Bitcoin Maintains Price Above $90,000 Amidst Positive Market Signals

Bitcoin maintains a price above $90,000 despite various influencing factors. A CryptoQuant analyst, aytekin466, shared insights regarding potential price corrections.

Are Major Corrections a Thing of the Past?

aytekin noted that Bitcoin's maximum decline of 30% in its current cycle is less severe than previous cycles, with the most significant drop occurring during the “carry trade shock” in August. The increasing presence of ETFs has contributed to market stabilization, reducing drastic fluctuations.

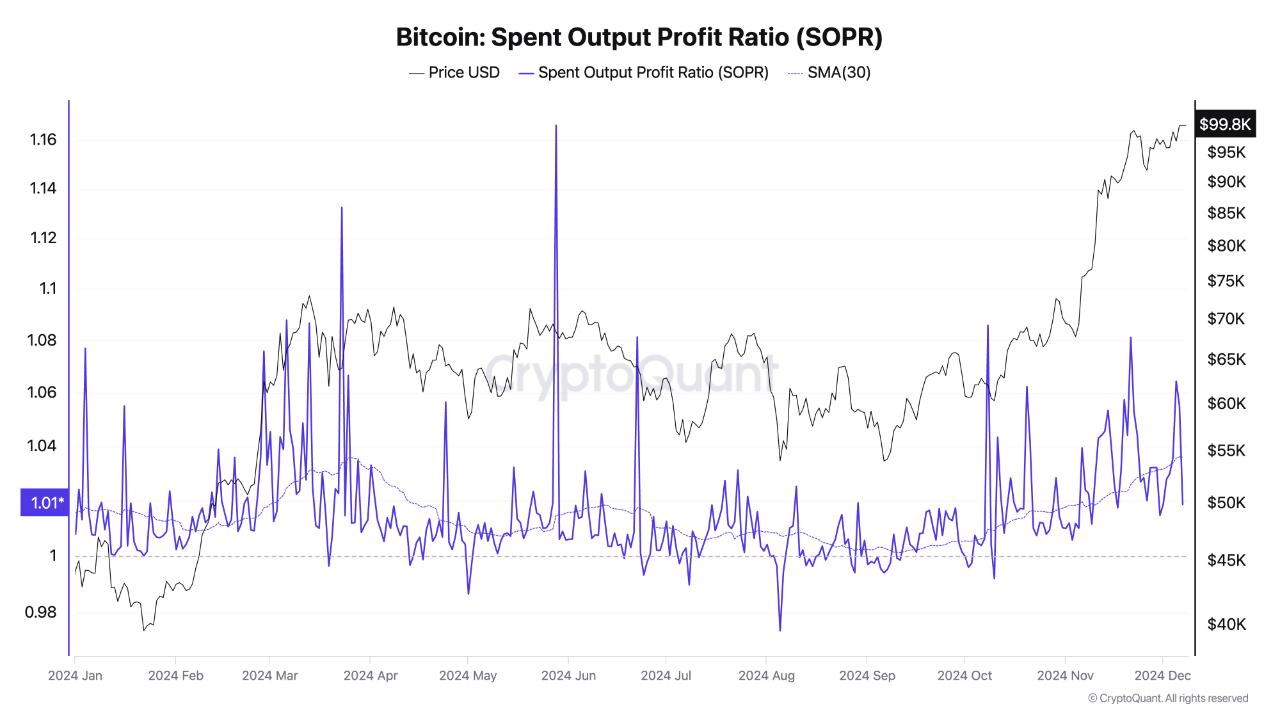

The analyst warned against waiting for a major correction to invest, as it might lead to missing out on rallies. Conversely, being overly aggressive during market surges poses risks. Current metrics, including a positive Coinbase premium and cooling Spent Output Profit Ratio (SOPR), suggest a "healthy consolidation phase."

Funding rates have eased after recent price changes, and miners are not rushing to liquidate. Additionally, stablecoin flows to spot exchanges are at their highest this year, indicating active market participation.

aytekin concluded that while a correction could occur without warning, the current indicators do not suggest a shift in market momentum.

