Bitcoin Price Analysis Highlights Potential for New Market Peaks

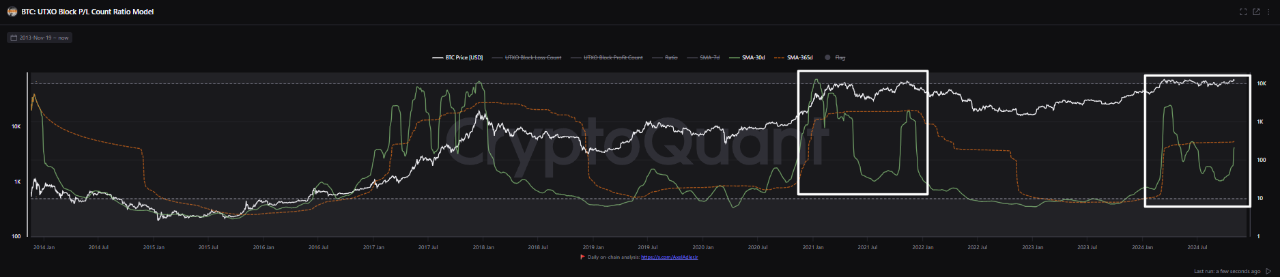

Bitcoin price has experienced numerous cycles characterized by growth phases, peaks, and corrections. A CryptoQuant analyst using the pseudonym 'datascope' has highlighted the UTXO Block Profit/Loss (P/L) Count Ratio Model as a tool for understanding these cycles.

This model provides insights into profitability and losses among Bitcoin market participants, helping to identify potential price reversals.

By analyzing various moving averages, the model tracks price changes and illustrates shifts in profitability over time, offering indications of future market peaks.

Predicting Market Peaks Through Profit And Loss Ratios

Datascope's analysis emphasizes the importance of short, medium, and long-term trends reflected in 7-day, 30-day, and 365-day moving averages.

This comprehensive approach benefits both long-term investors and short-term traders by distinguishing between short-term fluctuations and longer-term cycles that impact immediate market movements.

The model indicates that changes in the profitability ratio are crucial for assessing market sentiment and potential price actions.

A decrease in overall profitability ratios implies that short- and medium-term trading strategies may be more effective in a market less influenced by extreme long-term price swings.

A key finding from the UTXO P/L model is the relationship between the 30-day profit and loss ratio and the 365-day moving average. When the 30-day ratio exceeds the 365-day average, it may signal a new price peak.

Crossing short- and long-term profitability lines suggests a shift in investor sentiment towards more favorable conditions. Historically, this has preceded price increases due to heightened buying pressure.

Despite differing economic conditions in 2021 and 2022, similar trends were noted during both years, particularly regarding how the profit and loss ratio interacted with the annual moving average as a resistance line.

If profit and loss metrics consistently remain above the annual average, Bitcoin may be poised to reach new highs.

Bitcoin Market Performance

Currently, Bitcoin is experiencing a price increase following a recent correction that saw its price dip below $70,000.

Bitcoin is now trading at $70,379, reflecting a 0.9% decrease over the past day, after reaching a high of $71,500 within the previous 24 hours.

Featured image created with DALL-E, Chart from TradingView