Bitcoin Price Drops Below $95K Amid $1.1 Billion Market Liquidation

The crypto market experienced liquidations totaling $1.1 billion in the last 24 hours, causing significant declines in Bitcoin and altcoins. Bitcoin is now priced below $95K, while the total cryptocurrency market cap, excluding Bitcoin, has decreased by 18% this week to $1.27 trillion.

Currently, altcoin valuations have dropped by 22%, suggesting a potential bear cycle. Analysts are questioning whether Bitcoin will fall to $90K before 2025 and if it presents a buying opportunity.

Bitcoin Price Analysis: $90K as a Potential Reversal Point

The 4-hour chart indicates a strong bearish correction for Bitcoin, with prices breaking below the rising channel pattern and establishing a lower low formation. The price has fallen below the 200 EMA and the $95,000 support level, currently trading at $94,295, reflecting a 3.44% decline in the past 4 hours, marked by a significant bearish engulfing candle.

The price has fallen under the $94,400 support level, weakening bullish momentum. A closing below this level suggests that bearish pressure may persist. Bitcoin's key support levels are identified at $90,742 and $86,700. The RSI line is in the oversold zone, and a bearish crossover of the 20 and 100 EMA indicators is imminent, indicating increasing selling pressure.

Thus, Bitcoin is likely to retest the $90,000 support level. However, data on active wallets offers a potential positive outlook before 2025.

Reasons Why $90K Could Be an Optimal Buying Point

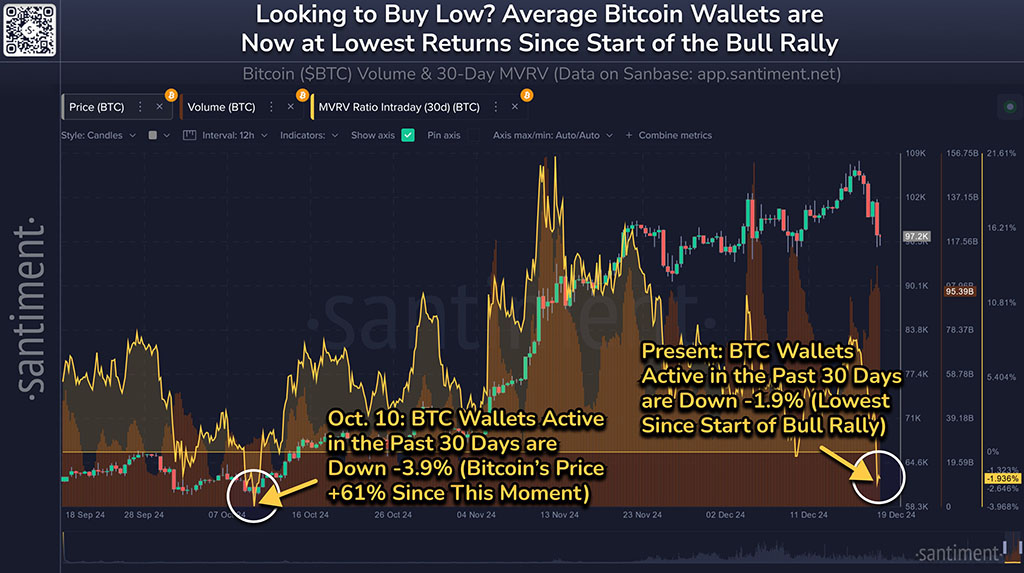

A recent tweet by Santiment highlights the importance of analyzing trader behavior when considering buying opportunities. Currently, Bitcoin's average returns for wallets that made at least one transfer in the past 30 days show a -1.9% return, despite Bitcoin reaching an all-time high just three days prior.

A negative Market Value to Realized Value (MVRV) ratio often indicates that the market may be undervalued. Many traders remain stuck at the peak during recent market highs. While there is no certainty that the local bottom has been reached, employing a dollar-cost averaging strategy could be a prudent approach to entering the market amid current uncertainties.