Bitcoin Price Shifts to 60-Day Cycle Following Drop Below $100,000

The Bitcoin price has experienced significant market dynamics, adjusting its cycle patterns following a decline below the $100,000 level. Analyst Bob Loukas noted a possible transition from a 56-day to a 60-day cycle, raising questions about whether Bitcoin will rebound or continue consolidating for two months.

Bitcoin Price Shift To A 60-Day Cycle

Cyclical patterns in cryptocurrency markets play a crucial role in technical analysis. These cycles consist of repetitive highs, lows, and consolidations, helping analysts predict future price movements. Analysts often utilize tools like Fibonacci extensions and Elliot Wave patterns.

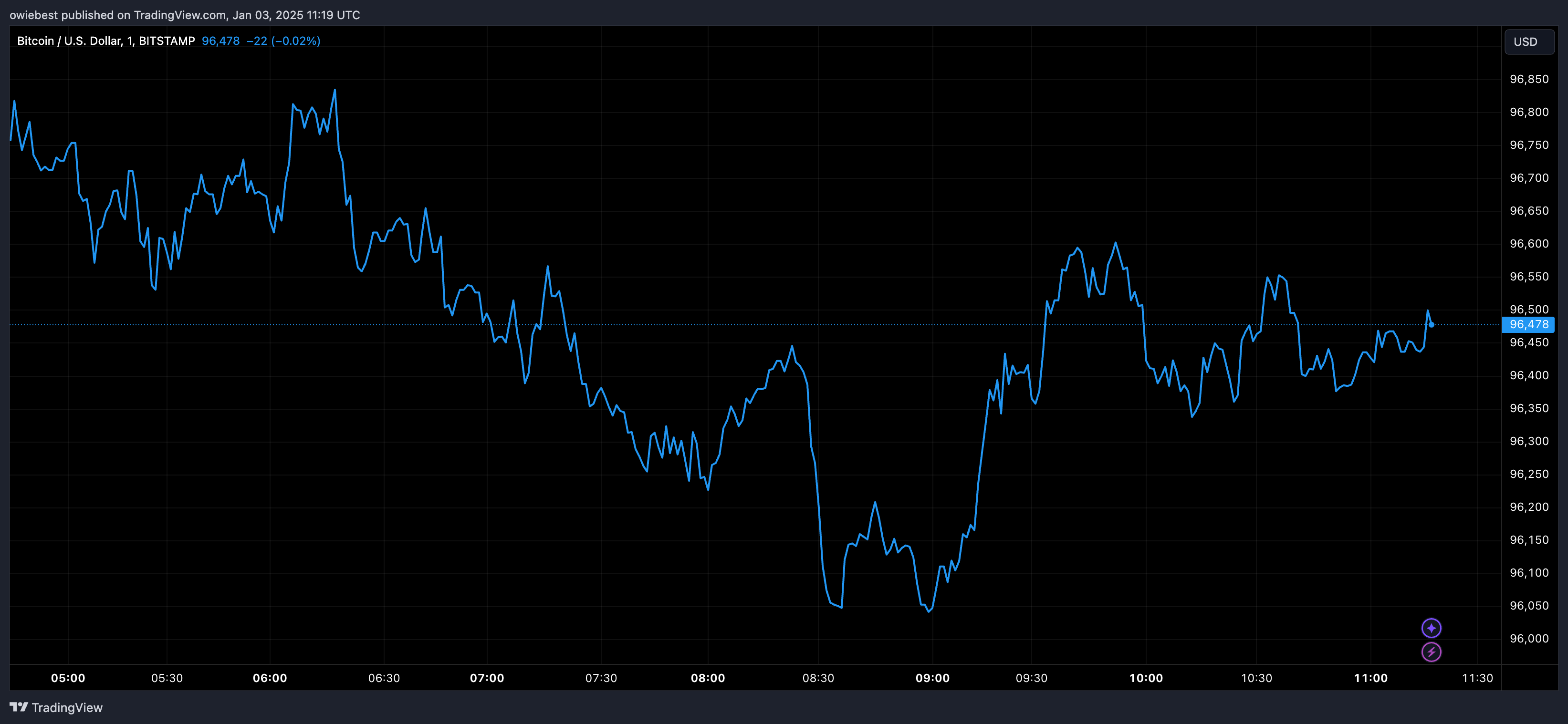

Bitcoin's recent price movements have mirrored previous cycles, primarily operating within a 56-day cycle until surpassing the $100,000 mark. After reaching an all-time high of $108,135 on December 17, Bitcoin entered a correction phase, dropping as low as $92,800 shortly thereafter.

Loukas indicates that this correction and subsequent consolidation have prompted a shift to a 60-day cycle. The implications of this change remain uncertain.

Was The Recent Decline Enough For A Reset?

A transition to a 60-day cycle indicates a potential change in Bitcoin’s market behavior. Currently, Bitcoin is beginning a new cycle count, with two possible scenarios over the next 60 days:

The first scenario suggests bullish momentum if the recent correction has reset the cycle, potentially leading Bitcoin to new all-time highs.

The second scenario anticipates Bitcoin may consolidate and trade within a narrow range for the next two months.

As of now, Bitcoin is trading at $96,146. If it successfully enters a 60-day cycle without further consolidation, it could enable recovery above $100,000 and support bullish momentum throughout Q1 2025.