Updated 21 December

Bitcoin Price Drops Below $100,000 Amid Speculation of Further Correction

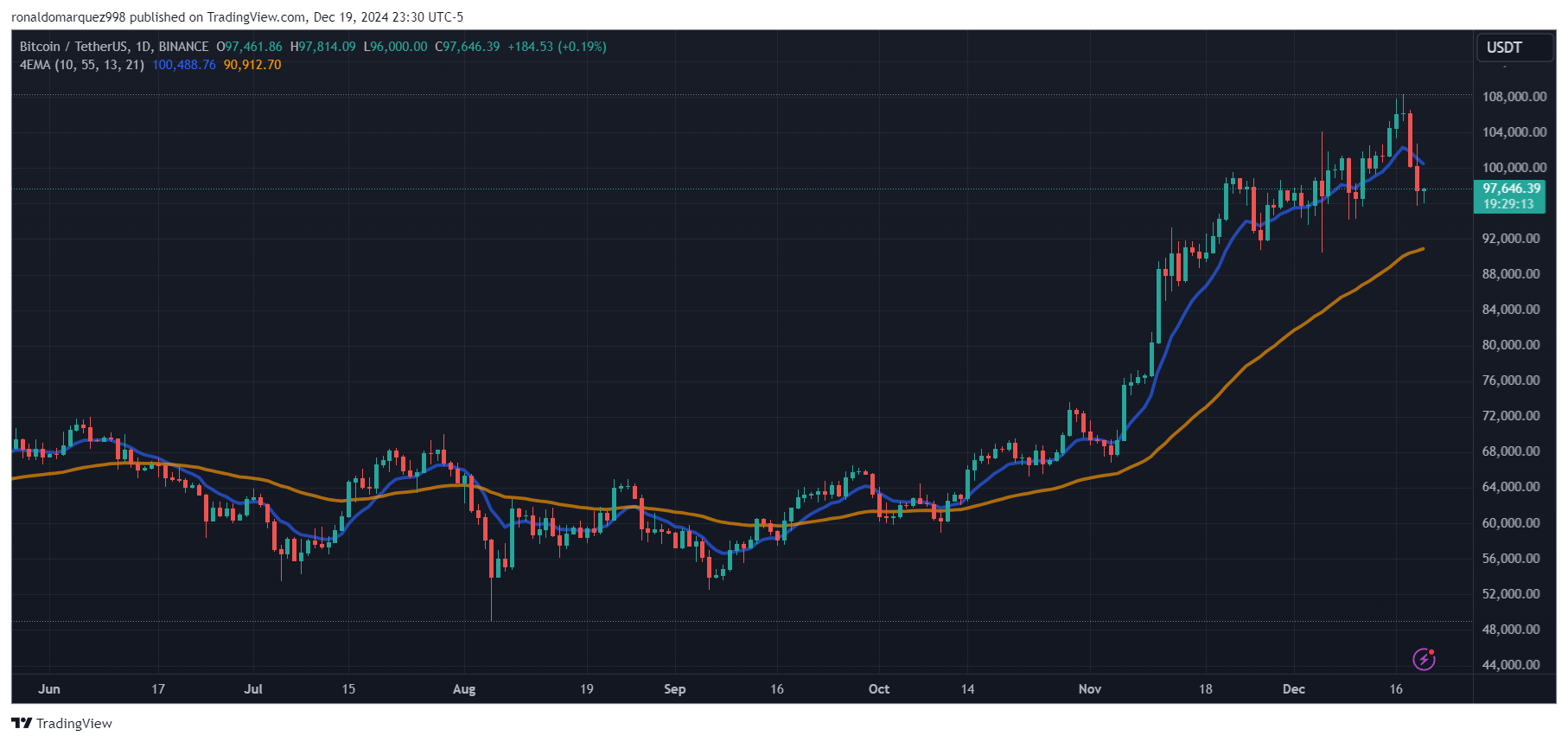

Following Donald Trump’s election victory on November 5, Bitcoin (BTC) reached record highs above $108,000. However, it has recently fallen below the critical $100,000 threshold, prompting speculation about a potential deeper correction, with some analysts predicting a drop to around $85,000 or even $75,000 before a possible recovery.

Temporary Setback or Prelude to a Final Surge?

Analyst Morecryptoonl suggests a significant likelihood of Bitcoin moving toward $85,000 due to recent price actions lacking the strength typically associated with bullish trends. The "overlapping and corrective nature" of the rally indicates a possible major pullback, which could set the stage for a final surge in prices.

Technical analyst Rekt Capital presents a different view, indicating that the perception of $75,000 as an attractive entry point is relative to its current price of approximately $97,000. Rekt Capital notes that what seems like a bargain now may not have appeared so appealing previously when Bitcoin was at that level.

Despite bearish sentiment from some experts, others see the recent correction as a buying opportunity. Analyst VirtualBacon argues that the market's reaction to Bitcoin's drop from $108,000 to $96,000 is "exaggerated."

Is Bitcoin Preparing for New Record Highs?

VirtualBacon asserts this decline does not indicate a market collapse but represents a healthy consolidation phase within an ongoing bull market. Historical data suggests that such corrections often precede new highs. Key support levels, including the weekly 21 exponential moving average (EMA) around $79,000 and the daily 200 EMA near $73,000, remain intact, implying that a brief dip would not destabilize the bullish structure.

The economic conditions also influence Bitcoin's future. Recent Federal Reserve actions, including a modest rate cut and a cautious monetary policy, suggest a stable environment. While the Fed continues quantitative tightening (QT), expectations indicate this will not last indefinitely. The rising US debt crisis may necessitate a return to quantitative easing (QE), historically supportive of bullish trends in crypto markets.

In summary, many view the recent dip in Bitcoin's price as a temporary setback rather than the end of the bull market. As long as Bitcoin remains above critical support levels, the bullish trend is expected to continue.

At the time of writing, BTC is trading at $97,720, down 3% over the last 24 hours and more than 2% for the week.

Featured image from DALL-E, chart from TradingView.com