Bitcoin Expected to Experience Significant Price Rise Within Two Months

Bitcoin Market Outlook: Sharp Rise Incoming

Bitcoin is poised for a potential price increase, as indicated by CryptoQuant analyst Crypto Dan. The emergence of a "golden cross" in the Spent Output Profit Ratio (SOPR) indicator suggests a significant market move could occur within two months.

The SOPR Ratio measures realized profits and losses in the Bitcoin market, reflecting investor sentiment. The identified "golden cross" occurs infrequently during bull markets and typically precedes notable price increases.

Crypto Dan notes that the current bullish cycle, which began in January 2023, may soon enter its final phase characterized by rapid price gains and reduced consolidation periods. This could limit opportunities for investors to acquire Bitcoin at lower prices.

If the anticipated rise materializes by late 2024 or early 2025, substantial new capital inflows could amplify Bitcoin's momentum, potentially leading the market to its peak during this cycle.

As the market moves towards the later stages of the cycle, the magnitude of the rise tends to be larger, and the periods of decline/adjustment are shorter. If a steep rise occurs as implied by this indicator within the end of 2024 to the first quarter of 2025, it can be expected that new inflows and additional funds will enter the market, bringing it to its peak.

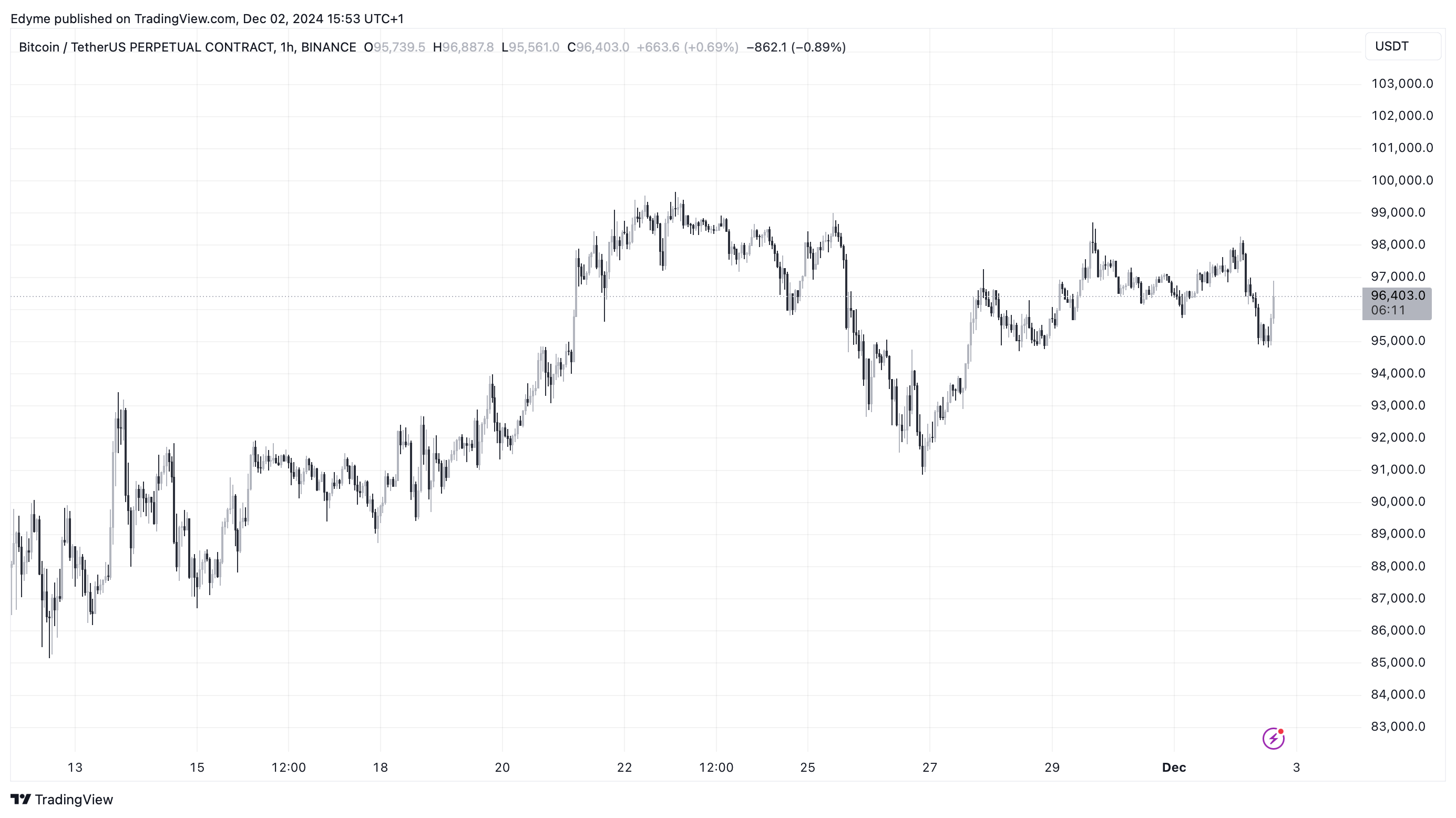

BTC Market Performance

Currently, Bitcoin maintains stability above $95,000, trading at $96,296. This represents a 1% decrease in the past day but an increase of nearly 40% over the past month.

Analyst Ali suggests Bitcoin could reach between $120,000 and $150,000 before experiencing a 30% price correction, contrary to expectations of a major retracement.

Given the fact that #Bitcoin tends to do the opposite of what the crowd believes, there is potential for $BTC to go higher. If the current cycle behaves like the last two, #BTC could go to $120,000-$150,000 before the first 30% price correction.

— Ali (@ali_charts) December 2, 2024

Featured image created with DALL-E, Chart from TradingView