Analyst Predicts 98% Bitcoin Price Crash After Surge to $250,000

A crypto analyst predicts a potential 98% drop in Bitcoin's price following a rally to $250,000. Despite this forecast, the analyst believes Bitcoin will ultimately reach this target before experiencing significant declines.

Bitcoin Price Projected To Crash 98%

On October 30, Gert van Lagen informed his 106,700 followers on X (formerly Twitter) that Bitcoin could fall to around $24,000 after peaking at $250,000. He noted that many investors are overly confident about Bitcoin's stability, especially with the introduction of Spot Bitcoin Exchange Traded Funds (ETFs).

Lagen highlighted that ETF assets often decrease significantly during economic recessions. He anticipates a "blowoff" to $250,000, after which profit-taking by investors may lead to substantial selling pressure.

As market sentiment shifts, institutional investors—key contributors to the $250,000 surge—are likely to divest their holdings. Lagen describes this sell-off as the “shake out of the century,” potentially driving Bitcoin's price down to 98% of its peak.

This scenario suggests Bitcoin could drop to $2,000, below Ethereum's current price of $2,635, according to CoinMarketCap. Lagen has also indicated that a High-Time Frame rising wedge pattern points to a price range between $1,000 and $10,000. If Bitcoin reaches $1,000, it may take four halving events to return to $200,000.

BTC To Break Above $73,000 And Rally Higher

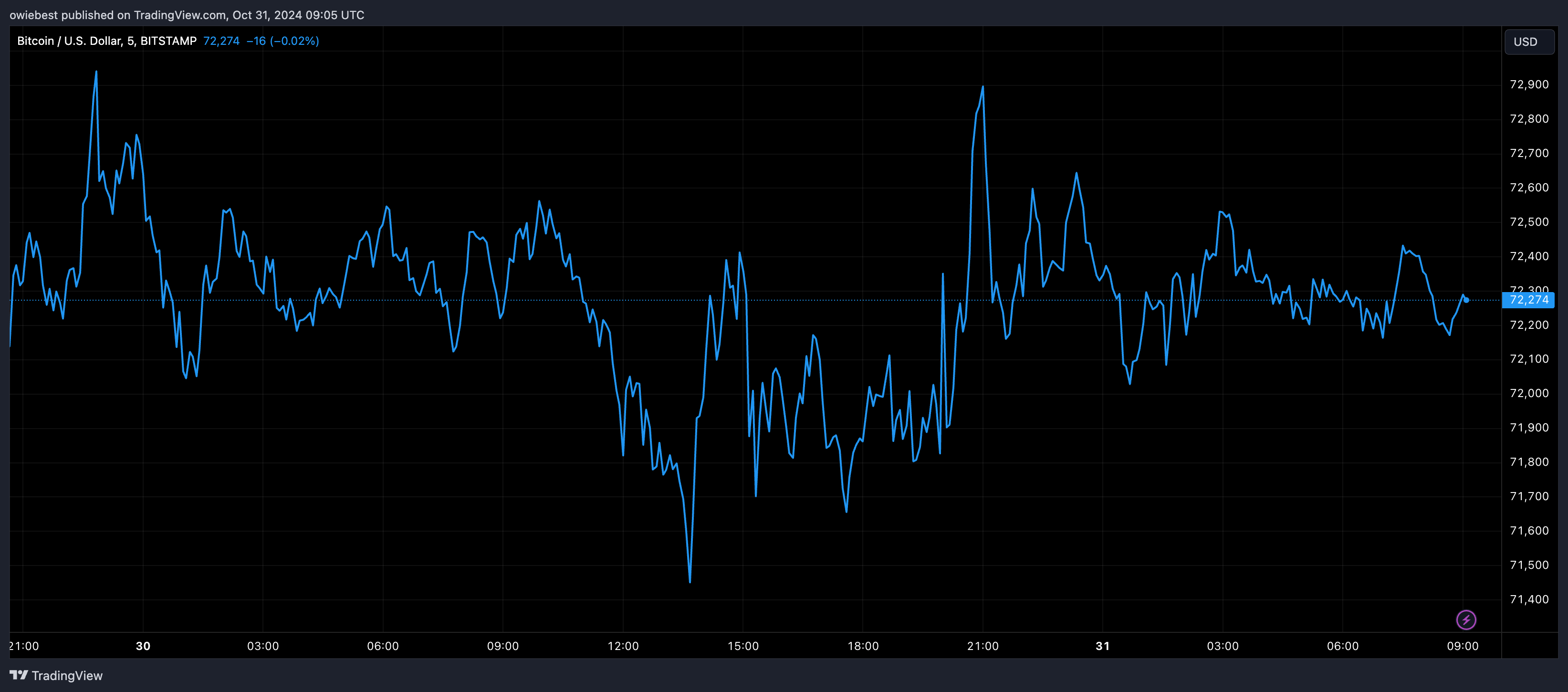

Currently, Bitcoin is trading at $72,433, having risen over 7.8% this week. Lagen has identified a potential “triangle bearish continuation pattern,” indicating a possible downward trend.

Lagen set a new target of $71,200 for Bitcoin, suggesting that if the cryptocurrency follows through with the bearish pattern, its price could decline significantly. Conversely, if Bitcoin surpasses the $73,000 mark, this would invalidate the bearish pattern, signaling a potential end to the downtrend and stronger upward momentum.