Bitcoin Must Surpass Stock Market Ratios to Enter Price Discovery Mode

No more questioning it: Bitcoin has never been worth this much against the US dollar.

Bitcoin reached a new price record of $89,864 during early Tuesday hours, marking a 15% increase above its inflation-adjusted record high from November 2021 ($77,975). As of now, Bitcoin's price has adjusted to below $87,600 but remains up 27% over the past week.

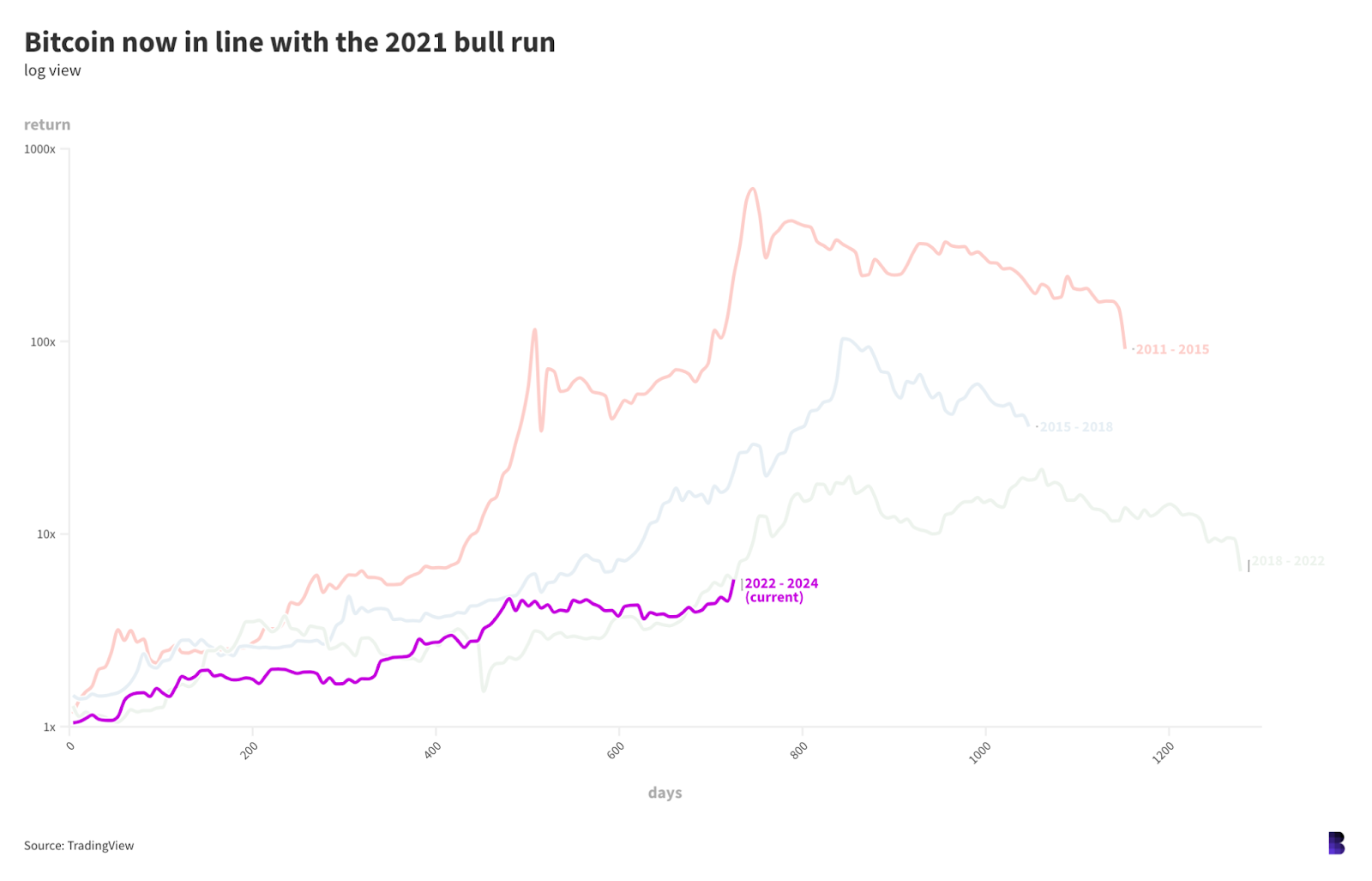

Bitcoin is following the trajectory of the previous bull market cycle from 2018 to early 2022.

