Bitcoin Options Traders Increase Bets on $115K Target by January 2025

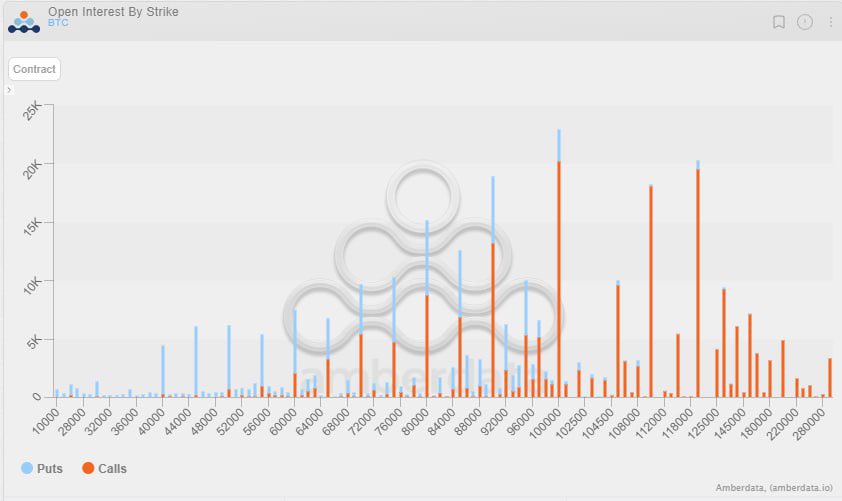

Bitcoin (BTC) options traders anticipate price targets of $110K and $115K by January 2025, with significant bullish bets on call options for a $115K target. Insights from the options exchange Deribit indicate that most traders are focused on these price points. As of now, the largest options expiries by Open Interest (OI) are set for December 2024 and March 2025. Approximately $4 billion in OI is being wagered on BTC hitting $100K and $110K by late 2024 or early 2025.

Following BTC's recent rise to $100K, some traders have also placed aggressive bets on a $120K target.

Leverage Risk Remains

Despite the bullish sentiment, BTC may experience substantial price volatility due to high leverage among traders. Analysts attribute the recent flash crash from $104K to $90.5K to this leverage. CryptoQuant’s JA Martunn noted that the surge was driven by borrowed funds, contributing to a more than 15% increase in open interest.

Historically, leverage-driven rallies have resulted in sharp pullbacks and increased market volatility as liquidations occur. The recent flash crash led to approximately $1 billion in liquidations across the market.

Jake Ostrovsksis, an options trader at Wintermute, cautioned about the potential for two-way volatility in the BTC market despite strong bullish flow. He indicated that significant leverage usage could lead to price swings exceeding $10K on either side, similar to fluctuations observed on December 5.

Currently, BTC is positioned within a short-term ascending channel established since mid-November but remains below a critical resistance level at $98K. A breakout above this level could lead to a target of $105K, while a drop beneath the channel might push the price down to recent lows of $90.5K or $85K.