Bitcoin Price Stabilizes Above $104K as Analysts Analyze Funding Rates

Bitcoin is currently trading above $104,000 after reaching a new all-time high of over $109,000. Despite slowing momentum, the performance has sparked renewed market interest.

Market Insights from Funding Rates

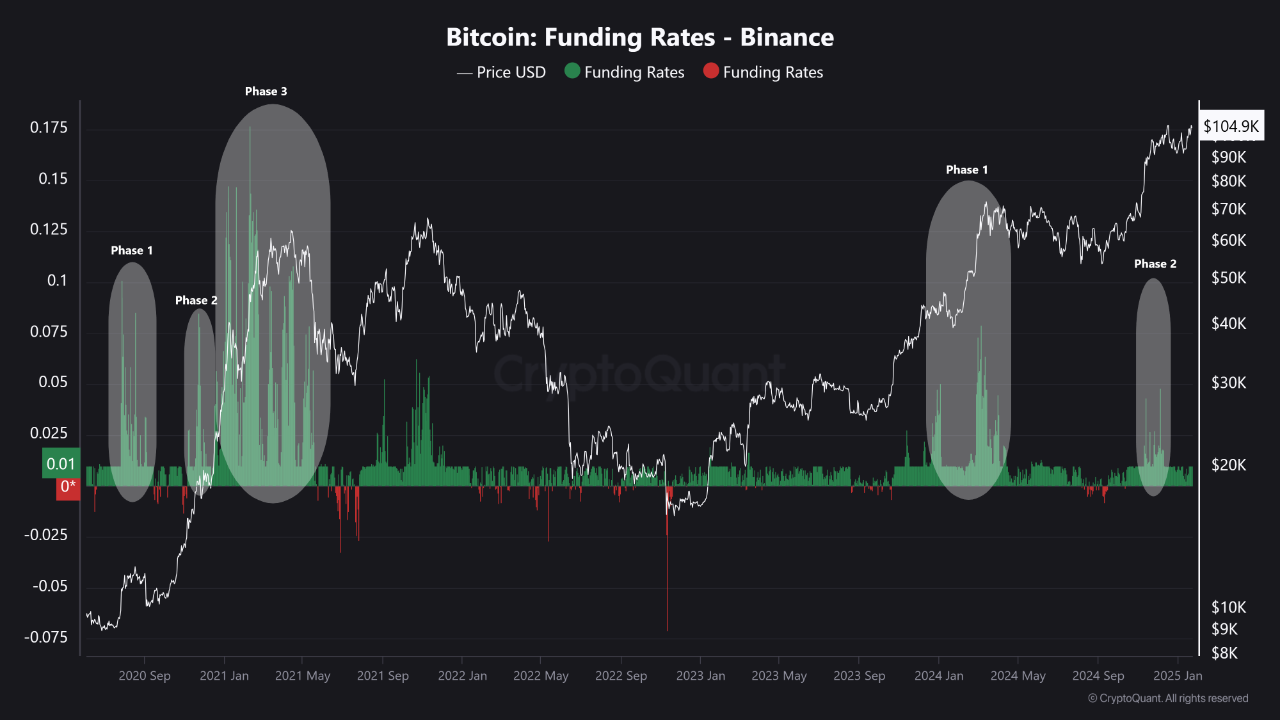

CryptoQuant analyst Burak Kesmeci analyzed Binance Bitcoin Funding Rates to assess market sentiment and potential future price behavior. His insights highlight three phases from previous bull cycles:

- Phase 1: Stable funding rates at 0.01 before demand surged, enabling Bitcoin to rise from $9,000 to $12,000.

- Phase 2: Initial rally followed by correction; funding rates briefly turned negative, then positive, supporting a rise from $12,000 to $19,000.

- Phase 3: As Bitcoin surpassed $60,000, funding rates climbed, indicating strong market support.

Kesmeci noted that current funding rates are at 0.01, consistent with early bull cycle stages. A sustained rise above this level could indicate increased futures market activity and potential upward movement. However, elevated rates may lead to corrections through long squeeze events.

Key Market Metrics

Another CryptoQuant analyst, TraderOasis, examined metrics like the Coinbase Premium Index, open interest, and funding rates, highlighting key divergences:

- Divergence between the Coinbase Premium Index and Bitcoin's price raises concerns about trend sustainability.

- Lack of alignment between open interest and price suggests weak foundations for continued upward momentum.

- Recent bearish sentiment among traders could precede sharp price movements.

The analysis indicates a possible initial upward spike to eliminate bearish positions, followed by a pullback, which could create conditions for a sustainable long-term uptrend.