The chart displays Bitcoin’s price performance across major bull cycles, with the current cycle depicted in purple, beginning when BTC bottomed out in November 2022. Bitcoin has increased by 580% since then, compared to a 570% gain at this point in the 2021 bull market and over 2,000% from 2015 to 2018.

Despite diminishing returns in past cycles, this trend appears to be reversing, though it is still early in the current cycle.

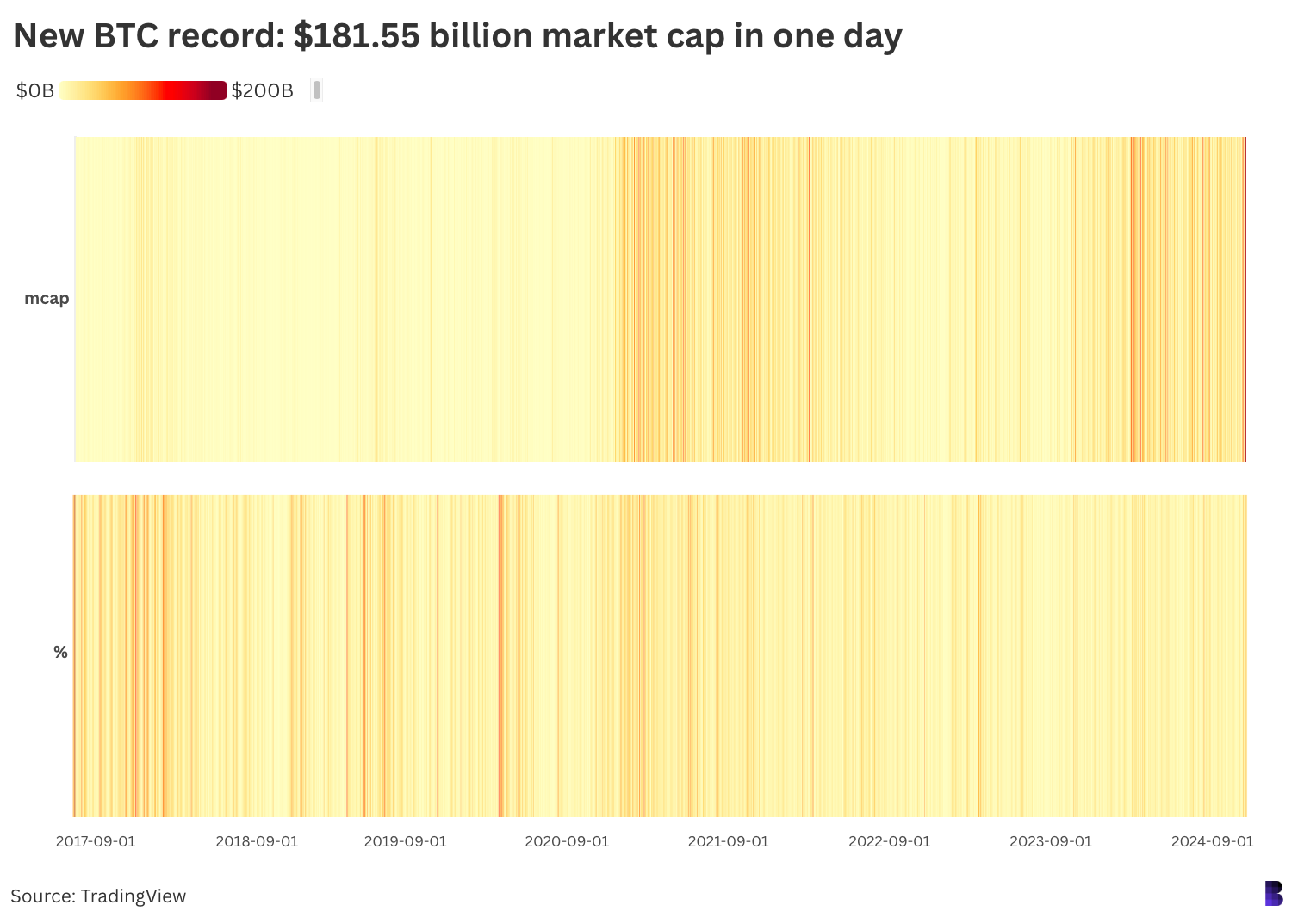

Additionally, Bitcoin saw a new record for its market cap, which rose by $181.55 billion in a single day—marking the largest dollar-denominated intraday spike on record. Previous records were $149.32 billion in August and $146.04 billion in February 2021.

Bitcoin’s market cap has surpassed $1.72 trillion, indicating that even minor percentage increases could add significant dollar amounts.

