Bitcoin Price Stalls at $94,790 Amid Market Correction

The price of Bitcoin has not shown overall gains over the past week as it continues to experience a market correction. Despite multiple upward movements, Bitcoin struggled to break past the $100,000 resistance, with its December performance deviating from previous bullish predictions. Market analysts are providing projections for Bitcoin’s potential price movements.

Is Bitcoin Price Top In?

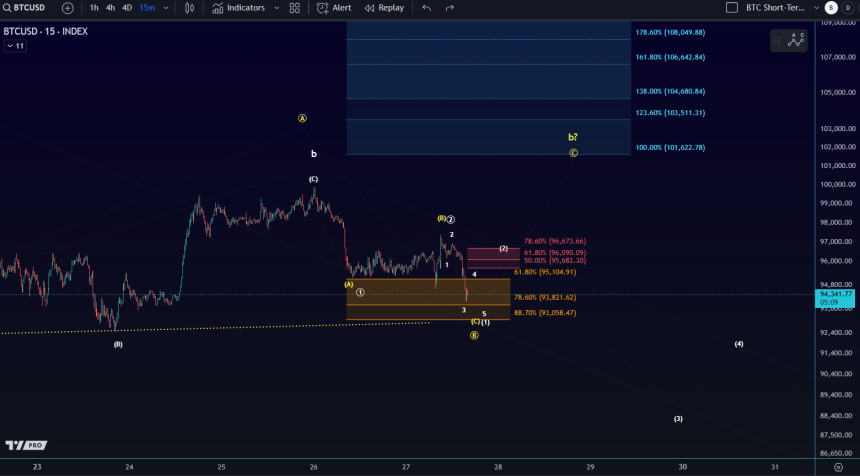

In an X post on December 27, More Crypto Online discussed predictions for Bitcoin's current corrective state using the Elliott Wave Theory. This theory suggests that financial markets move in repetitive fractal patterns called waves, which can help predict future price movements. Currently, Bitcoin is in a corrective structure, moving against the bullish trend. The white scenario indicates Bitcoin completed a B-wave, recording a local price top on December 26th.

Bitcoin is now in a C-wave, potentially targeting the mid to low $80,000 range. The original support zone is around $95,068 – $96,670. As Bitcoin establishes new lows, these resistance regions will be adjusted.

The yellow scenario posits that the B-wave is still developing within a larger corrective structure, indicating no price top has been recorded yet. For this scenario to hold, BTC must break above $96,673, signaling an ongoing upward movement. As long as this price zone remains unbroken, the white scenario remains the dominant outlook.

BTC Price Overview

Currently, Bitcoin trades at $94,790, reflecting a 1.04% decline in the past 24 hours. Daily trading volume has increased by 10.35%, reaching $52.24 billion. Over the past week, Bitcoin has dropped 2.00%, with its monthly performance also entering negative territory.

For market bulls, surpassing $96,600 is essential according to the Elliott Wave theory; however, significant resistance remains at $100,000. Optimism persists in the Bitcoin market, particularly with the upcoming inauguration of US President-elect Donald Trump, anticipated to introduce pro-crypto policies.