6 0

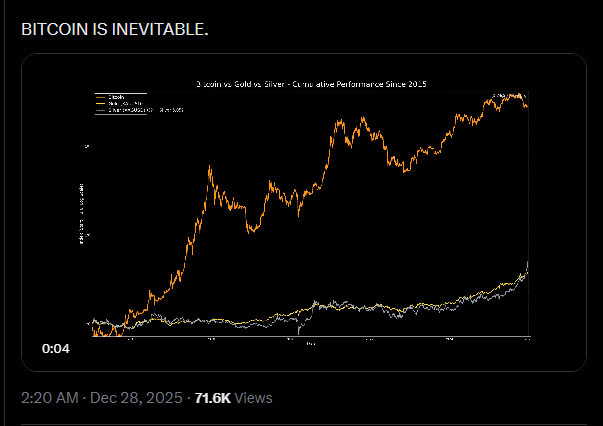

Bitcoin Gains 27,700% Since 2015, Surpassing Gold and Silver

A significant divide has emerged between Bitcoin and precious metals supporters due to notable market movements. Bitcoin's long-term gains highlight its performance supremacy, while gold and silver have recently seen unexpected rallies.

Bitcoin’s Performance Since 2015

- Bitcoin increased by approximately 27,700% since 2015, significantly outperforming silver (400%) and gold (280%).

- Analyst Adam Livingston emphasizes Bitcoin's superior performance, even excluding its early years.

Timeframe Criticism

- Gold advocate Peter Schiff suggests evaluating Bitcoin over a shorter period, implying its peak may have passed.

- Matt Golliher notes that commodity prices often revert to production costs, with profitable mining resuming as prices rise.

Supply and Macro Influences

- Gold reached $4,533 per ounce, and silver nearly $80 per ounce in 2025 amid a weakening US dollar.

- US Dollar Index declined by about 10%, influencing asset movements.

- Expectations of Federal Reserve easing in 2026 and geopolitical tensions are pushing traders to scarce assets.

- Zaner Metals strategist Peter Grant attributes sharp price swings to thinner trading and Fed outlook.

Bitcoin’s Independent Path

- Analysts from Glassnode assert Bitcoin can rise without gold or silver declining.

- Lyn Alden and Arthur Hayes suggest both digital and physical stores of value could see demand simultaneously.

Image credits: Unsplash, TradingView