Bitcoin Pulls Back 7% from All-Time High as Bears Regain Control

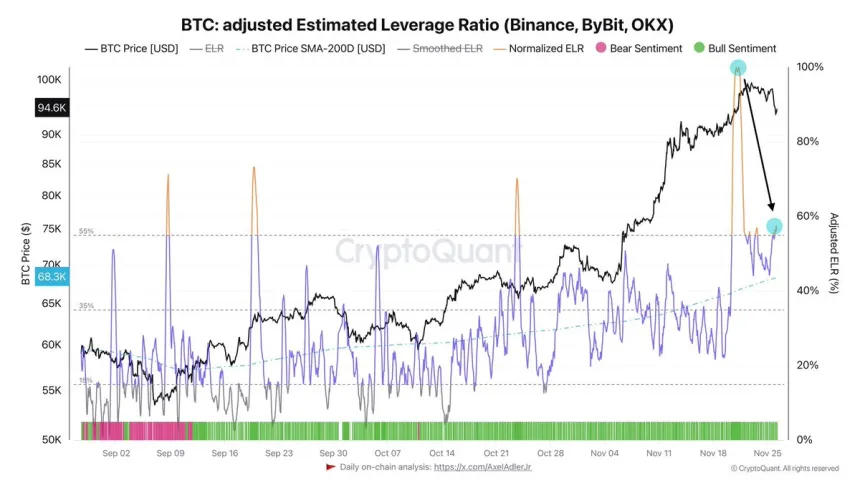

Bitcoin has experienced a significant pullback of 7% from its all-time high of $99,800, following an increase from $67,500 on November 5, representing nearly a 50% rise in a few weeks. This decline indicates growing caution in the market despite elevated leverage levels and increasing short positions contributing to the retracement.

The current dip raises questions about Bitcoin's ability to surpass the $100,000 threshold or if further consolidation is expected. While some investors view this pullback as a healthy correction within a bullish cycle, high leverage suggests ongoing volatility. The upcoming days are critical in determining Bitcoin’s short-term trajectory.

Bitcoin Bears Showing Up

After three weeks with minimal bear resistance, signs indicate their return as Bitcoin struggles to breach the $100,000 level. CryptoQuant analyst Axel Adler noted that recent price movements may signify a shift in momentum. Elevated leverage remains a concern, especially with many long positions established around $93,000, which presents opportunities for bears as Bitcoin fails to gain traction.

Currently, Bitcoin’s price hovers around $93,500, raising the possibility of a correction towards $88,500 or extended sideways movement below $100,000, influencing altcoin performance in the coming weeks. The next two weeks will be crucial as market participants monitor Bitcoin’s actions closely.

BTC Testing Fresh Demand

As Bitcoin trades at $93,500, bears have regained control post-all-time high. The price must remain above the critical support level of $92,000 for bulls to maintain structural bullishness amidst selling pressure. Sustaining above this mark could lead to attempts at overcoming key resistance levels, while a drop below it might signal further declines.

The next critical support zone is around $84,000, aligning with the 4-hour 200 EMA. A breakdown could amplify bearish momentum, affecting market sentiment negatively. Conversely, holding above $92,000 would bolster bullish confidence, potentially leading to recovery efforts and a push toward previous highs.

Market participants are keenly observing these levels, as Bitcoin’s ability to remain above $92,000 will dictate its short-term structure between bullish and bearish influences.

Featured image from Dall-E, chart from TradingView