Bitcoin Shows Potential for Short-Term Rally, Says Coinbase Premium Index

Recent insights indicate that Bitcoin (BTC) may be approaching a rally, suggesting potential for short-term upward momentum. This analysis centers on the Coinbase Premium Index, an essential metric evaluated by CryptoQuant analyst Yonsei Dent.

Upward Move On The Horizon

The Coinbase Premium Index measures the price gap between Bitcoin on Coinbase and other exchanges, providing insight into market sentiment and institutional demand. Dent's analysis focuses on daily and weekly moving averages. Historical data shows significant Bitcoin price movements often follow when the daily average crosses above the weekly average, known as a "golden cross."

According to Dent, the weekly moving average has shifted from a negative to a positive slope, indicating a potential golden cross. Previous occurrences of this combination have led to pronounced price increases.

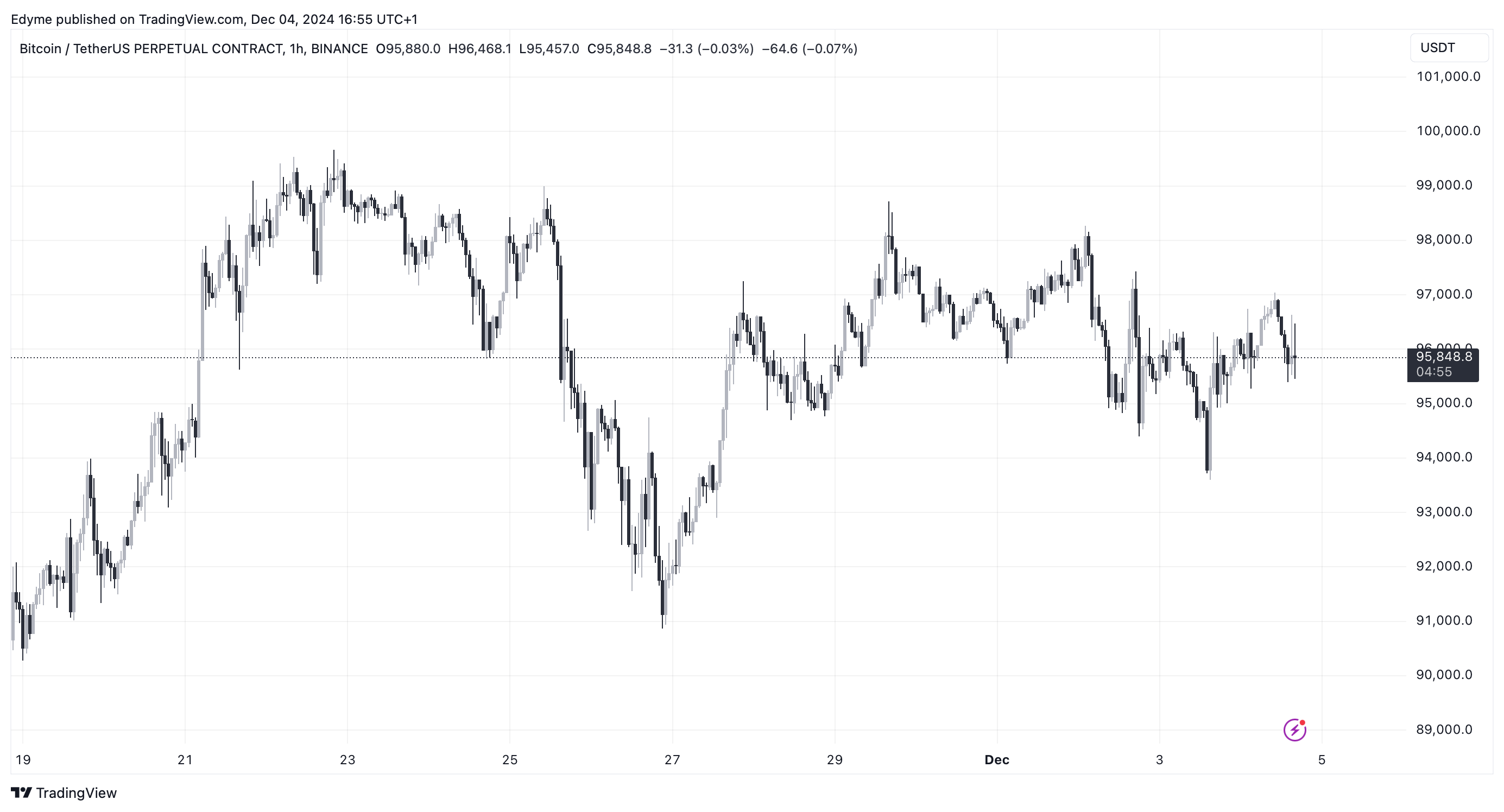

Bitcoin is also forming higher lows and a converging triangle pattern. If demand rises sufficiently, these technical patterns could suggest the start of a renewed uptrend. Sustained demand is crucial, as historical trends indicate strong upward momentum follows when demand materializes, attracting retail and institutional investors back into the market.

Technical Outlook On Bitcoin

Bitcoin is currently trading at $96,216, reflecting a 0.3% increase in the past day and a 1.3% rise over the past week.

A report from CryptoQuant analyst Burak Kesmeci highlights notable behavior among US investors, who are capitalizing on minor dips in BTC’s value. In the last 24 hours, Coinbase recorded two significant withdrawals exceeding 8,000 BTC, demonstrating sustained investor interest in the asset.

Two Significant Outflows Exceeding 8k #BTC Each from Coinbase in the Last 24h

“19,487 $BTC were withdrawn, with an average cost of $96,043. The total value of these two transactions amounts to approximately $1.87 billion.” – By @burak_kesmeci

Link

https://t.co/4WkEJ2p3vw pic.twitter.com/ADf1qWvkV2

— CryptoQuant.com (@cryptoquant_com) December 3, 2024

Kesmeci noted that since the approval of spot Bitcoin ETFs, institutional demand has significantly increased. With retail investor interest likely to join this trend soon, Bitcoin appears positioned to surpass the $100,000 mark in the near future.

Featured image created with DALL-E, Chart from TradingView