Bitcoin Price at $94K Faces Risk of Falling to $70K

Bitcoin (BTC) struggles below the $100K level, triggering a sharp pullback and raising concerns about maintaining key support levels. With bearish signals prevalent and liquidation events surging, the price now faces critical zones.

Bitcoin Price Analysis Hints at $90K Breakdown

The failure to reach $100,000 resulted in a 3.71% pullback after a rejection at $99,881, forming a bearish engulfing candle. Currently, BTC is down to $94,624 following an intraday pullback of 1.11%, testing the crucial support level of $94,403 and approaching the 50-day EMA at $93,170.

The daily RSI indicates continued downtrend risk, with the 50-day EMA serving as the final support before a potential retest of the $90,000 level. The crypto market experienced $251 million in liquidations over the last 24 hours, primarily from long-side investors, indicating a market-wide selling trend.

Expert Opinions on Bitcoin's Future

Market analysts express concerns about a potential drop to the $90K support level. Independent analyst Ali Martinez notes bearish sentiment, while Tone Vays warns that trading below $95K could lead to significant declines, possibly extending to $73K. Technical analyst Peter Brandt identifies a broadening triangle pattern, with support at $90K.

A break below $90K may lead to a drop to approximately $76,614. While some analysts foresee short-term corrections, Thomas Lee projects Bitcoin reaching $250K by 2025, whereas Mark Newton predicts a decline to $60K before any upward movement. Benjamin Coven anticipates a crash to $60K near Donald Trump's inauguration day.

On-Chain Data and Key Levels

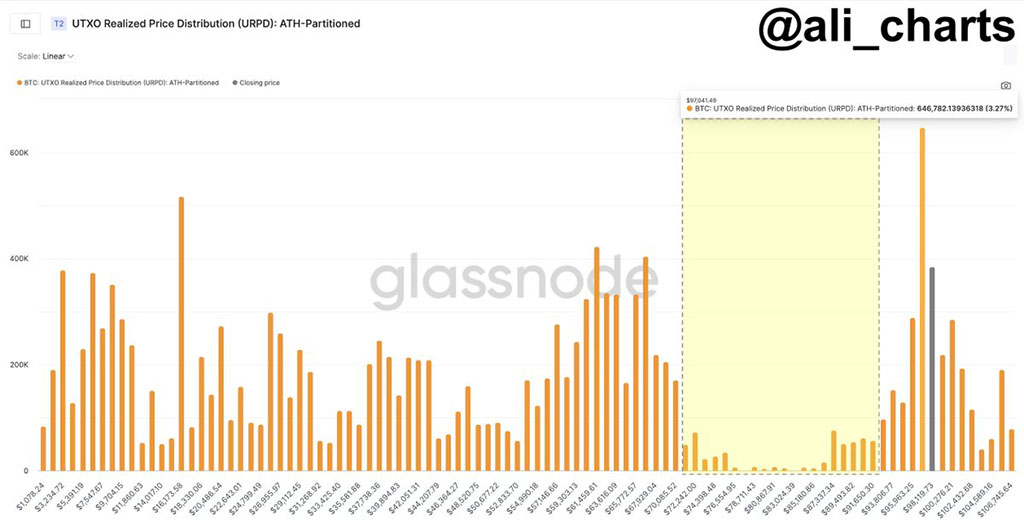

On-chain data suggests $70,000 as a potential target if BTC trades below $93,806. Ali Martinez previously identified a key support zone between $93,806 and $97,041.

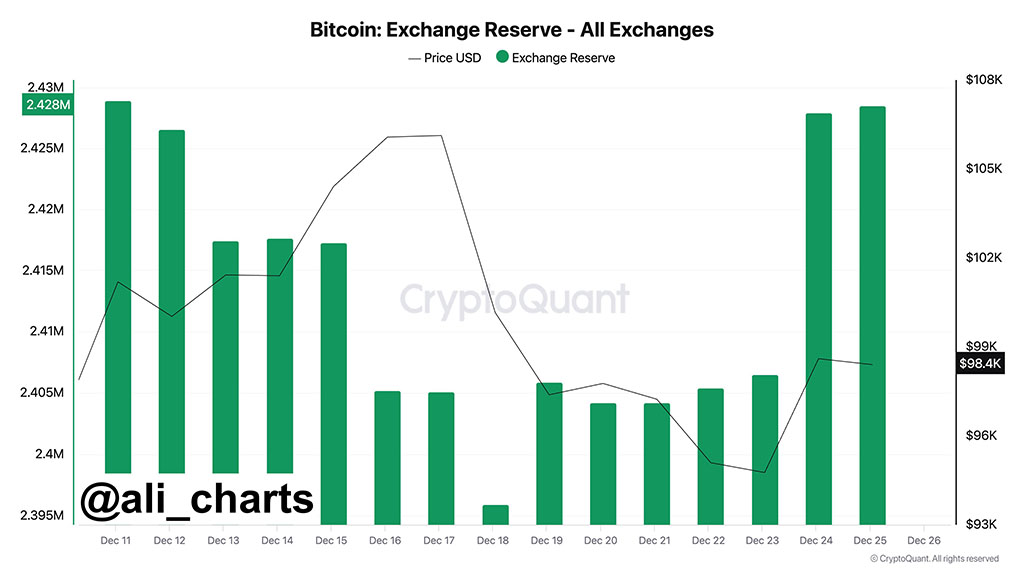

If this demand area fails to hold, significant support lies around $70,085. Recently, investors have transferred 33,000 BTC to exchanges, valued at $3.23 billion, while others realized $7.17 billion in profits on December 23.

Conclusion

Bitcoin currently tests critical support at $94,403 and the 50-day EMA at $93,170. A break below these levels could lead to retests of $90K or even $70K, as indicated by experts such as Tone Vays and Peter Brandt. Despite short-term bearish risks, long-term optimism remains with projections of a parabolic rise to $250K by 2025. Traders should closely monitor key levels amid current market uncertainty.