Bitcoin Price Stabilizes Above $95,000 Amid Increased Stablecoin Inflows

Bitcoin has stabilized after a decline from $99,000 to $90,000, currently trading above $95,000. This price point is critical for determining whether Bitcoin will regain upward momentum or seek lower liquidity for stronger support.

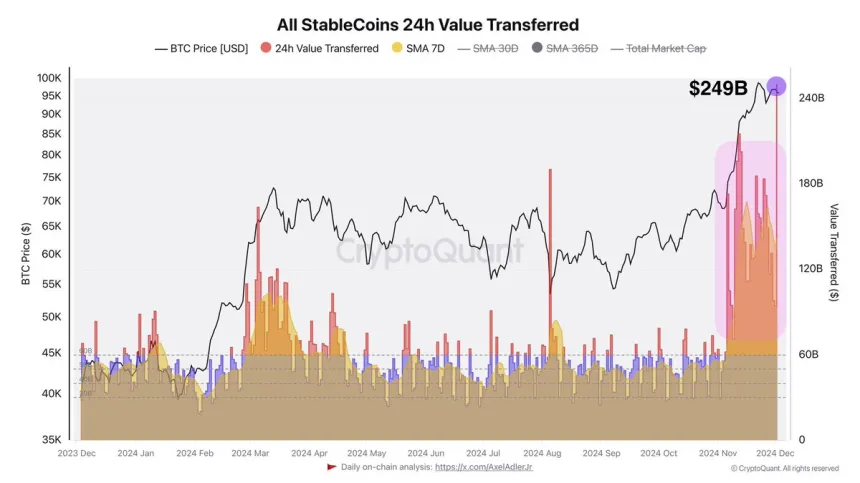

Market sentiment remains optimistic, supported by on-chain data. CryptoQuant reports an increase in stablecoin transfer volumes coinciding with Bitcoin’s price movements. This trend may indicate heightened purchasing power entering the market, potentially signaling renewed buying interest in Bitcoin.

As Bitcoin consolidates above $95,000, traders are monitoring its ability to reclaim psychological resistance at $100,000. A failure to maintain support could lead to retesting levels near $90,000 or deeper liquidity zones.

Bitcoin And Stablecoins: What They Have In Common?

Bitcoin is nearing the $100,000 mark due to increased institutional and retail buying. This surge reflects global demand, with investors using stablecoins to purchase BTC. Stablecoins serve as an efficient bridge for cross-border transactions.

CryptoQuant analyst Axel Adler notes that the rise in stablecoin transfers correlates with Bitcoin’s price climb. This indicates stablecoins’ vital role in providing liquidity and supporting market momentum. Cash inflows through stablecoins help sustain Bitcoin's price even as it approaches critical levels.

The relationship between stablecoin activity and Bitcoin price offers insights into market behavior. Increased stablecoin transfers signal higher demand for Bitcoin, serving as a reliable indicator of potential price movements. This dynamic is significant in identifying high buying pressure periods, facilitating swift market participation.

As Bitcoin approaches the $100,000 threshold, the influx of stablecoin liquidity highlights its global appeal. The influence of stablecoins in driving demand will be crucial in determining Bitcoin’s price trajectory, whether leading to a breakout above $100,000 or a consolidation phase.

BTC Price Nears Critical Zone

Bitcoin is currently above the essential $95,000 level, which influences its short-term direction. This price acts as both a psychological and technical support zone, potentially enabling BTC to reach the anticipated $100,000 milestone this week or delaying it until next year.

For Bitcoin to surpass $100,000, the $95,000 level must remain stable for several days to attract fresh liquidity. Sustained buying pressure in this range is likely to facilitate breaking the psychological barrier, continuing its rally.

However, risks to bullish momentum exist. If Bitcoin fails to hold the $95,000 level, it may retest $92,000, another critical support. Losing both levels could result in a correction, pushing Bitcoin towards demand zones around $85,000 or below $80,000, reversing recent gains and impacting market confidence.

The upcoming days are crucial as traders look for sustained support above $95,000. If bulls effectively defend this level, Bitcoin could soon reach $100,000; otherwise, the market may prepare for a deeper retracement before regaining upward momentum.

Featured image from Dall-E, chart from TradingView