Bitcoin Price Faces Potential Correction After Recent All-Time High

In a recent video, crypto analyst Rekt Capital explored the potential risks for Bitcoin following its all-time high of $108,374 on December 17, noting a price decline of over -11%.

How Low Can Bitcoin Price Go?

Rekt Capital analyzed Bitcoin's recent price pullback within a historical context. He highlighted weeks 6, 7, and 8 as critical periods in Bitcoin’s “price discovery uptrend,” citing past cycles from 2013, 2016–2017, and 2021 where significant corrections occurred. Dips during these weeks have reached as much as 34% or more.

He emphasized the importance of these weeks, stating that they often lead to considerable downturns. For instance, in week 7 of 2013, Bitcoin faced a 75% pullback over 13 weeks, while week 8 of the 2016-2017 period saw a 34% decline.

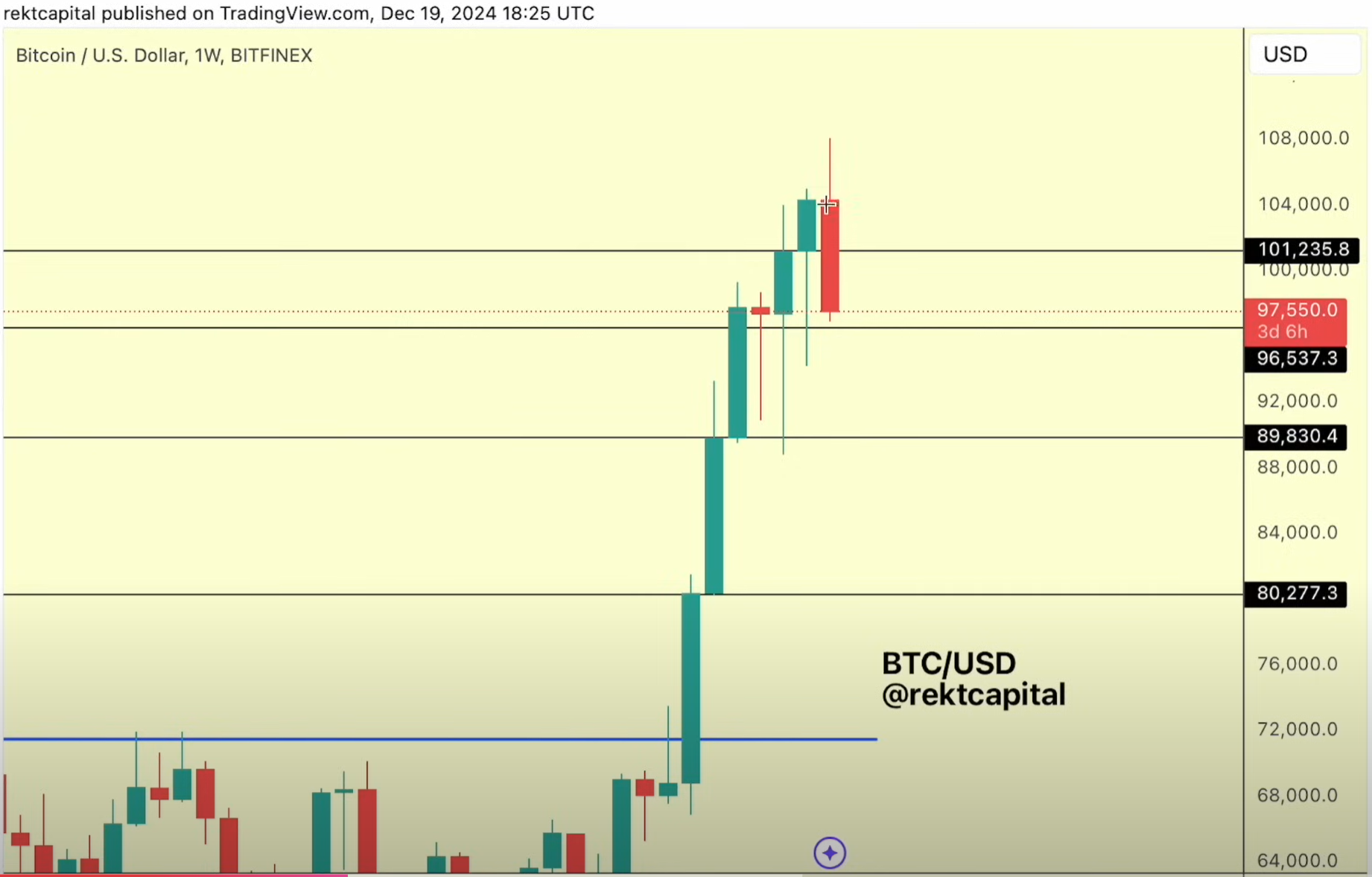

Currently, Bitcoin has retraced over 10%, entering a historically significant support zone at $96,537 on the weekly chart. Rekt Capital noted this level as crucial for maintaining upward momentum, warning that a breach could lead to a further drop to $89,830.

