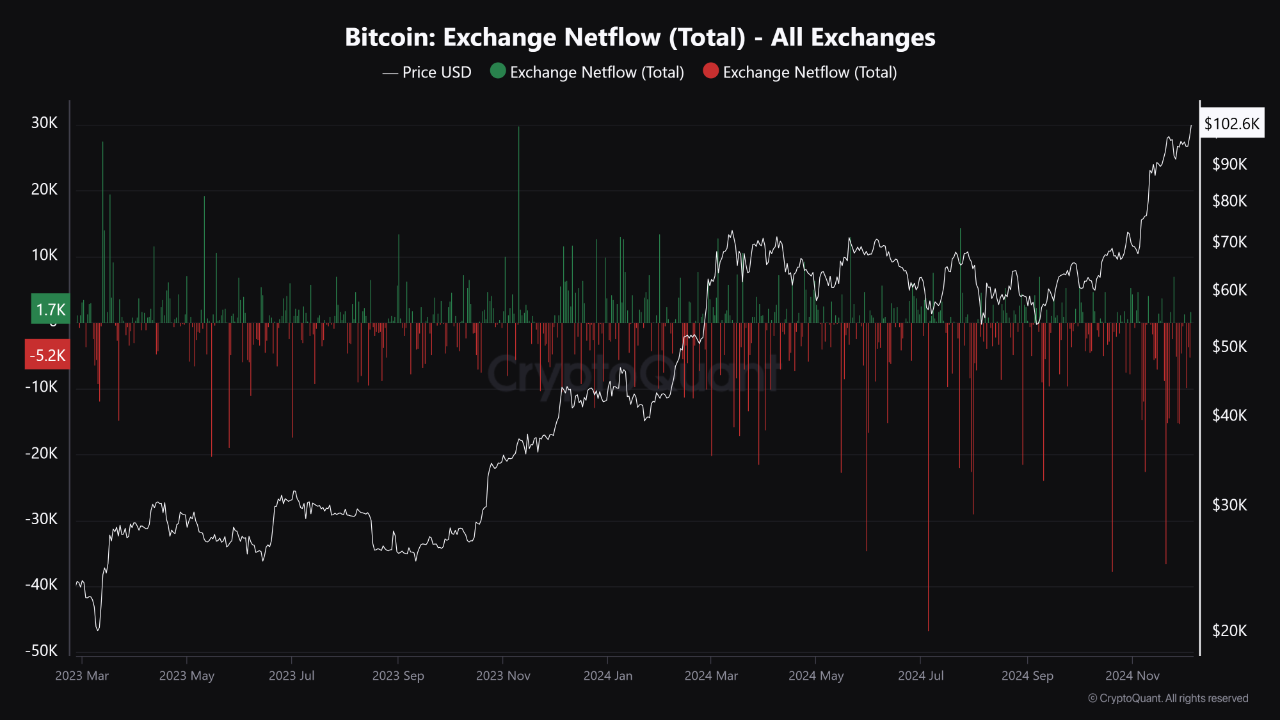

An analyst from CryptoQuant noted that Bitcoin continues to flow out of exchanges. The relevant metric is the "Exchange Netflow," which tracks the net amount of BTC entering or exiting wallets associated with centralized platforms.

A positive value in this metric indicates net deposits to exchanges, typically a bearish signal as holders may be preparing to sell. Conversely, a negative value means there are more outflows than inflows, suggesting long-term holding intentions by investors, which can be bullish for price.

The chart below illustrates the trend in Bitcoin Exchange Netflow over the past couple of years:

The graph shows significant negative spikes in Bitcoin Exchange Netflow in recent weeks, indicating large withdrawals despite the asset reaching new ATHs. This contrasts with the rally in Q1, where notable net inflow spikes suggested selling demand was present.

The persistent negative Exchange Netflow during the latest rally past $100,000 suggests investors remain unwilling to sell their BTC at these elevated prices. If this trend continues, further price increases may occur; however, the duration of this holding pattern is uncertain.

As investor profits increase, the likelihood of a mass selloff also rises. Thus, while Bitcoin's performance remains strong, a profit-taking spree could emerge soon.

BTC Price Update

Bitcoin has broken free from recent consolidation with over a 7% surge in the last 24 hours, briefly surpassing $104,000 before slightly retreating to $103,500.