Bitcoin Hits New All-Time High of $108,000 Amid Selling Pressure

Before the recent decline, Bitcoin reached a new all-time high of $108,000, marking a significant milestone in its upward trend.

However, recent analysis indicates potential market volatility as long-term holders begin selling.

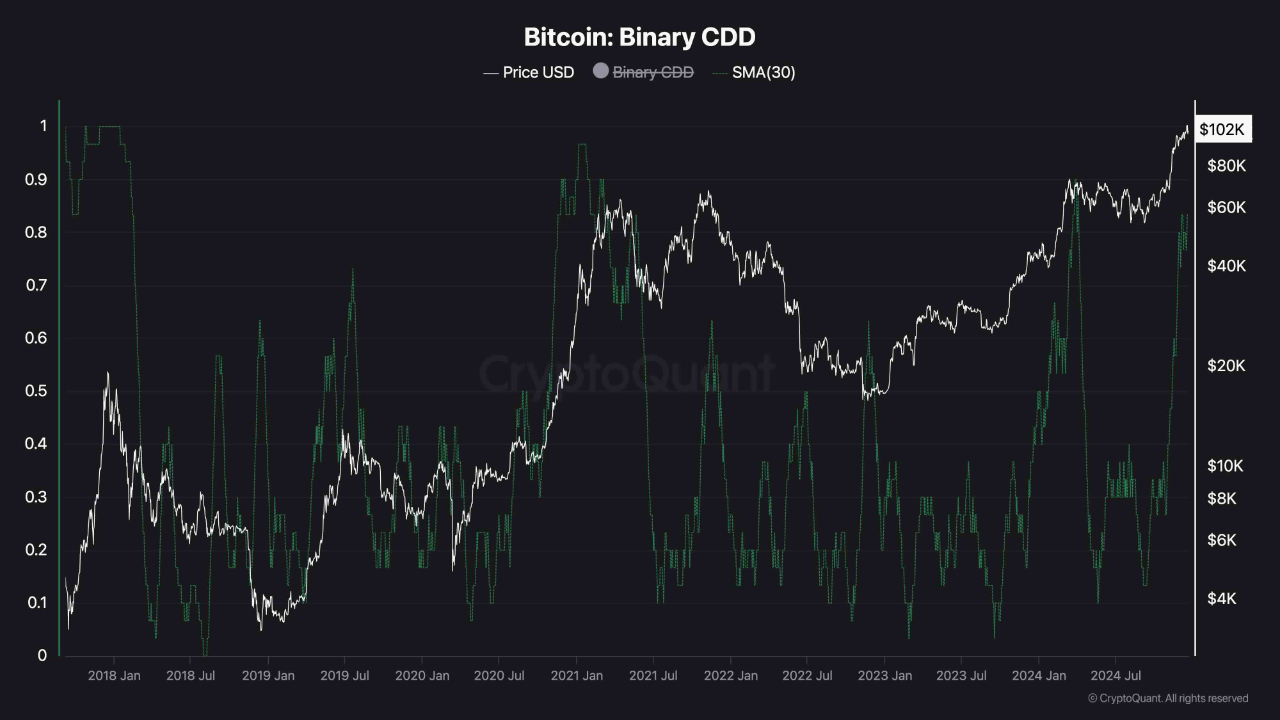

The Binary Coin Days Destroyed (CDD) metric is crucial for assessing long-term Bitcoin holder behavior.

Current Signals from Long-Term Holders

The Binary CDD metric measures activity among long-term holders by tracking "coin days" destroyed relative to total supply. A spike in this metric often signals increased selling pressure from these investors.

According to CryptoQuant analyst ShayanBTC, the Binary CDD metric has seen a sharp increase alongside Bitcoin's new price high.

Historically, spikes in this metric precede market corrections, indicating that holders are reducing their exposure at current price levels.

Shayan notes that actions of long-term holders often reflect broader market sentiment. The recent surge in the Binary CDD suggests that these holders might see the peak above $108,000 as a strategic exit point.

If selling pressure increases, it could lead to greater market volatility and possibly trigger a price correction.

Bitcoin Market Outlook

Bitcoin experienced significant price fluctuations recently. Following the FOMC news and Jerome Powell's speech, Bitcoin dropped to the $98,000 level.

However, there has been a rebound, with Bitcoin recovering to trade above $105,000 after reclaiming the $100,000 mark.

Currently, Bitcoin stands at $100,718, reflecting a 3.5% decrease over the past day and about 6.6% below its all-time high.

Adding to Shayan's insights, another CryptoQuant analyst, Onatt, highlighted additional indicators suggesting potential turbulence.

The Coinbase Premium Index, which measures the price difference between Coinbase and other exchanges, is currently negative, indicating increased selling pressure.

Furthermore, the adjusted Spent Output Profit Ratio (aSOPR), used to assess profit-taking behavior, has shown sudden spikes.

Onatt concludes that these signals underscore the need for sustained institutional demand, particularly through Bitcoin exchange-traded funds (ETFs), to stabilize market conditions.

Featured image created with DALL-E, Chart from TradingView