Recent price action revealed a bearish engulfing candle on the weekly timeframe, indicating potential reversals. Rekt Capital observed, “We’re losing resistances that turned into support,” suggesting a possible shift towards a corrective phase.

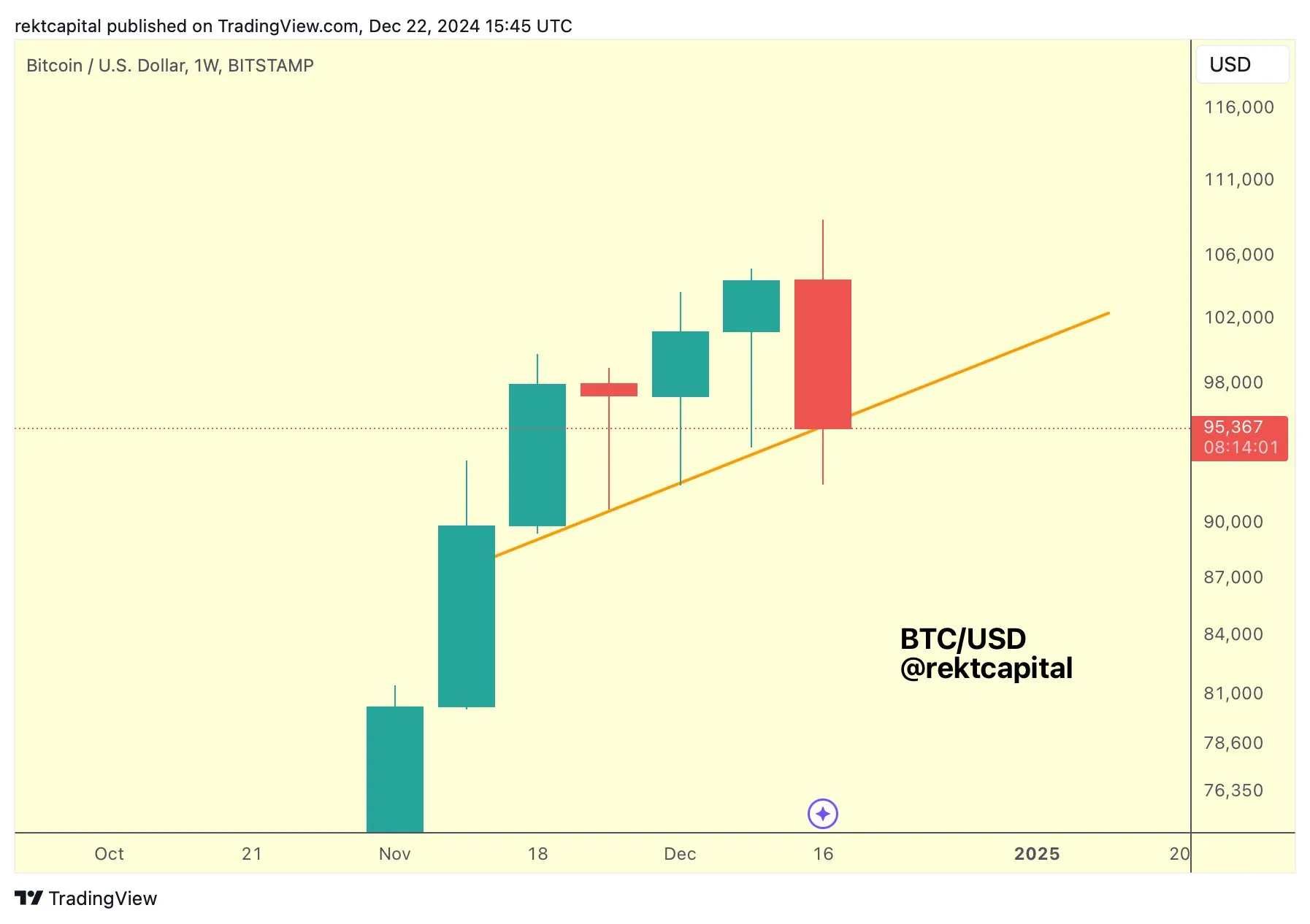

The analyst also stressed the significance of maintaining the 5-week technical line. He stated, “If we lose this 5-week technical uptrend and the orange trend line, it would be mounting evidence that we might be transitioning into a corrective period.”

Additionally, he addressed the unfilled CME gap between $78,000 and $80,000. He remarked that dips of 26% to 28% could potentially fill this gap. Historically, CME gaps tend to get filled, although some remain unaddressed.

Despite cautionary signals, Rekt Capital maintains a long-term bullish outlook, asserting that corrections facilitate future uptrends in the cycle's parabolic phase. He referenced the 2021 cycle, where Bitcoin experienced a 16% pullback in week 6 and an 8% dip in week 8, yet continued its overall upward trend. The current 10% retracement may similarly set the stage for the next leg of price discovery.

As of now, BTC is trading at $95,000.