Further Growth In Bitcoin Price Expected?

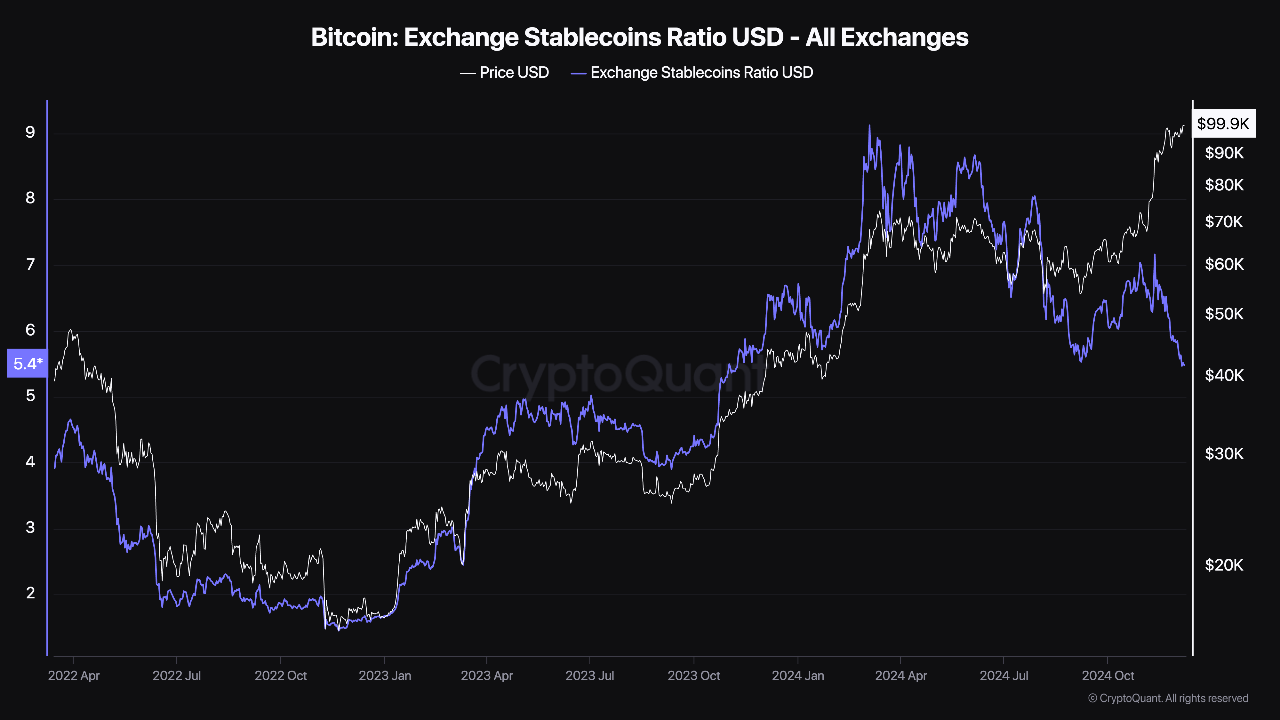

Another CryptoQuant analyst, Darkfost, pointed to positive signals from stablecoin activity and Bitcoin netflows. The declining Exchange Stablecoin Ratio indicates strong buying pressure as stablecoins are increasingly used for Bitcoin purchases, while Bitcoin reserves on exchanges decrease.

Weekly Bitcoin netflows show consistent withdrawals from exchanges, reflecting a sentiment shift towards mid- to long-term holding among investors.

These trends indicate a favorable market environment characterized by strong demand and investor confidence. The reduced exchange stablecoin ratio aligns with decreased immediate selling pressure, suggesting that market participants view the current situation as supportive of long-term growth.

Darkfost stated that the combination of lower exchange stablecoin ratios and decreasing Bitcoin reserves underscores a positive market environment, highlighting sustained demand and investor confidence in Bitcoin’s potential.

Featured image created with DALL-E, Chart from TradingView