The top heatmap illustrates daily growth in Bitcoin’s market cap, with the reddest strips indicating the most substantial gains. The bottom reflects percentage gains over the same period, showing less impressive results compared to 2017-2021.

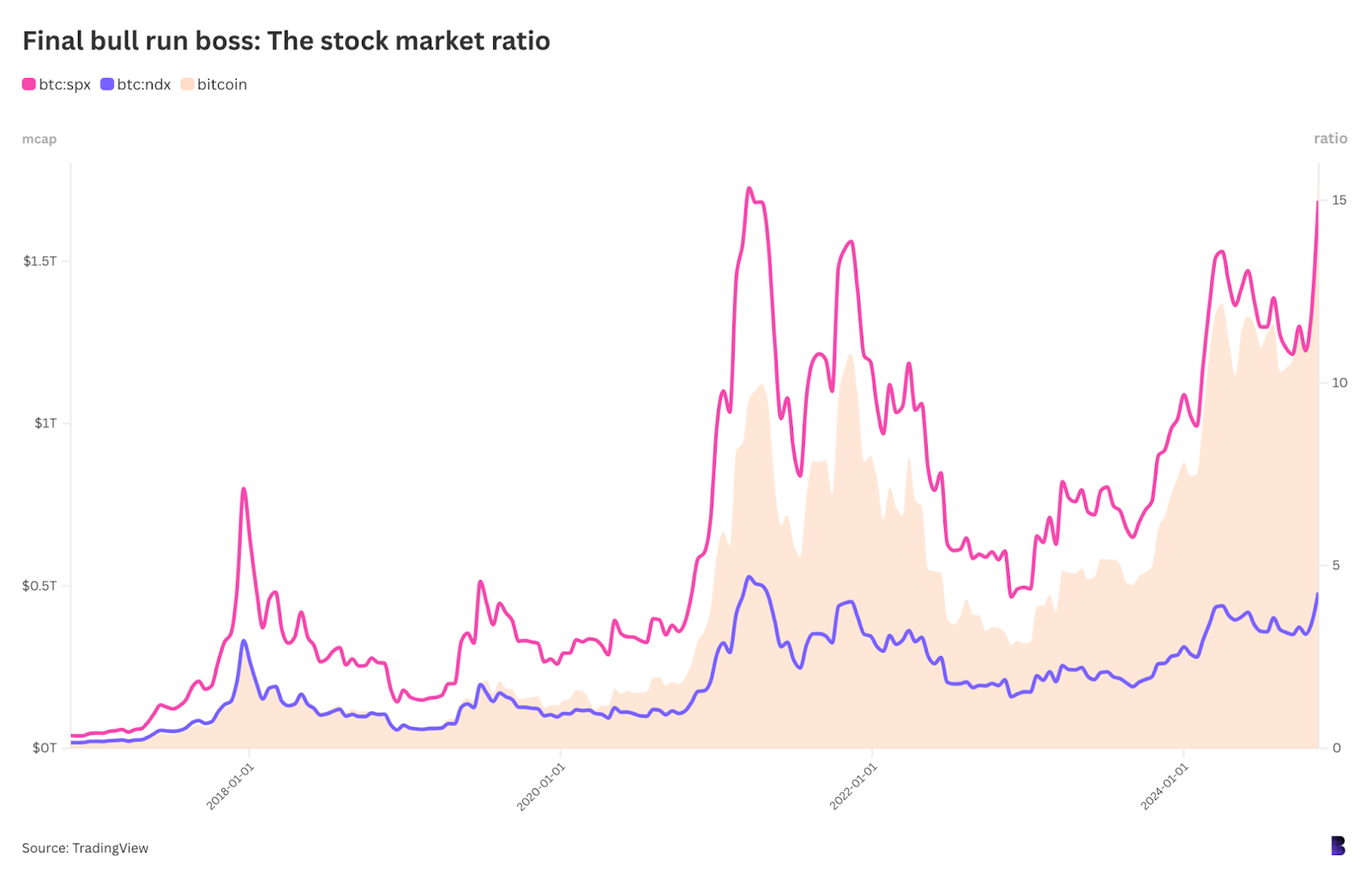

Bitcoin must surpass its stock market ratios before confirming a price discovery phase. Its current ratios against the S&P 500 and Nasdaq 100 are below late 2021 records.

As of today, the BTC/SPX ratio stands at 14.99, down from 15.34 in March 2021, while the BTC/NDX ratio is 4.26, 11% below its peak of 4.7 in March 2021. Bitcoin would need to reach approximately $95,000 to set new highs against these indices at current prices.

This indicates the previous strength of parts of the stock market leading up to the current Bitcoin euphoria.