28 January 2025

3 0

Bitcoin Price Reclaims $101,000 After Dipping Below $100,000

Bitcoin has seen a modest recovery, trading just above $101,000 after dipping below the $100,000 mark. The asset experienced a 3.7% decline in the last 24 hours.

Key Support Level for Bitcoin

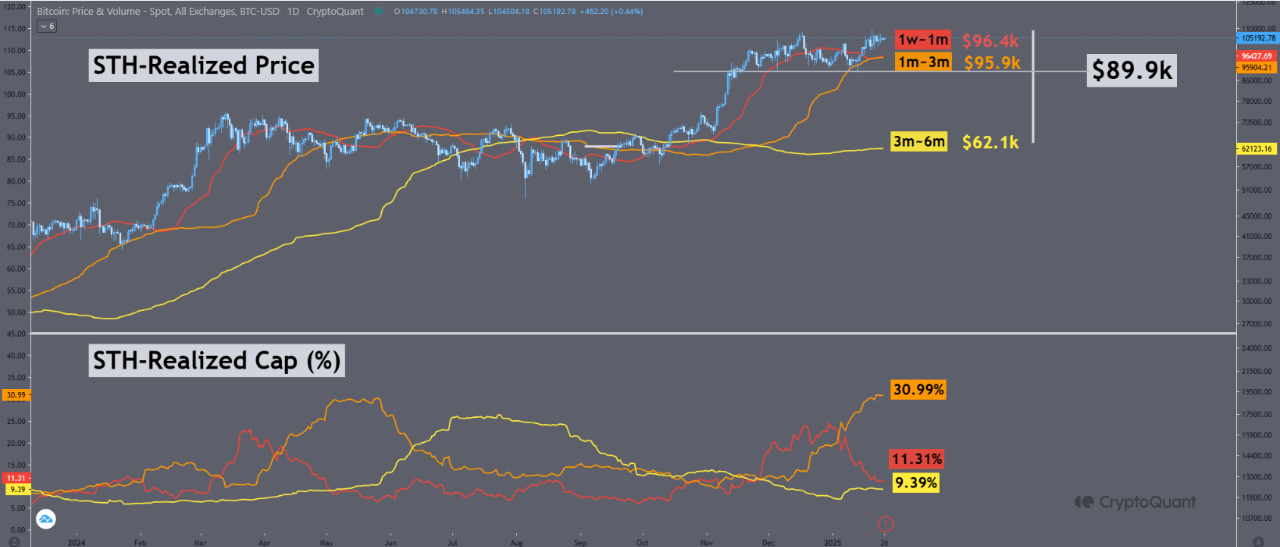

Analyst Yonsei Dent from CryptoQuant identified key metrics indicating that short-term holders (STH) are crucial for defining immediate support levels. Key points include:

- $89,900 is identified as a critical support level for holders with BTC for one week to six months.

- Most short-term holders are currently in profit, which may reduce selling pressure.

- Holders in the three-to-six-month range face losses but represent only 9.4% of the Realized Cap, minimizing their market impact.

- The $89,900 level acts as both technical and on-chain support.

- Market volatility compression increases the importance of this support level; a breach or bounce here will attract trader attention.

- Short-term pullbacks are unlikely to trigger widespread panic selling, maintaining market stability around this price point.

Major Players Refuse to Sell Their BTC Holdings

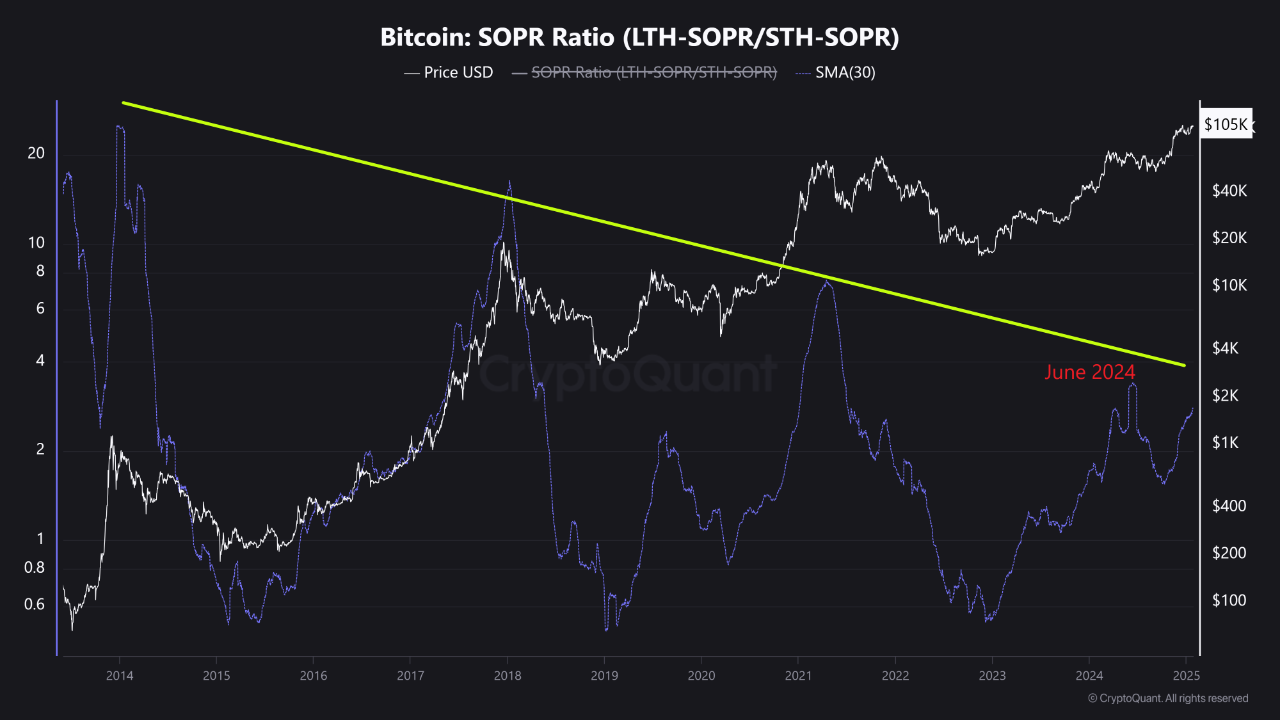

Another analyst, Grizzly, provided insights into holder behavior, noting:

- The SOPR ratio indicates less speculative trading in the current bull run compared to previous cycles.

- This suggests a shift towards treating Bitcoin as a long-term asset rather than a quick profit opportunity.

- Increased institutional participation has altered market dynamics, leading to reduced immediate selling pressure.

- Longer holding periods and fewer speculative fluctuations may characterize future Bitcoin cycles.