Bitcoin Faces Potential 20%-30% Correction Amid Market Uncertainty

Bitcoin's price is declining, seeking a stable support level amidst market uncertainty. The downward trend raises concerns among investors and analysts about whether Bitcoin has reached its cycle top. Market sentiment has shifted from optimism to fear.

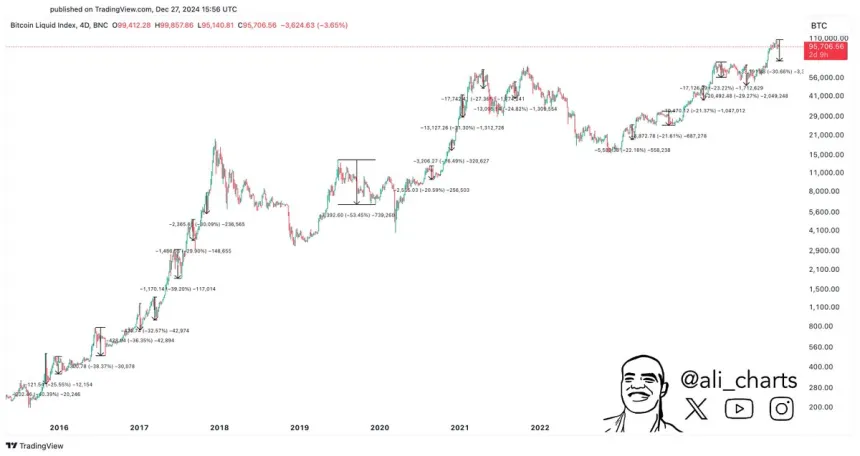

Crypto analyst Ali Martinez presents a more positive outlook, suggesting that a 20% to 30% correction could be the most favorable outcome for Bitcoin at this time. He notes that such pullbacks historically lead to stronger rallies by eliminating weaker positions and allowing the market to reset before continuing upward.

As Bitcoin's price approaches a potential breakdown, focus is on key support levels that could influence the next movement. The upcoming weeks are critical for determining Bitcoin's trajectory.

Bitcoin Correction Looms

Bitcoin is nearing a significant correction phase, with the $92K level identified as crucial. Analysts warn that falling below this threshold, and potentially the $90K mark, could result in increased selling pressure, pushing prices below $80K. This growing anxiety threatens Bitcoin's bullish narrative.

However, not all interpretations are bearish. Martinez offers a contrarian viewpoint, asserting that a 20% to 30% correction could be beneficial within a bull trend. His analysis of past Bitcoin corrections indicates that each served as a market reset, enabling stronger rallies.

Martinez emphasizes that corrections are a natural part of Bitcoin’s price cycles, particularly during bull markets. A significant pullback could precede a more robust rally in the following months.

BTC Testing 'The Last Line Of Defense'

Currently trading at $94,500, Bitcoin faces persistent selling pressure and bearish trends. Many analysts believe that losing the $92,000 mark may lead to an accelerated decline.

The $90,000 level is critical for maintaining a bullish outlook, serving as both a psychological and technical barrier. Holding above this mark could lead to a recovery and renewed bullish momentum toward previous highs.

Conversely, a significant drop below $90,000 may intensify selling pressure, risking a decline to around $75,000, marking a substantial retreat from recent peaks.

Featured image from Dall-E, chart from TradingView