Bitcoin Price Hovers at $96,200 with $90K Support Under Pressure

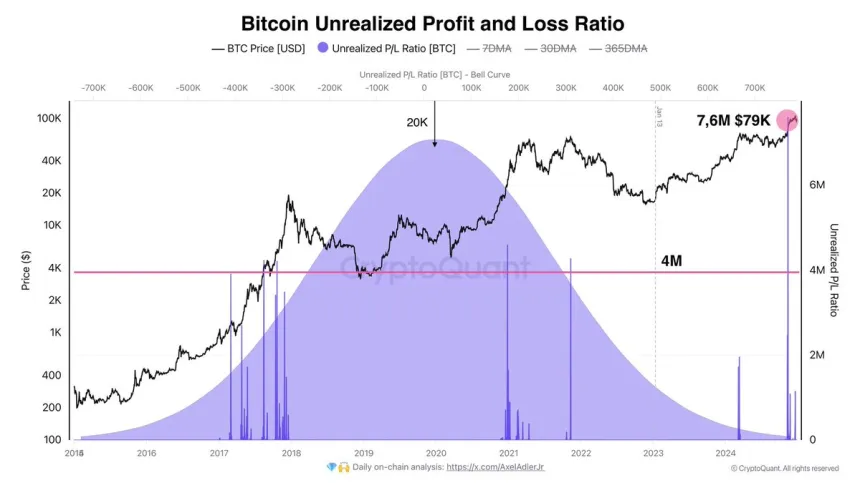

Bitcoin is currently facing challenges in reclaiming the $100,000 mark after a recent market sentiment shift from optimism to caution. Following a price surge, Bitcoin now trades below this threshold, indicating heightened uncertainty among investors. Analyst Axel Adler has identified the $90,000 level as a significant support zone, extending down to $79,000, which is vital for Bitcoin's stabilization and potential bullish recovery.

Despite current caution, historical trends indicate that Bitcoin often performs well after testing key support levels. The market's attention is on whether BTC can sustain this critical zone in the coming days, with the $90K mark emerging as a crucial battleground for its future direction. Investors and analysts are closely observing these developments.

Bitcoin Finding Demand Below $100K

Bitcoin's price dynamics have shifted towards finding demand below the $100,000 mark, determining if the rally will continue or if a deeper correction will occur. Adler's insights stress the importance of the $79,000 level, which has recently shown significant unrealized profit and loss activity, highlighting its role as both a psychological benchmark and a crucial support level.

Adler notes that maintaining above the $90K mark would strengthen bullish momentum, making a breach past $100K more likely. However, he also warns of a possible sideways consolidation phase, allowing the market to stabilize before moving upward. Bitcoin's price remains at a critical juncture, with support levels influencing whether it will breakout or correct further.

Technical Analysis: Key Levels To Hold

Currently trading at $96,200, Bitcoin exhibits indecision and sideways movement, leaving traders uncertain about future actions. For bullish momentum to resume, Bitcoin must break above the psychological $100,000 mark, signaling strength and potentially leading to further price increases. Maintaining above the $92,000 level could still support a bullish outlook, showcasing resilience at a key support area.

Concerns remain regarding a potential downturn, with predictions suggesting Bitcoin could drop to $70,000 if the $92K support fails. This scenario would indicate a significant correction, impacting market sentiment.

Bitcoin's price is at a decisive point, requiring bulls to regain control for upward movement. Until then, the market remains susceptible to both bullish advances and bearish declines, prompting investors to monitor these critical levels closely.

Featured image from Dall-E, chart from TradingView